Calculate Your Zakat Pendapatan in Johor: A Comprehensive Guide

In the heart of Islam lies the concept of Zakat, a pillar that upholds the faith's commitment to social justice and compassion. Among the various types of Zakat, Zakat Pendapatan, or income Zakat, holds particular significance in today's world. For Muslims residing in Johor, Malaysia, understanding how to calculate and pay Zakat Pendapatan is not just a religious obligation but also a pathway to spiritual purification and societal well-being.

Imagine a system where wealth is shared, poverty is alleviated, and the community thrives on the principles of empathy and support. That's the vision Zakat Pendapatan aims to achieve. This guide delves into the intricacies of Zakat Pendapatan specifically tailored for residents of Johor, providing you with the knowledge and resources to fulfill this crucial duty.

Calculating Zakat Pendapatan correctly requires a clear understanding of several factors, including the Nisab (the minimum threshold of wealth), the current market value of gold and silver (which determines the Nisab), and the applicable Zakat rate. This guide will demystify these aspects, offering step-by-step instructions and practical examples to simplify the process.

In the vibrant state of Johor, known for its economic dynamism and cultural richness, fulfilling Islamic obligations like Zakat Pendapatan takes on added significance. By contributing our fair share, we contribute to a more equitable and just society, upholding the values of Islam and strengthening the bonds of our community.

This comprehensive guide will equip you with the tools and knowledge to confidently calculate your Zakat Pendapatan in Johor. From understanding the fundamental principles to exploring practical examples and addressing common questions, we'll embark on this journey together, ensuring that your act of worship is carried out with accuracy and sincerity.

Advantages and Disadvantages of Paying Zakat Pendapatan

While the concept of Zakat doesn't operate on a system of "advantages," it's beneficial to frame these aspects as positive outcomes and potential challenges:

| Positive Outcomes | Potential Challenges |

|---|---|

| Purification of Wealth | Accurate Calculation Complexity |

| Social Welfare Contribution | Identifying Eligible Recipients |

| Spiritual Growth | Lack of Awareness |

Best Practices for Zakat Pendapatan in Johor

Here are some practical tips to streamline your Zakat Pendapatan process:

- Maintain Detailed Records: Keep organized records of your income and expenses. This simplifies the calculation process.

- Consult Official Sources: Refer to the official guidelines provided by the Johor Islamic Religious Council (MAINJ) for the most up-to-date information on Nisab, rates, and payment methods.

- Utilize Online Calculators: Leverage Zakat calculators available on trusted websites or apps to ensure accuracy in your calculations.

- Seek Guidance from Scholars: If you have doubts or specific questions, don't hesitate to consult qualified Islamic scholars for guidance on your Zakat obligations.

- Pay Zakat Promptly: Once calculated, fulfill your Zakat obligation promptly to ensure that your contribution reaches those in need without delay.

Common Questions and Answers About Zakat Pendapatan in Johor

1. What is the Nisab for Zakat Pendapatan in Johor?

The Nisab is determined by the current market value of gold or silver. You can find the most up-to-date Nisab value from MAINJ's official website or publications.

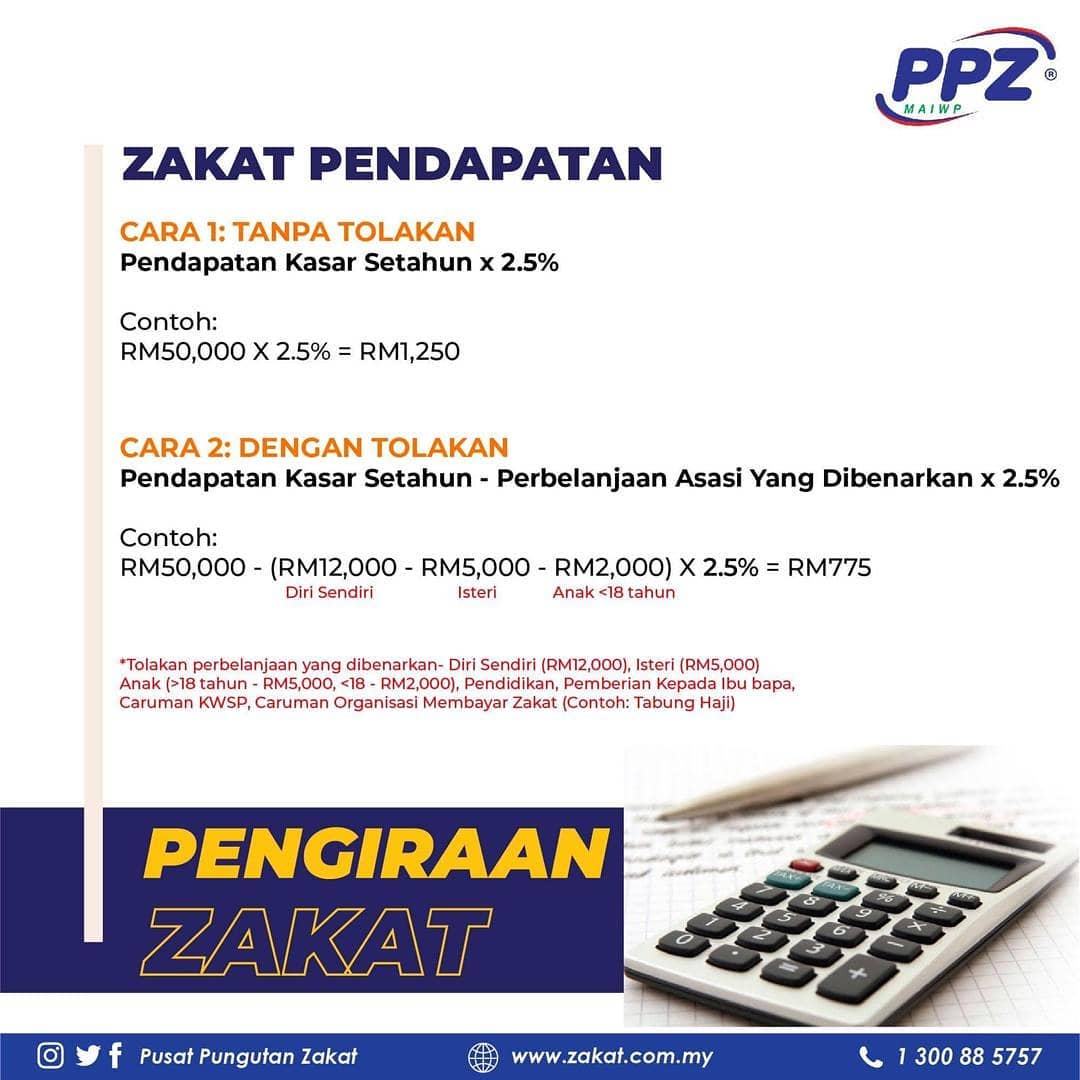

2. How is Zakat Pendapatan calculated?

Generally, if your annual income exceeds the Nisab, you are obligated to pay Zakat. The standard rate is 2.5% of your total annual income. However, it's recommended to use Zakat calculators or consult with scholars for accurate calculations based on your specific income and deductions.

3. Where can I pay my Zakat Pendapatan in Johor?

You can pay your Zakat Pendapatan through various channels authorized by MAINJ, including online platforms, banks, and designated Zakat collection centers.

4. What are the consequences of not paying Zakat Pendapatan?

Fulfilling Zakat is a fundamental pillar of Islam. Neglecting this duty without valid reasons is considered a serious matter within the faith.

5. Can I deduct business expenses before calculating Zakat on my income?

Yes, legitimate business expenses are generally deductible when calculating your Zakat obligation. However, seeking guidance from religious authorities or qualified professionals is recommended for specific deductions.

6. Is it permissible to pay Zakat Pendapatan in installments?

Yes, many Zakat institutions offer flexible payment options, including monthly installments, to facilitate regular contributions.

7. Who are the eligible recipients of Zakat?

The Quran outlines eight categories of recipients eligible to receive Zakat: the poor, the needy, Zakat administrators, those whose hearts are to be reconciled, those in bondage, debtors, in the cause of Allah, and the wayfarer.

8. Can I choose to whom my Zakat is distributed?

While it's permissible to distribute Zakat directly to individuals or causes that fall within the eight categories, it is generally recommended to entrust Zakat distribution to established Islamic institutions equipped to identify and assist those most in need effectively.

Conclusion

Navigating the path of Zakat Pendapatan in Johor is an integral part of our Islamic journey. By understanding the principles, embracing best practices, and seeking guidance when needed, we fulfill this sacred duty with diligence and sincerity. Remember, Zakat is not just a financial obligation; it's a transformative act that purifies our wealth, uplifts communities, and draws us closer to Allah's blessings.

Unleash your creativity exploring the power of perchance ai story generation

The purrfect start exploring the world of katze guten morgen gifs

Wordle hints and strategies mastering the daily puzzle