Calculating Monthly Interest: A Comprehensive Guide

Understanding how to calculate monthly interest is a fundamental financial skill that empowers you to make informed decisions about loans, investments, and savings. Whether you're evaluating a loan offer, tracking investment growth, or planning for future financial goals, the ability to determine monthly interest payments is crucial for effective financial management.

This comprehensive guide will equip you with the knowledge and tools needed to confidently calculate monthly interest. We'll explore various methods, delve into the underlying formulas, and illustrate their practical application through real-world examples. By mastering this essential skill, you can gain a clearer understanding of the true cost of borrowing, the potential return on investments, and the growth of your savings over time.

The concept of calculating interest dates back centuries, evolving alongside the development of financial systems and lending practices. Initially used for simple loans, the methods for interest calculation have become increasingly sophisticated to accommodate complex financial instruments and varying interest rate structures. Today, understanding monthly interest is more critical than ever due to the prevalence of loans, mortgages, and investment opportunities.

One of the main issues surrounding monthly interest calculations is the potential for confusion due to different interest rate types and compounding periods. It's essential to distinguish between nominal interest rates, which are stated annual rates, and effective interest rates, which reflect the actual cost of borrowing or return on investment after accounting for compounding. Compounding, the process of earning interest on previously earned interest, can significantly impact the total interest accrued over time.

A key aspect of understanding how to determine monthly interest involves grasping the concept of annual percentage rate (APR). The APR provides a standardized measure of the true cost of borrowing, encompassing not only the interest rate but also any associated fees and charges. By comparing APRs, borrowers can make informed decisions about loan offers and choose the most cost-effective option. Similarly, for investments, the annual percentage yield (APY) represents the total return earned on an investment, including compound interest.

To determine monthly interest using the simple interest method, multiply the principal amount by the annual interest rate and then divide by 12. For example, on a $1,000 loan with a 6% annual interest rate, the monthly simple interest would be $5. However, most loans use compound interest, where interest is calculated on the principal plus accumulated interest. The formula for compound interest is slightly more complex and requires using exponentiation.

Benefits of Calculating Monthly Interest:

1. Informed Borrowing Decisions: Calculating monthly interest payments allows you to accurately assess the affordability of loans and compare different loan offers based on their true cost.

2. Effective Investment Tracking: By determining the monthly interest earned on investments, you can monitor their performance and make adjustments to your portfolio as needed.

3. Accurate Financial Planning: Understanding how interest accrues on savings accounts helps you project future growth and plan for financial goals such as retirement or a down payment on a house.

Action Plan for Calculating Monthly Interest:

1. Determine the principal amount, interest rate, and compounding period.

2. Choose the appropriate formula based on whether the interest is simple or compound.

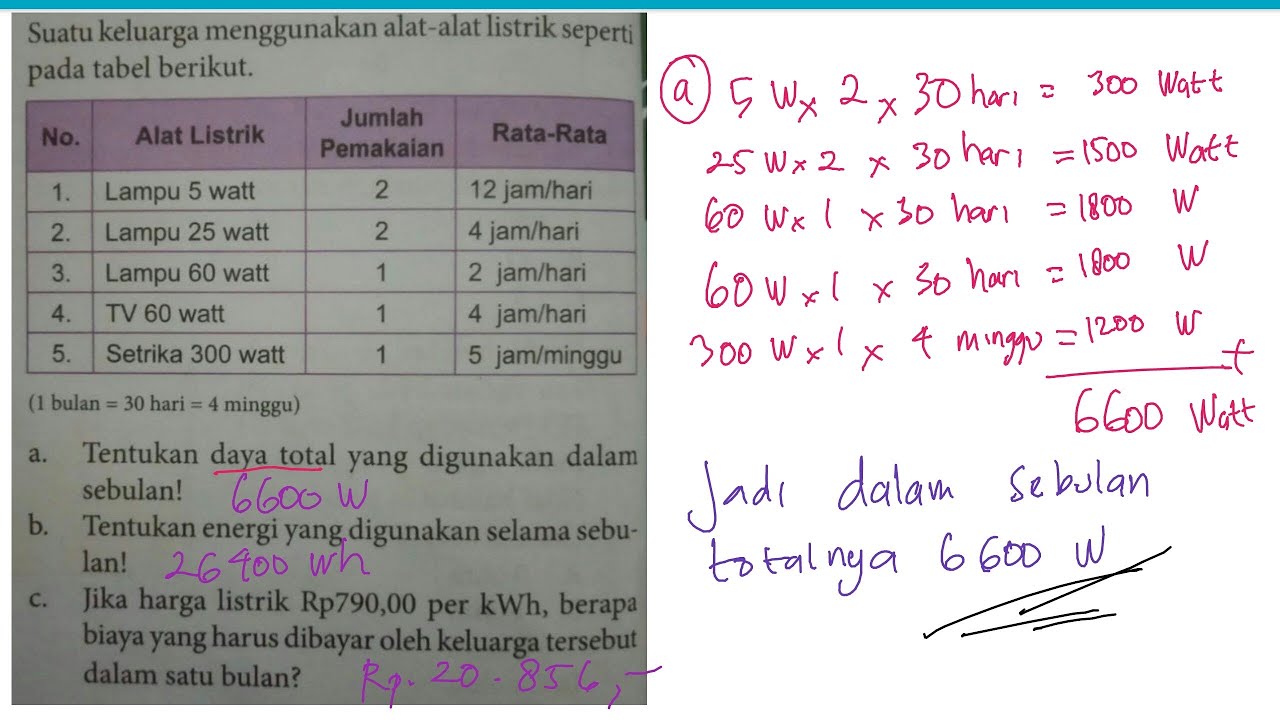

3. Perform the calculations accurately, using a calculator or spreadsheet if necessary.

4. Review and analyze the results to ensure they align with your expectations.FAQs:

1. What is the difference between simple and compound interest? Simple interest is calculated only on the principal, while compound interest is calculated on both the principal and accumulated interest.

2. What is APR? APR stands for Annual Percentage Rate and represents the annualized cost of borrowing, including interest and fees.

3. How does compounding frequency affect interest earned? More frequent compounding (e.g., daily or monthly) results in higher interest earned compared to less frequent compounding (e.g., annually).

4. How can I calculate monthly interest using a spreadsheet? Spreadsheets offer built-in functions like IPMT to calculate monthly interest payments.

5. What is the formula for compound interest? The formula is A = P (1 + r/n)^(nt), where A is the future value, P is the principal, r is the annual interest rate, n is the number of times interest is compounded per year, and t is the number of years.

6. What are some online resources for calculating monthly interest? Several online calculators and financial websites provide tools for calculating monthly interest.

7. How can I estimate monthly interest quickly? You can use a simplified approach by dividing the annual interest rate by 12 to get an approximate monthly rate.

8. What is APY? APY stands for Annual Percentage Yield and represents the total return earned on an investment, including compound interest.

Tips and Tricks: Use a financial calculator or spreadsheet software for complex calculations. Double-check your inputs and calculations to ensure accuracy. Consult with a financial advisor for personalized guidance on managing your finances.

In conclusion, the ability to compute monthly interest is a crucial life skill. By understanding the different methods of calculation, the impact of compounding, and the distinctions between various interest rate types, you can make informed financial decisions that support your goals. Whether you're managing loans, investments, or savings, mastering this skill empowers you to take control of your finances and navigate the complexities of the financial world with confidence. By incorporating the principles discussed in this guide, you can gain a deeper understanding of your financial obligations, maximize your investment returns, and effectively plan for a secure financial future. Start practicing today, and you'll quickly appreciate the benefits of this essential financial skill.

Digital mob rule the allure of gangster wallpapers

The allure of transparent golden circular frames

Finding your travel bliss the meaning of feliz y bendecida semana