Can You Sign a Check Over to Someone Else at Chase Bank?

Imagine this: you receive a check, but you need to give the funds to someone else. Can you simply sign the check over to them? While it seems simple enough, the world of endorsed checks, especially at a specific bank like Chase, has its nuances. This article dives into the details of signing a check over to someone else at Chase bank, outlining the process, potential hurdles, and essential precautions.

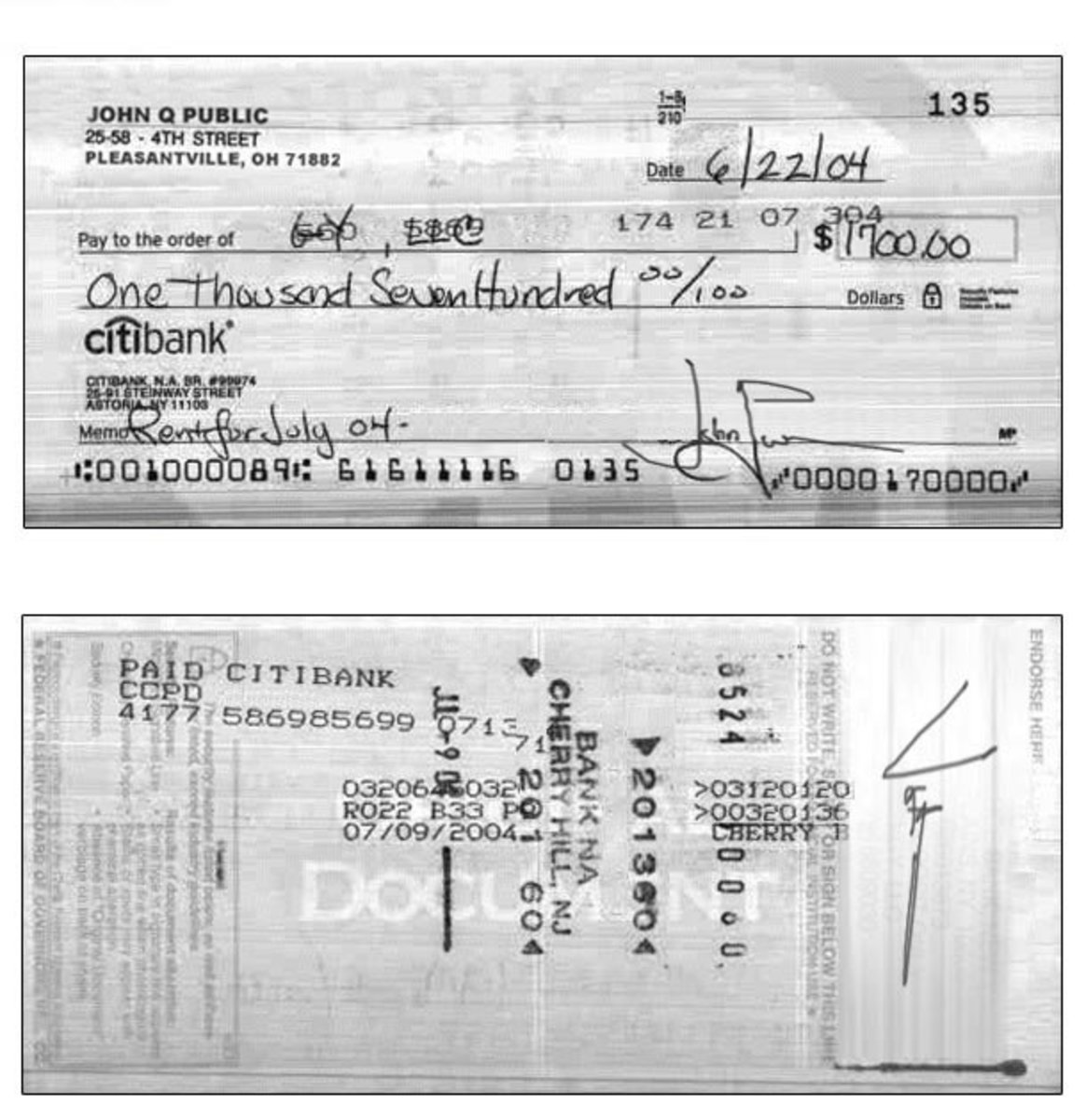

First, let's clarify what signing a check over means. It's the act of transferring the right to the funds on a check to another person or entity. The original payee, the person to whom the check is made out, signs the back of the check, essentially endorsing it to a new payee. This act, often called a "third-party check endorsement," can seem like a convenient way to handle money, but it's not always as straightforward as it appears, especially when dealing with a large institution like Chase Bank.

While Chase Bank generally follows the standard banking practices regarding endorsed checks, there can be specific requirements or restrictions. It's important to understand that banks, including Chase, operate under various regulations designed to prevent fraud and money laundering. These regulations can sometimes lead to additional scrutiny, especially with third-party checks.

The potential for complications arises because a third-party check introduces an additional layer of transaction complexity. This complexity might lead to delays in processing or, in some cases, even refusal to cash or deposit the check. Chase, like other banks, prioritizes the security of its customers and their funds. Therefore, they may take extra precautions when handling checks that have been signed over.

So, while the option to sign a check over at Chase Bank exists, it's not always the most streamlined method. Various factors influence whether Chase will accept, potentially delay, or even reject a check signed over to another party. Understanding these factors is crucial for anyone considering this method of transferring funds.

Advantages and Disadvantages of Signing a Check Over at Chase

| Advantages | Disadvantages |

|---|---|

| Convenience for the original payee | Potential for delays in processing |

| Direct transfer of funds to the intended recipient | Increased risk of fraud or disputes |

| Alternative to carrying large sums of cash | Possibility of the check being rejected by Chase |

Best Practices for Signing Over a Check at Chase Bank

1. Communicate with Chase: Before attempting to sign a check over, it’s wise to contact Chase Bank directly. Inquire about their specific policies, requirements, and any potential restrictions on third-party checks.

2. Verify Check Acceptance: Not all checks are created equal. Some checks, like payroll checks or insurance settlement checks, might have restrictions on third-party endorsements. Always confirm with Chase if they have any limitations on the type of check being endorsed.

3. Jointly Visit the Bank: If possible, the original payee and the new recipient should visit a Chase branch together. This joint presence can streamline the process and address any concerns the bank might have.

4. Provide Identification: Both parties involved should be prepared to present valid government-issued identification. This step helps Chase verify identities and reduces the risk of fraud.

5. Endorse Correctly: The original payee should endorse the check correctly on the back. This usually involves signing their name in the designated area and writing "Pay to the order of [new payee's name]."

Common Questions and Answers About Signing a Check Over at Chase

Q: Can I sign a check over to a business at Chase?

A: Yes, but the business might need to provide additional documentation, like a business license, to verify their identity.

Q: Is there a limit on the amount I can sign over?

A: Chase might have limits on third-party check amounts, especially for non-customers. It’s best to inquire directly.

Q: What if the original check is already endorsed?

A: Generally, a check with multiple endorsements can become difficult to process. It's best to contact Chase for guidance.

Q: Can I sign a check over to someone else online or through mobile banking?

A: Chase typically doesn't allow endorsing checks to third parties through online or mobile banking due to security concerns.

Q: What if I lose the check after signing it over?

A: Contact Chase immediately to report the lost check and discuss options for stopping payment or issuing a new one.

Q: Can I sign a check over as a gift?

A: Yes, but be aware of potential tax implications for large gifts.

Q: Are there fees for signing a check over at Chase?

A: Chase might not charge a specific fee for signing over a check, but it’s always best to confirm their current fee schedule.

Q: What if I suspect fraudulent activity related to a signed-over check?

A: Contact Chase's fraud department immediately to report the suspicious activity.

Tips and Tricks for a Smooth Transaction

- Maintain clear communication with all parties involved.

- Keep copies of the check and any related documentation.

- Follow up with Chase after the transaction to ensure the check has cleared.

While the convenience of signing a check over at Chase Bank is appealing, understanding the potential complexities and following the recommended precautions is vital. By being informed and prepared, you can ensure a smoother and more secure transaction for all parties involved. Remember, clear communication and a proactive approach can significantly reduce the risk of delays, complications, or even financial loss. Always prioritize secure banking practices when dealing with endorsed checks or any financial instruments.

Unleash your creativity with graphic charcoal n500 6

Heartfelt words finding the perfect mensajes para dia del padre

Unlocking potential ea fc 24 career mode player ratings

/how-to-write-a-check-4019395_FINAL-eec64c4ad9804b12b8098331b5e25809.jpg)

/man-signing-contract--close-up--deal-concept-894443420-584be9bfdc5a40ab8b66175eb7b12432.jpg)