Cara Cari No Cukai Pendapatan: Your Guide to Malaysian Tax Identification

Taxes. They're a crucial part of any functioning society, ensuring public services and infrastructure are funded. In Malaysia, the income tax system plays a vital role in national development. Whether you're a seasoned professional, a fresh graduate, or new to Malaysia, understanding the ins and outs of your income tax obligations is essential. A key part of this is knowing your 'no cukai pendapatan', which directly translates to 'income tax number'.

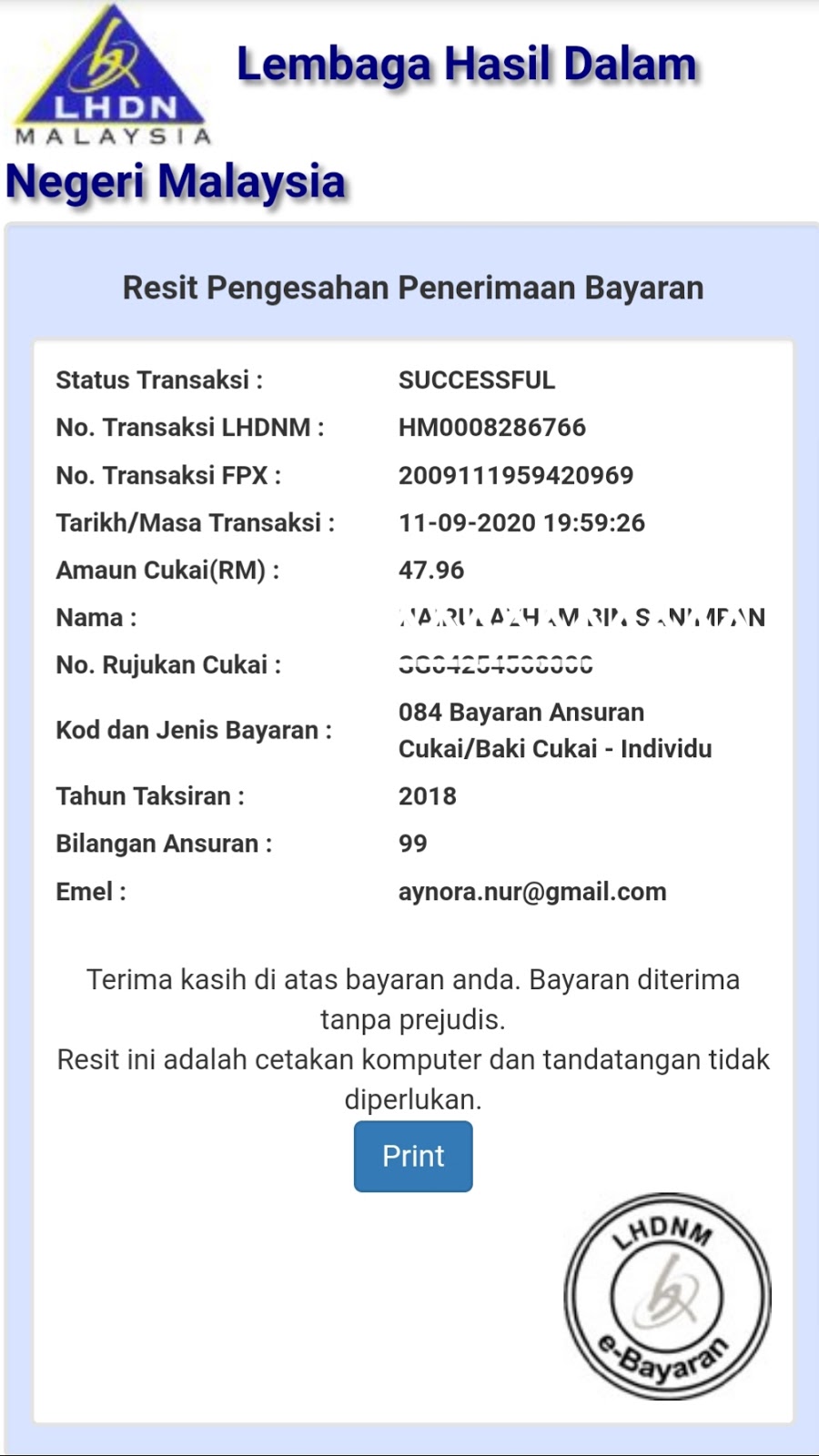

Think of your 'no cukai pendapatan' as your personal tax identifier. It's a unique number assigned to you by the Inland Revenue Board of Malaysia (LHDN), formerly known as the Lembaga Hasil Dalam Negeri. This number is crucial for various tax-related processes, from filing your annual returns to claiming refunds. Without it, navigating the Malaysian tax landscape can feel like trying to solve a jigsaw puzzle with missing pieces.

This guide aims to simplify the 'cara cari no cukai pendapatan' process for you. We'll delve into the importance of this number, the different ways you can retrieve it, and answer some common questions you might have along the way.

Before we dive into the specifics, it's helpful to understand the broader context. The Malaysian income tax system operates on a self-assessment basis. This means the responsibility lies with you, the taxpayer, to accurately report your income, calculate your tax liability, and file your returns on time.

Your 'no cukai pendapatan' is your key to unlocking the world of Malaysian income tax. It's a unique identifier that connects you to the system, allowing you to fulfill your tax obligations and access the benefits associated with being a compliant taxpayer.

Advantages and Disadvantages of Having a No Cukai Pendapatan

While there isn't a direct disadvantage to having a 'no cukai pendapatan' – after all, it's a legal requirement for taxpayers – let's frame the conversation in terms of the benefits of knowing and utilizing your tax identification number effectively:

| Advantages | Potential Challenges |

|---|---|

| Seamless tax filing and payment processes. | Keeping track of your 'no cukai pendapatan' and ensuring its security. |

| Eligibility for tax refunds and rebates. | Understanding the nuances of the Malaysian tax system to maximize the benefits associated with your tax number. |

| Access to government assistance programs linked to income tax status. |

Even seemingly simple tasks, like updating your contact information with the LHDN, require your 'no cukai pendapatan'. By keeping this number readily accessible and understanding its significance, you're better equipped to manage your tax affairs smoothly and efficiently.

While the prospect of dealing with taxes might seem daunting, remember that information and understanding are your greatest allies. This guide is designed to empower you with the knowledge to confidently navigate the Malaysian income tax system.

Unveiling history your guide to understanding indian tribe names list

Is tattoo ink bad for your health unmasking the truth

Unlocking space the magic of handle pintu sliding dekson