Chase Bank Paying In Cheques: A Comprehensive Guide

In today's digital age, it's easy to forget about the humble check. We can transfer money instantly with a few taps on our phones, pay bills online, and even deposit checks from the comfort of our couch. Yet, checks persist, and sometimes, they're unavoidable. Whether it's a gift from a relative, a payment from a client who prefers traditional methods, or a reimbursement that insists on the paper trail, knowing how to navigate the world of checks remains relevant. This is especially true when it comes to larger financial institutions like Chase Bank.

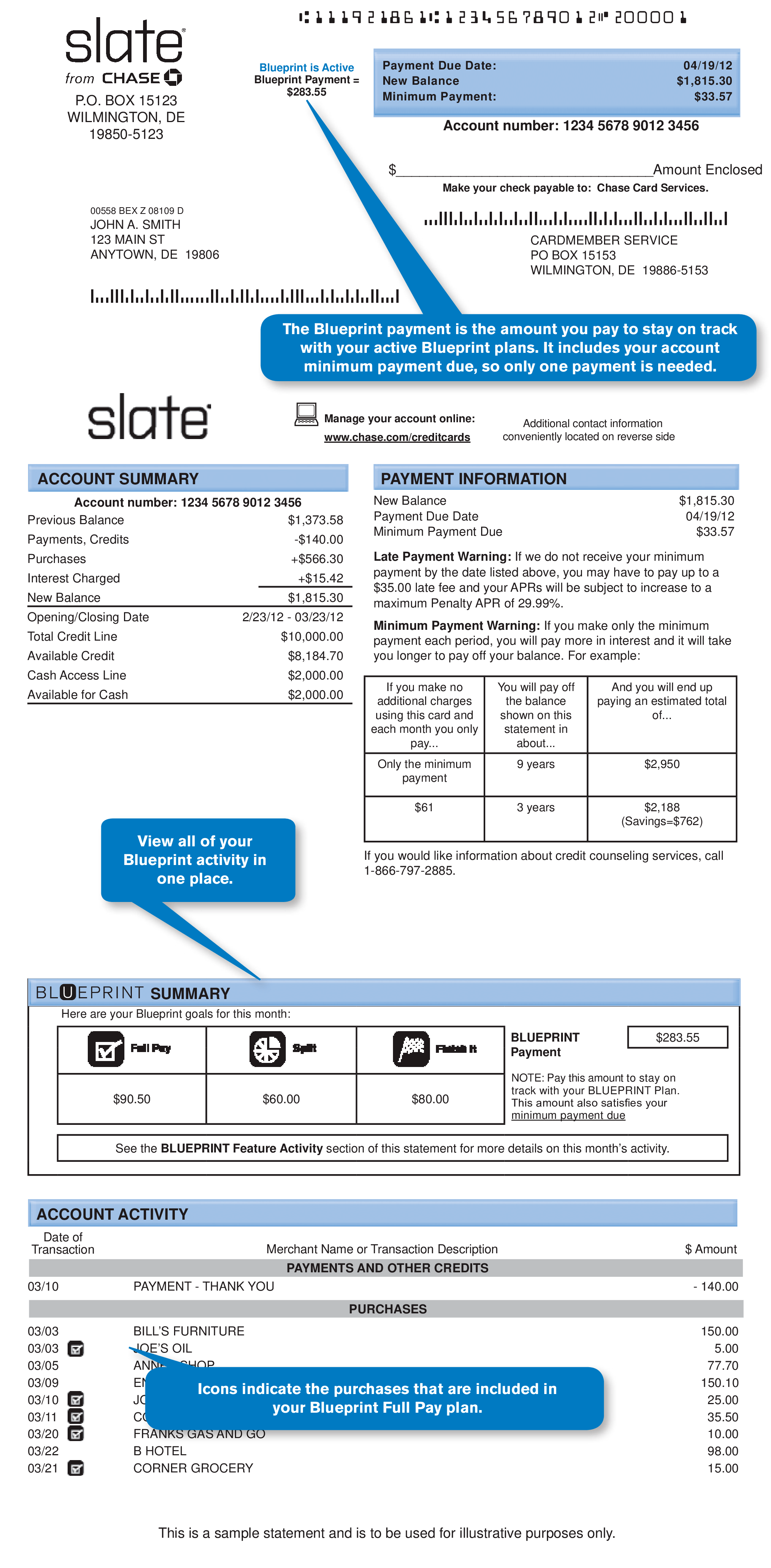

Chase Bank, a banking giant, offers a vast array of financial services, and yes, dealing with checks is still very much a part of their repertoire. But in a world increasingly reliant on digital transactions, understanding the nuances of depositing or cashing a check at Chase, along with the benefits and potential drawbacks, can be incredibly helpful. This comprehensive guide is designed to equip you with all the knowledge you need about Chase bank paying in checks.

Before we delve into the specifics, it's crucial to understand why checks, despite the rise of digital banking, maintain their relevance. For many, particularly the older generation, checks represent a familiar and trusted method of payment. They provide a tangible record of transactions and offer a sense of security that some digital natives might find surprising. Additionally, certain transactions, especially large ones or those involving legal or business matters, often necessitate checks due to their paper trail and inherent security features.

While Chase has streamlined its check depositing process with features like mobile check deposit, understanding the bank's policies, fees (if any), and the various options available to you is key to a smooth and hassle-free experience.

This guide will cover everything from the different ways to deposit a check at Chase bank to potential hold periods, limits on check cashing, and the security measures in place to protect you. We'll also compare check depositing with Chase's digital alternatives, helping you determine the best option for your financial needs. Whether you're new to Chase bank or simply looking to brush up on your check depositing knowledge, this article has something for you.

Advantages and Disadvantages of Chase Bank Paying in Checks

| Advantages | Disadvantages |

|---|---|

| Familiarity and Trust | Slower Processing Times |

| Tangible Record of Transaction | Potential for Fees |

| Security for Large Transactions | Limited Accessibility |

While this section provides a general overview of using checks with Chase bank, remember that specific rules and procedures might vary. It's always best to consult the official Chase website or reach out to their customer service for the most up-to-date information.

Navigating the world of finance can be tricky, but with the right information, you can make informed decisions that best suit your needs. We hope this guide has provided you with valuable insights into Chase bank paying in checks, empowering you to confidently handle your finances.

Discovering the delightful world of casa ramos mexican restaurants

The mystery of antonio pedro es pedro infante unraveling a fan theory

Evoking empire british colonial paint color schemes