Conquering the Paper Dragon: Your Guide to Wells Fargo Mobile Check Deposit

Remember the days of carving time out of your schedule, battling traffic, and standing in endless bank lines just to hand over a piece of paper? Thankfully, technology has liberated us from this archaic ritual. Now, you can deposit checks from the comfort of your couch with just a few taps on your phone. Enter the world of Wells Fargo mobile check deposit—a modern-day superpower disguised as a banking feature.

The allure of instant gratification is undeniable. We crave speed, efficiency, and the ability to manage our lives with minimal friction. Wells Fargo mobile check deposit perfectly aligns with this desire, allowing you to bypass the traditional banking system and deposit checks anytime, anywhere. But how did we get here, and what are the intricacies of this transformative technology?

The journey to mobile check deposit began with the advent of online banking. As the internet revolutionized how we communicate, shop, and consume information, it was only a matter of time before it infiltrated the world of finance. Online banking paved the way for remote check deposit, allowing customers to scan and submit checks electronically for the first time. This innovation eliminated the need for physical branches and expanded banking services to those who couldn't easily access traditional banks.

However, the true game-changer arrived with the rise of smartphones. The unparalleled convenience and portability of these pocket-sized computers created the perfect environment for mobile banking to flourish. With smartphones becoming ubiquitous, financial institutions recognized the need to offer seamless and intuitive mobile banking experiences. Thus, mobile check deposit was born, empowering customers with an unprecedented level of financial control and flexibility.

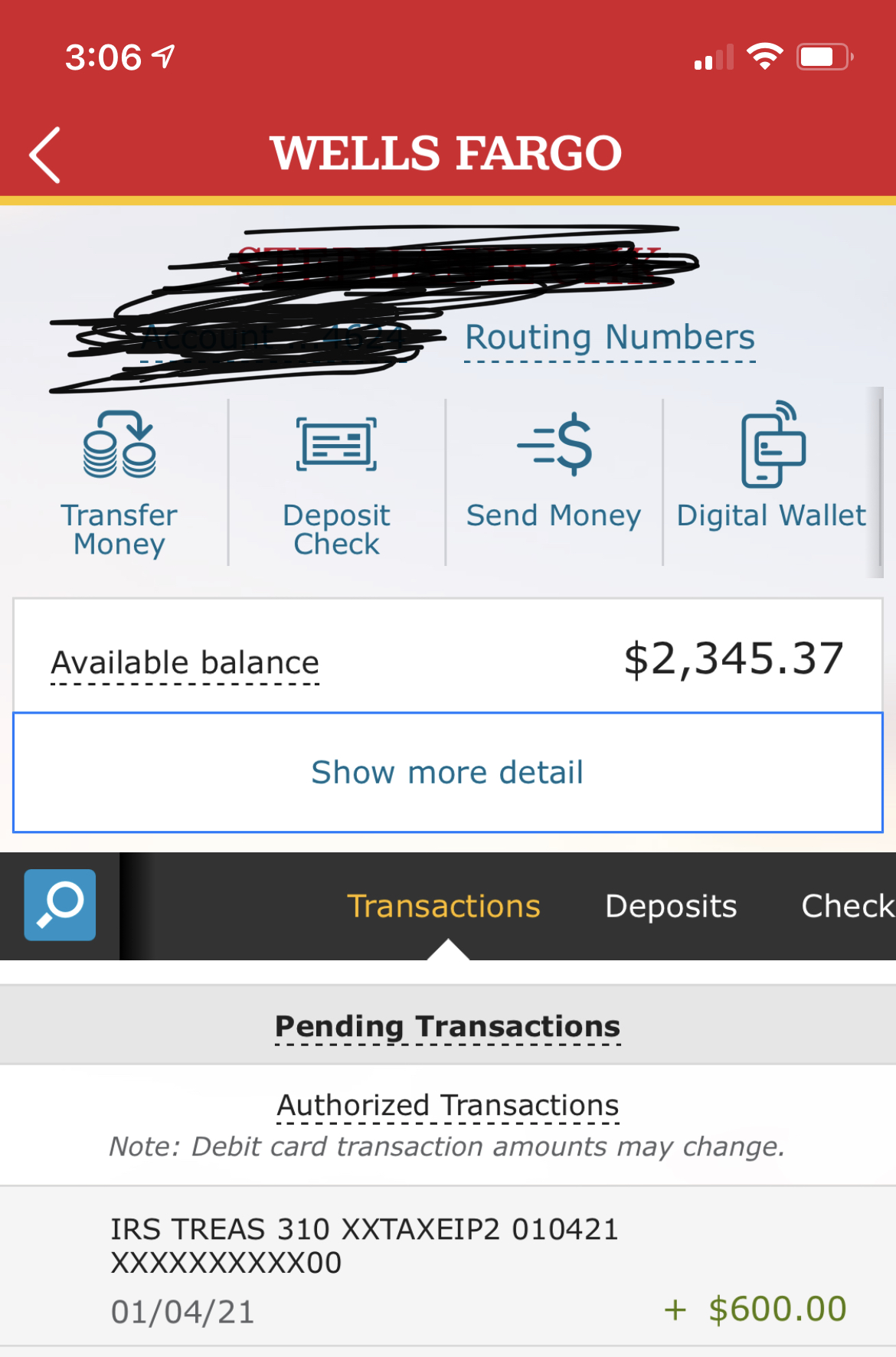

The ability to deposit checks with a few taps on your phone might seem like magic, but it's all made possible by sophisticated image processing technology. When you snap a photo of your check using the Wells Fargo mobile app, the software analyzes the image, extracts relevant information like the check number and amount, and converts it into a digital format. This process, known as optical character recognition (OCR), eliminates the need for manual data entry and enables the electronic processing of your check.

Advantages and Disadvantages of Wells Fargo Mobile Check Deposit

| Advantages | Disadvantages |

|---|---|

| Convenience: Deposit checks anytime, anywhere. | Potential for technical issues: App glitches or poor internet connectivity can disrupt the process. |

| Time-saving: Skip the trip to the bank and deposit checks instantly. | Deposit limits: There might be restrictions on the amount or number of checks you can deposit daily or monthly. |

| Improved recordkeeping: Track your deposits easily through the mobile app. | Security concerns: While rare, there's always a slight risk of fraud or unauthorized access when using mobile banking apps. |

While mobile check deposit has revolutionized banking, it's not without its limitations. Technical glitches, deposit limits, and security concerns are all factors to consider. However, the unparalleled convenience, time savings, and improved recordkeeping offered by Wells Fargo mobile check deposit far outweigh any potential drawbacks. As technology advances and security measures improve, mobile check deposit will likely become the standard for managing personal finances, further cementing its place as an indispensable tool in the modern financial landscape.

Carpet glue removal deconstructing sticky situations

Navigating out of office etiquette your guide to contoh borang keluar pejabat

Boat travel distance unlocking nautical horizons