Consciously Uncoupling From Your Credit Card

Ending a relationship can be challenging, whether it's with a person or a plastic rectangle that whispers promises of retail therapy. When it comes to severing ties with your credit card, a conscious uncoupling requires a thoughtful approach. Crafting a formal letter to request cancellation is key. Think of it as a ritualistic cleansing of your financial aura – a necessary step to manifest abundance and align with your truest spending self.

A request to terminate a credit card agreement shouldn't be taken lightly. This isn't just hitting "unsubscribe" on a newsletter. A well-structured cancellation letter provides clarity, protects you from potential future charges, and sets the tone for a clean financial break. It's an act of self-care, a way to declutter your financial life and invite new, more aligned opportunities.

The history of credit card cancellation letters is entwined with the evolution of credit cards themselves. As these little pieces of plastic became ubiquitous, so too did the need for a formal process to end their reign in our wallets. Initially, a phone call might have sufficed. But in today's digital age, a written record is crucial. A template or pre-formatted letter serves as a starting point, ensuring all essential information is included for a seamless transition.

One of the biggest challenges when discontinuing your credit card services is ensuring that all recurring charges are transferred to a new payment method. A properly drafted termination letter serves as a crucial tool in mitigating these potential issues. It also confirms in writing your intent to close the account, protecting you from any lingering fees or charges. Using a request for termination letter template guarantees you address all necessary points, preventing any unpleasant financial surprises down the road.

Imagine sending a poorly written cancellation request – a hastily scribbled note or a rushed email. The universe might interpret this as a lack of commitment to your financial well-being. A meticulously crafted letter, on the other hand, signals your intention clearly and powerfully. It's a declaration to the financial gods that you're taking charge of your destiny.

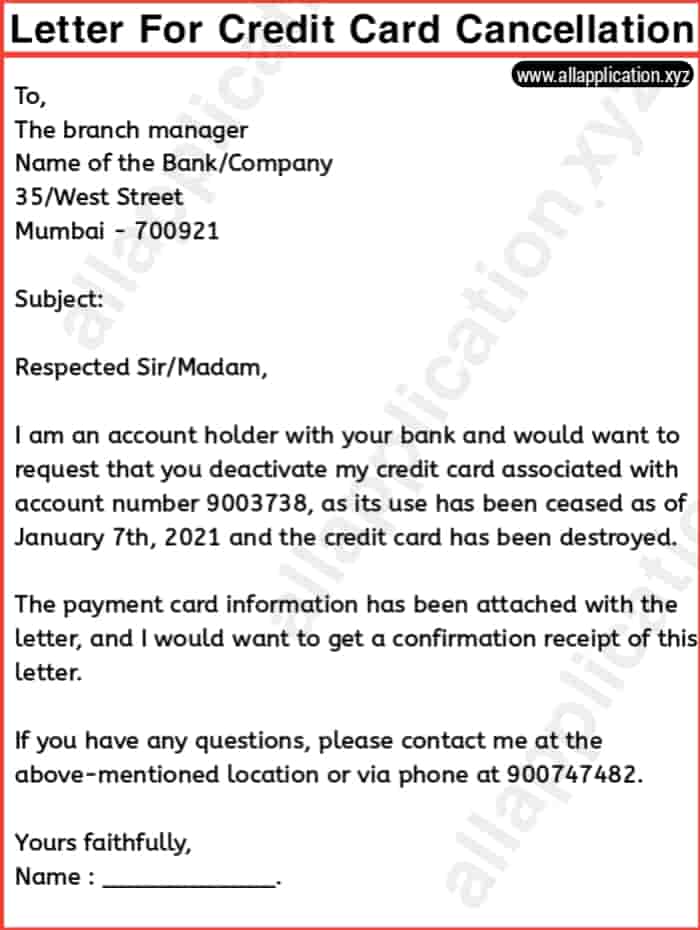

A credit card termination letter, simply put, is your official notification to the credit card company that you wish to close your account. A sample letter provides a framework, ensuring you include essential information like your account number, name, and the date you want the card deactivated. For example, a simple phrase like "I am writing to request the closure of my credit card account" sets the tone for the entire communication.

Benefit 1: Confirmation. A written letter provides tangible proof of your request. Benefit 2: Clarity. It leaves no room for misinterpretation. Benefit 3: Protection. It helps avoid potential disputes about outstanding charges.

Action Plan: 1. Gather your account information. 2. Find a sample letter format. 3. Personalize the letter. 4. Send it via certified mail.

Checklist: Account number, name, signature, date of requested closure.

Step-by-Step Guide: 1. Draft the letter. 2. Review for accuracy. 3. Print and sign. 4. Mail.

Advantages and Disadvantages of Using a Sample Letter

| Advantages | Disadvantages |

|---|---|

| Saves time and effort | May not address specific circumstances |

Best Practice 1: Always send the letter via certified mail. Best Practice 2: Keep a copy of the letter for your records. Best Practice 3: Follow up with the credit card company to confirm receipt.

Example 1: John Doe used a sample letter and successfully closed his account. Example 2: Jane Doe adapted a sample letter to include specific details about a disputed charge.

Challenge 1: Finding a reliable sample letter. Solution: Consult reputable financial websites. Challenge 2: Adapting the letter to your specific situation. Solution: Consult a financial advisor if needed.

FAQ 1: What if I have a balance on my card? Answer: You must pay the balance before closing the account. FAQ 2: How long does the cancellation process take? Answer: It varies depending on the credit card company.

Tip: Always maintain a positive tone in your letter. Trick: Clearly state your desired outcome.

Closing a credit card account is a significant financial decision. Utilizing a sample credit card cancellation letter format offers a structured and efficient approach to this process. It ensures clarity, protects your financial interests, and allows you to consciously uncouple from a financial commitment that no longer serves you. Taking charge of your financial well-being is an act of self-empowerment, and a well-crafted cancellation letter is a crucial tool in this journey. Remember, a clear and concise communication sets the tone for a healthy financial future, paving the way for abundance and prosperity to flow freely into your life. By following the guidelines outlined above and embracing the mindful approach to financial decisions, you can confidently navigate this process and cultivate a more aligned and fulfilling relationship with your finances. This is more than just severing ties with a piece of plastic; it's about stepping into a new chapter of financial freedom and intentional living.

Score big with football colouring pages uk

Creating stunning english covers your guide to caratula ingles para imprimir

Exploring malone stores in your area