Decoding Humana Medicare Part B Coverage

Medicare can feel like navigating a maze, especially when choosing a Part B plan. You’re bombarded with options, each promising the best coverage. So, how do you cut through the noise and find a plan that truly fits your needs? This guide will unpack Humana Medicare Part B options, providing you with the knowledge to make an informed decision about your healthcare.

Humana offers a variety of Medicare Part B plans, tailoring their coverage to different needs and budgets. These plans supplement Original Medicare, helping to cover services like doctor visits, outpatient care, and preventive services. Understanding the nuances of these plans can significantly impact your healthcare costs and access to care.

Choosing a Medicare Part B plan isn't a one-size-fits-all endeavor. Factors like your health status, budget, and preferred doctors can influence your choice. Understanding these factors and how they intersect with Humana's offerings is crucial for making a smart decision.

This comprehensive guide will dive deep into the world of Humana Medicare Part B insurance, exploring everything from coverage specifics to cost considerations. We'll also address common concerns, offer practical tips, and equip you with the information you need to confidently select a plan that aligns with your healthcare goals.

Let's start by examining the history and significance of Medicare Part B and how Humana plays a role in providing this essential coverage to seniors and individuals with disabilities. Medicare Part B was established in 1965 as part of the Social Security Amendments, aiming to provide coverage for medically necessary services outside of hospital stays. Private insurance companies, like Humana, partner with Medicare to offer Part B coverage, giving beneficiaries more choices and plan options.

Humana's Medicare Part B plans function as supplemental coverage to Original Medicare Part B. This means they help cover expenses like doctor visits, outpatient care, and some preventive services. Several issues can arise with Medicare Part B plans, such as understanding the costs associated with different plans, navigating network restrictions, and determining coverage for specific medical procedures. It's vital to research and compare plans carefully.

One key aspect of Humana's plans are their different cost structures. Some plans may have higher monthly premiums but lower out-of-pocket expenses, while others have lower premiums but higher co-pays and deductibles. For example, a Humana plan might have a $150 monthly premium and a $20 co-pay for doctor visits, while another might have a $100 premium but a $50 co-pay. Understanding these trade-offs is crucial for budget planning.

Three key benefits of Humana Medicare Part B plans often include a wider network of doctors, additional coverage for preventive services, and prescription drug coverage. Access to a larger network provides greater flexibility in choosing healthcare providers. Enhanced preventive care can lead to early detection and management of health issues. Combined prescription drug coverage streamlines medication management.

Advantages and Disadvantages of Humana Medicare Part B Plans

| Advantages | Disadvantages |

|---|---|

| Wider network of doctors | Potential network restrictions |

| Additional coverage for preventive services | Varying out-of-pocket costs |

| Prescription drug coverage options | Plan complexity |

Five best practices for selecting a Humana Medicare Part B plan include: 1. Assessing your current health needs. 2. Evaluating your budget. 3. Comparing plan premiums, deductibles, and co-pays. 4. Researching doctor networks. 5. Contacting Humana directly to discuss your specific needs.

Frequently Asked Questions:

1. What does Humana Medicare Part B cover? (Answer: Doctor visits, outpatient care, preventive services, etc.)

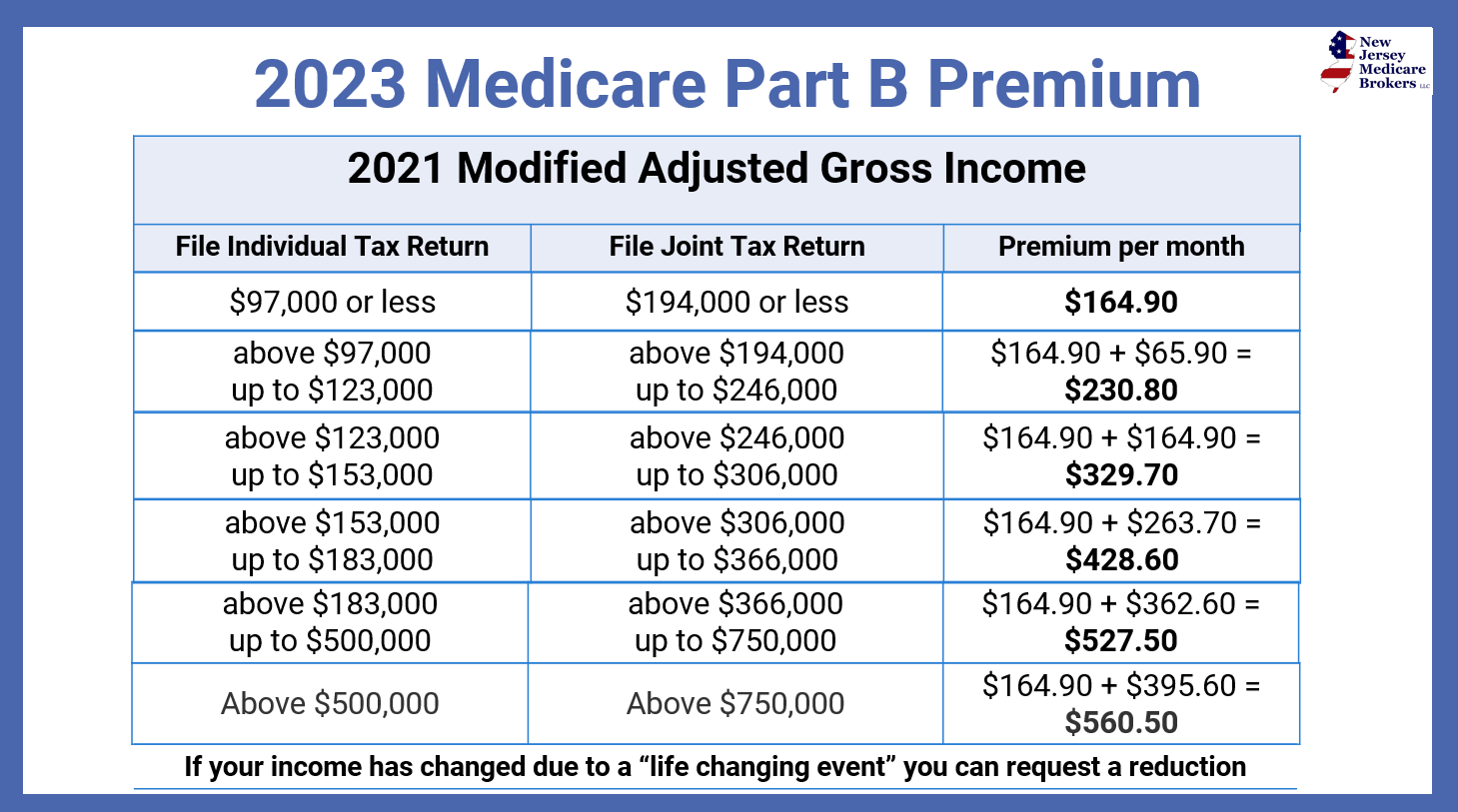

2. How much does a Humana Medicare Part B plan cost? (Answer: Costs vary depending on the specific plan.)

3. How do I enroll in a Humana Medicare Part B plan? (Answer: Contact Humana directly or visit their website.)

4. Can I change my Humana Medicare Part B plan? (Answer: Yes, during specific enrollment periods.)

5. Does Humana offer prescription drug coverage with their Medicare Part B plans? (Answer: Some plans do.)

6. What is the difference between Original Medicare Part B and a Humana Medicare Part B plan? (Answer: Humana plans supplement Original Medicare Part B.)

7. Does Humana have a customer service line for Medicare Part B questions? (Answer: Yes, contact information is available on their website.)

8. Are there any resources available to help me choose a Humana Medicare Part B plan? (Answer: Yes, Humana's website and Medicare.gov provide helpful information.)

One tip for maximizing your Humana Medicare Part B plan is to utilize all available preventive services. This can help prevent future health issues and potentially reduce your overall healthcare costs.

In conclusion, navigating the landscape of Humana Medicare Part B plans requires careful consideration of your individual needs and circumstances. By understanding the different plan options, coverage details, and associated costs, you can make an informed decision that empowers you to take control of your healthcare. Humana Medicare Part B plans offer valuable supplemental coverage to Original Medicare, providing access to a wider range of services and potential cost savings. Taking the time to thoroughly research and compare plans is essential. Remember, your health is an investment, and choosing the right Medicare Part B plan is a crucial step in securing your well-being. Reach out to Humana directly or consult with a Medicare advisor to discuss your specific needs and find the perfect plan for you. Don't delay; take control of your healthcare future today!

Unlocking ea fc mobile your ultimate guide

Unlocking clear speech articulation and phonology assessments

The power of simplicity emoji symbols copy paste black and white

.jpg)