Decoding the JPMorgan Chase Bank Wire Routing Number Maze

So, you're about to dive into the thrilling world of wire transfers with JPMorgan Chase. Buckle up, because navigating the world of financial codes can be trickier than finding a parking spot in midtown Manhattan. But fear not, intrepid fund-mover, this guide will illuminate the mysteries of the JPMorgan Chase bank wire routing number.

Let's be honest, nobody *wants* to deal with routing numbers. They're like the fine print of banking, the stuff we all skim over until we absolutely need it. But when it comes to moving serious cash – whether it's for that dream vacation home or a crucial business transaction – understanding the JPMorgan Chase wire routing number is non-negotiable.

A JPMorgan Chase bank wire routing number is essentially the address of your bank in the vast digital network of financial institutions. It’s a nine-digit code that tells other banks where to send your money. Without it, your funds could end up lost in the digital ether, a financial ghost ship sailing endlessly on the seas of cyberspace. And nobody wants that.

Think of it like this: you wouldn't send a letter without a street address, would you? The same logic applies to wire transfers. The routing number ensures your money arrives at the right destination – your JPMorgan Chase account – safe and sound.

Now, here's where things get a little more complicated. JPMorgan Chase, like many large banks, has different routing numbers depending on your account location and the type of transaction. Using the wrong number can lead to delays, returned payments, and a whole lot of headache. So, how do you find the right one? We'll get to that.

The history of routing numbers goes back to the early 20th century, when the American Bankers Association (ABA) created the system to streamline check processing. Over time, these numbers became essential for electronic transfers as well. JPMorgan Chase, as a product of numerous mergers and acquisitions, inherited various routing numbers from legacy institutions, adding to the complexity. It's a historical quirk that makes finding the right number all the more crucial.

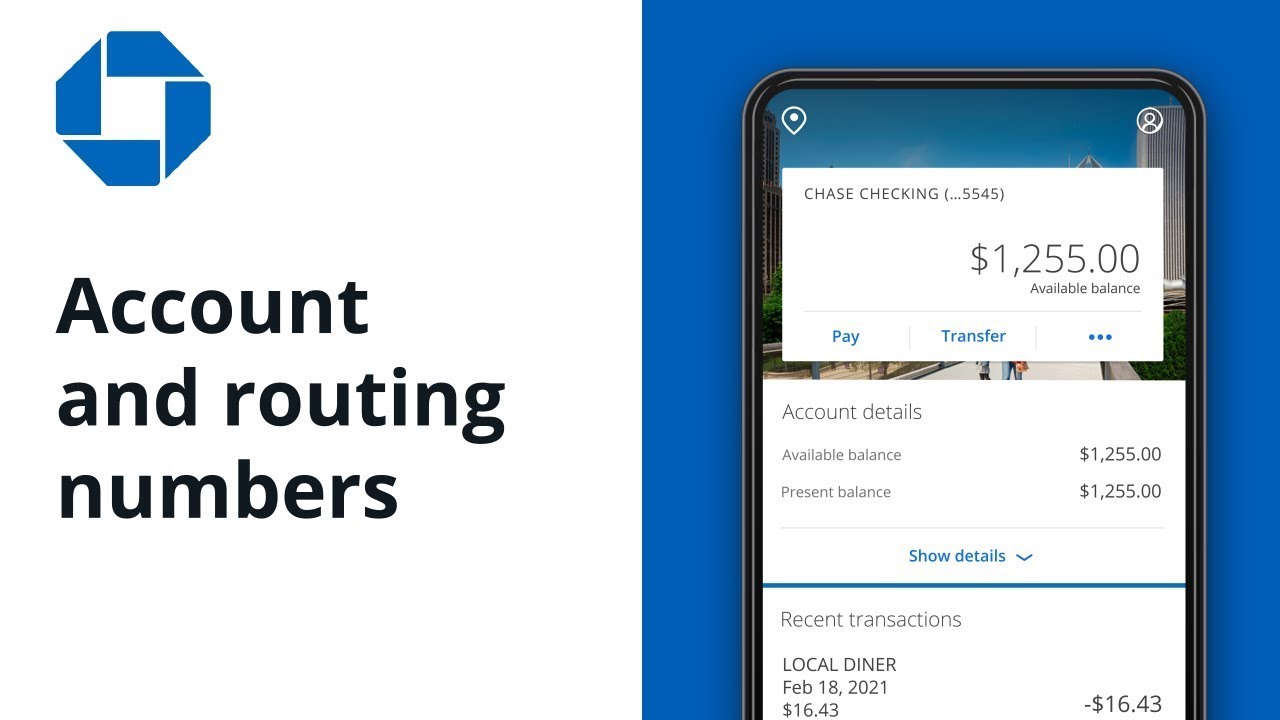

One way to find your JPMorgan Chase wire transfer routing number is to check your personal checks. The number is usually located in the bottom left corner. You can also find it on your online banking platform or by contacting customer support. Remember, accuracy is paramount when it comes to financial codes.

Getting the JPMorgan Chase bank routing number right ensures smooth and efficient transactions. It also prevents costly errors and delays. Finally, it offers peace of mind knowing your money is headed to the right place.

Double-check all information before initiating a wire transfer. Ensure you have the correct account number and routing number for the recipient. If anything seems unclear, contact JPMorgan Chase customer service.

Advantages and Disadvantages of Wire Transfers

| Advantages | Disadvantages |

|---|---|

| Fast transfer speeds | Potential for errors if information is incorrect |

| Large sums of money can be transferred | Typically more expensive than other transfer methods |

| Secure and reliable | Irreversible once sent |

Best Practices for Wire Transfers

1. Verify all recipient information.

2. Double-check the routing and account numbers.

3. Keep records of your transactions.

4. Be aware of fees associated with wire transfers.

5. Contact customer support if you have any questions.

FAQs

1. What is a wire transfer routing number? (Answer: A nine-digit code identifying the financial institution)

2. How do I find my JPMorgan Chase routing number? (Answer: Check your checks, online banking, or contact customer service)

3. Are all JPMorgan Chase routing numbers the same? (Answer: No, they vary by location and transaction type)

4. What happens if I use the wrong routing number? (Answer: The transfer may be delayed or returned)

5. Can I use a routing number for a domestic wire for an international transfer? (Answer: No, different numbers are required)

6. Is it safe to provide my routing number? (Answer: Yes, as long as it's to a trusted party for a legitimate transaction)

7. What is the difference between a routing number and an account number? (Answer: The routing number identifies the bank, the account number identifies your specific account)

8. Where can I find more information about wire transfers? (Answer: Contact JPMorgan Chase customer support)

In conclusion, understanding the JPMorgan Chase bank wire routing number is fundamental for anyone looking to send or receive money electronically. Knowing where to find it, ensuring its accuracy, and following best practices can save you time, money, and unnecessary stress. While navigating the complexities of wire transfers might seem daunting, with a little knowledge and preparation, you can master this essential financial tool. Take the time to understand your routing number and empower yourself to manage your finances efficiently and effectively. Don't let the numbers intimidate you – take control of your financial destiny!

Unlocking the power of clean typography your guide to segoe ui font options

Exploring the family dynamics of jungkook an in depth look

Delving into the depths of disciple of the lich volume 6