Decoding the PNC Bank Routing Number in Florida: A Comprehensive Guide

The subtle click of keys, the soft glow of a screen – these are the hallmarks of modern banking. But behind this seemingly simple interface lies a complex network of numbers and codes that keep the financial world turning. One such crucial piece is the routing number, a nine-digit code that identifies your bank's location. In Florida's vibrant financial ecosystem, understanding your PNC Bank routing number is paramount for seamless transactions.

Imagine the routing number as a unique address for your bank. When you initiate a transaction, whether it's a direct deposit, a bill payment, or an online transfer, the routing number guides the funds to the correct destination – your PNC Bank account in Florida. Without it, the transaction would be lost in the digital ether, much like a letter without a proper address.

The American Bankers Association developed the routing number system in 1910. Initially designed to facilitate check processing, its role has expanded significantly in the digital age. Now, it's essential for various electronic transactions, making it a cornerstone of modern banking. For PNC Bank customers in Florida, having the correct routing number is essential for smooth financial operations.

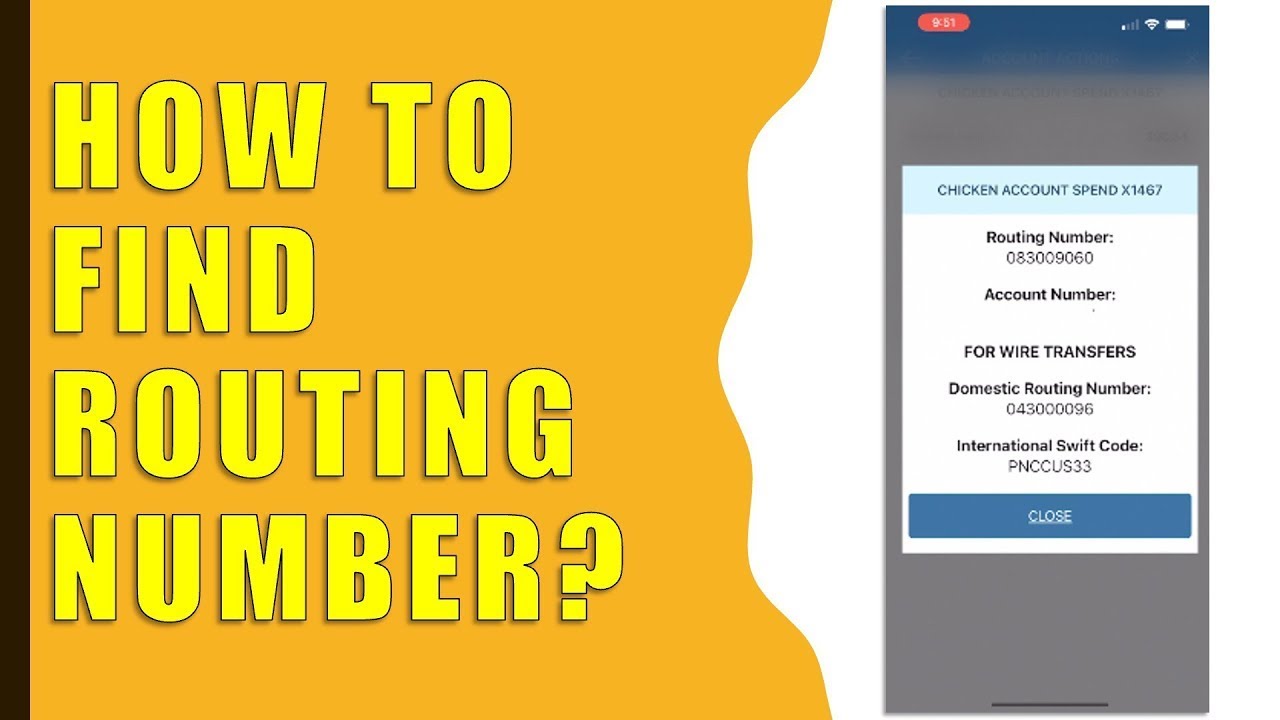

Locating your PNC Bank routing number in Florida is relatively straightforward. It can typically be found on your checks, in your online banking portal, or on your monthly bank statement. PNC Bank also provides this information on its official website, ensuring accessibility for all customers. Being aware of where to find this vital information empowers you to manage your finances effectively.

The implications of using an incorrect PNC Bank routing number can range from minor inconveniences to significant disruptions. A rejected transaction can lead to late payment fees, missed deadlines, and even overdraft charges. Therefore, double-checking the routing number before initiating any transaction is crucial for maintaining a healthy financial profile.

The PNC Bank routing number in Florida plays a vital role in ensuring the smooth flow of funds to and from your account. Its accuracy is paramount for successful transactions. Understanding its importance and knowing where to find it empowers you to navigate the financial landscape with confidence.

For instance, setting up direct deposit requires providing your employer with both your account number and the correct PNC Bank routing number for Florida. This ensures your paycheck arrives in your account without delay. Similarly, when scheduling automatic bill payments, the correct routing number is essential for ensuring timely payments and avoiding late fees.

Three key benefits of knowing your PNC Bank routing number include: seamless transactions, efficient financial management, and avoiding potential financial penalties. These benefits contribute to a smoother and more streamlined banking experience.

Before initiating any transaction involving your PNC Bank account in Florida, always double-check the routing number. Confirm it on your check, bank statement, or the official PNC Bank website. This simple step can prevent potential delays and complications.

Advantages and Disadvantages of Routing Numbers

While routing numbers are essential, it's important to understand their limitations.

| Advantages | Disadvantages |

|---|---|

| Enables electronic transactions | Potential for errors if entered incorrectly |

| Automates payments and deposits | Doesn't provide account-specific security |

Best Practices:

1. Verify the routing number before every transaction.

2. Keep your routing number secure, like your account number.

3. Use online banking to easily access your routing number.

4. Contact PNC Bank directly for any discrepancies.

5. Be wary of phishing scams asking for your routing number.

FAQs:

1. What is a routing number? A nine-digit code identifying your bank's location.

2. Where can I find my PNC Bank routing number in Florida? On your checks, online banking, or bank statements.

3. Why is the routing number important? It ensures funds are directed to the correct account.

4. What happens if I use the wrong routing number? The transaction may be rejected or delayed.

5. Is my routing number the same as my account number? No, they are distinct.

6. Can I use the same routing number for all my PNC accounts? Not necessarily, it depends on the location of the account.

7. How do I update my routing number information? Contact PNC Bank directly.

8. Is my routing number confidential? Yes, treat it like any other sensitive financial information.

Tips and Tricks: Store your routing number securely in a password manager or a safe place. Always double-check the number before entering it for any transaction. Be aware of phishing attempts and never disclose your routing number through unsolicited emails or phone calls.

In conclusion, the PNC Bank routing number in Florida is a fundamental element of modern banking. Understanding its function, knowing where to find it, and adhering to best practices ensures the smooth operation of your financial life. From direct deposits to online bill payments, this nine-digit code plays a crucial role in connecting you to the vast network of financial transactions. By taking the time to understand and correctly utilize your PNC Bank routing number, you are empowering yourself to navigate the financial landscape of Florida with efficiency and confidence. Contact PNC Bank directly if you have any questions or concerns about your routing number or any other aspect of your account. Taking proactive steps to manage your financial information ensures a smooth and secure banking experience.

Upgrade your ride the ultimate guide to car stereo wiring harnesses

What does it take to be a doctor que se necesita para ser un doctor

Unveiling the kingdom exploring kingdom of the planet of the apes free