Decoding the Wells Fargo Wire Transfer Maze

Ever felt that tiny thrill of anticipation, mixed with a dash of "did I do this right?" when sending a wire transfer? Especially with bigger banks like Wells Fargo, the process can feel a little like navigating a labyrinth of numbers and codes. Let's demystify the Wells Fargo wire transfer and explore what those all-important wire transfer numbers actually mean.

Think of a wire transfer as the express train of the money-moving world. It's the fastest way to send money electronically, often internationally, directly from one bank account to another. But unlike handing cash over, you need specific identifiers to ensure the money lands in the correct account. This is where your Wells Fargo wire transfer number comes into play. It acts like a GPS coordinate for your money, guiding it safely to its destination.

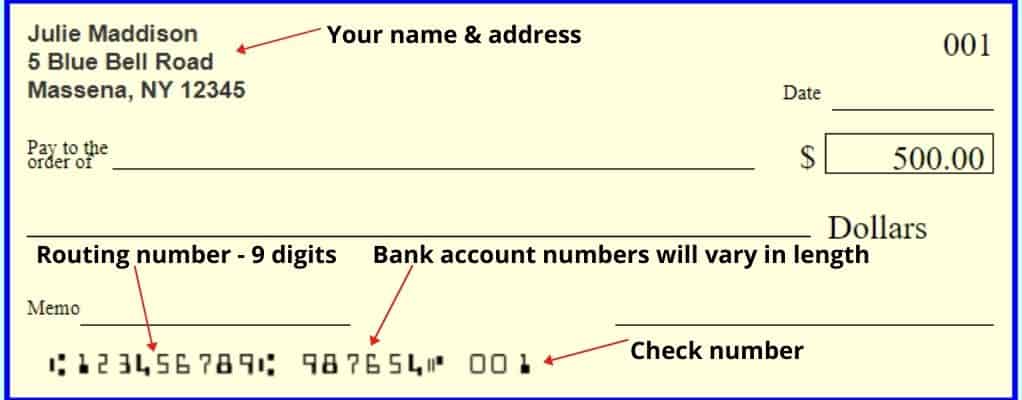

Now, when we talk about a "Wells Fargo wire transfer number," we're really referring to several key pieces of information required for both domestic and international wires. These typically include your account number, the Wells Fargo routing number (which identifies the bank itself), and, for international transfers, a SWIFT code. Each number plays a crucial role in ensuring your transfer goes off without a hitch. Imagine sending a letter without a zip code – it might get there eventually, but it'll take a lot longer and could easily get lost along the way. The same principle applies to wire transfers.

The history of wire transfers goes way back, pre-dating the internet. Initially, they relied on telegraph networks. Today, while the technology has evolved, the fundamental principles remain the same: securely transmitting funds electronically. For Wells Fargo, a major player in the financial landscape, facilitating these transfers is a core part of their service, and they've developed sophisticated systems to handle these transactions efficiently and securely.

One of the primary issues surrounding wire transfers is security. Because these transactions are typically irreversible, it's crucial to ensure all the information is accurate. A single incorrect digit in the Wells Fargo wire transfer number, such as the account number, could result in the funds being sent to the wrong account. This highlights the importance of double and triple-checking every detail before initiating a transfer.

Three key benefits of understanding your Wells Fargo wire transfer numbers: Speed, security (with accurate information), and global reach. For example, needing to quickly send money to family overseas for an emergency – a wire transfer is often the best solution. Knowing the correct SWIFT code and account details ensures the funds arrive swiftly and securely.

Before initiating a Wells Fargo wire transfer, gather your recipient's account details, the Wells Fargo routing number, and the SWIFT code if it’s an international transfer. Verify this information meticulously with your recipient. Log in to your Wells Fargo online banking platform or visit a branch to initiate the transfer, carefully entering the required information. Review the details one final time before submitting.

Tips for smooth Wells Fargo wire transfers: Always confirm recipient details. Keep records of your transfer confirmation. If sending internationally, understand any applicable fees.

Advantages and Disadvantages of Wire Transfers

| Advantages | Disadvantages |

|---|---|

| Speed | Cost |

| Security (with correct information) | Irreversible |

| Global Reach | Potential for fraud if details are incorrect |

Frequently Asked Questions:

1. Where do I find my Wells Fargo routing number? (Answer: On your checks, online banking, or the Wells Fargo website)

2. What is a SWIFT code? (Answer: A unique identifier for international banks)

3. How long does a Wells Fargo wire transfer take? (Answer: Typically 1-3 business days)

4. Can I cancel a wire transfer? (Answer: Difficult, often impossible once processed)

5. Are there fees for wire transfers? (Answer: Yes, vary depending on domestic/international)

6. How do I track my Wells Fargo wire transfer? (Answer: Through online banking or by contacting customer service)

7. What should I do if my wire transfer goes to the wrong account? (Answer: Contact Wells Fargo immediately)

8. Is online wire transfer secure? (Answer: Yes, with proper precautions)

In the fast-paced digital age, understanding your Wells Fargo wire transfer number and the associated details empowers you to move money efficiently and securely. Whether you're supporting family abroad, closing a business deal, or managing your finances, grasping these seemingly small but essential details can make all the difference. Taking the time to double-check information and understand the process not only safeguards your funds but also provides peace of mind. By being informed and proactive, you can confidently navigate the world of wire transfers and make the most of this powerful financial tool.

Conquer your day with hilarious cat gifs the ultimate guide

Dive into the world of digital manhwa english translations

Unraveling the mystery whats the deal with po box 4116 concord ca