Decoding Your Paycheck: A Guide to Hourly Wage Calculation

Ever glanced at your paycheck and wondered how those numbers magically appeared? Or perhaps you're considering a job offer and want to ensure you're being paid fairly. Understanding the ins and outs of hourly wage calculation is crucial for both employees and employers alike. It's about more than just multiplying hours worked by an hourly rate – it's about transparency, fairness, and ensuring everyone is on the same page.

In today's dynamic job market, hourly work is prevalent, encompassing a diverse range of professions from freelance designers to restaurant servers. Unlike salaried positions with a fixed annual income, hourly wages fluctuate based on the actual time worked. This makes grasping the concept of hourly wage calculation even more critical, empowering individuals to accurately track their earnings and advocate for their rights.

While the concept of calculating hourly wages appears simple at first glance, several factors can influence the final amount on your paycheck. Overtime, bonuses, taxes, and deductions all come into play, creating a need for a clear understanding of the process.

The historical evolution of hourly wages is intricately linked with the rise of organized labor and workers' rights movements. As industries shifted from agricultural practices to factory-based production, the need for a standardized system of compensation emerged. Hourly wages provided a more equitable way to compensate workers based on their actual contributions, paving the way for fairer labor practices.

However, the journey hasn't been without its challenges. Disputes over minimum wage laws, unpaid overtime, and wage discrepancies persist, highlighting the ongoing importance of understanding and accurately calculating hourly wages. By arming yourself with the knowledge of how your pay is calculated, you can ensure you're being compensated fairly for your hard work.

Advantages and Disadvantages of Hourly Wages

| Advantages | Disadvantages |

|---|---|

| Potential for overtime pay | Income fluctuation based on hours worked |

| Clear tracking of hours worked | No pay for time off (sick leave, vacation) |

| Greater flexibility in work schedule (for some roles) | Limited benefits compared to salaried positions |

Best Practices for Implementing Hourly Wage Calculation

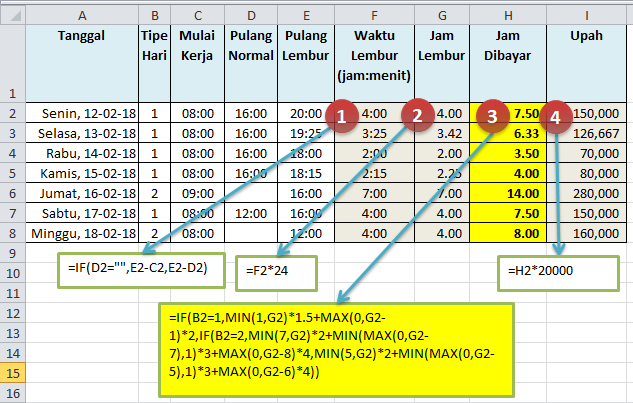

1. Accurate Time Tracking: Utilize reliable time tracking systems to record employee hours worked, ensuring accurate calculation of regular and overtime hours.

2. Transparent Pay Stubs: Provide detailed pay stubs that clearly outline hourly rates, hours worked, overtime calculations, taxes withheld, and any other deductions.

3. Compliance with Labor Laws: Stay updated on federal, state, and local labor laws regarding minimum wage, overtime pay, and other wage-related regulations.

4. Clear Communication: Foster open communication with employees regarding their pay rates, how wages are calculated, and any changes in compensation policies.

5. Regular Audits: Conduct periodic audits of payroll records to ensure accuracy, compliance with regulations, and identify any potential discrepancies.

Frequently Asked Questions About Hourly Wage Calculation

1. How is overtime calculated for hourly employees? Overtime pay is typically calculated at 1.5 times the regular hourly rate for hours worked beyond the standard 40-hour workweek.

2. Are tips included in the hourly wage calculation? Tips are considered part of an employee's income. However, employers are often allowed to pay a lower minimum wage if tips bring the total earnings to the minimum wage requirement.

3. How do taxes affect my hourly wage? Taxes are typically deducted from an employee's gross pay (hourly rate x hours worked). The amount deducted varies depending on individual tax withholdings and filing status.

4. What should I do if I believe my wages have been calculated incorrectly? First, review your pay stubs and any relevant employment agreements. If discrepancies persist, address the issue with your employer or consult with a labor rights organization or attorney if necessary.

5. Are there any tools or resources available to help me calculate my hourly wage? Yes, numerous online calculators and payroll software solutions can assist in calculating hourly wages, including overtime, deductions, and net pay.

6. What is the difference between gross pay and net pay for hourly workers? Gross pay refers to the total amount earned before taxes and deductions, while net pay represents the take-home pay after all deductions have been made.

7. Can my employer change my hourly rate without notice? While laws vary, employers generally need to provide reasonable notice before making significant changes to an employee's pay rate.

8. What are some common deductions from an hourly wage? Common deductions include federal and state income taxes, Social Security taxes, Medicare taxes, health insurance premiums, and retirement contributions.

In today's complex work landscape, understanding hourly wage calculation is paramount. It empowers both employees and employers to ensure fair compensation, transparency, and compliance with labor laws. By grasping the fundamentals of hourly wages, individuals can confidently navigate their paychecks, advocate for their rights, and make informed decisions about their careers. Whether you're a seasoned professional or just starting, comprehending this essential aspect of employment empowers you to take control of your earnings and secure a brighter financial future.

Unlocking the mystery how to calculate volumetric weight in inches

Effortlessly chic casual clothing guide for women over 65

Journeying beyond the allure of sci fi exploration vehicles