Does Bank of America Have Checks? Your Burning Questions Answered

In today's digital age, you might find yourself swiping a card or tapping your phone to make payments more often than not. Yet, the humble check persists as a surprisingly resilient payment method. This begs the question: does Bank of America, one of the nation's leading financial institutions, still offer checks to its customers?

The answer, in short, is a resounding yes. While the financial landscape continues to evolve, Bank of America recognizes that some customers value the familiarity and tangible nature of checks. Whether you need to pay your rent, send money to family, or make a donation, Bank of America provides several avenues for you to access and use checks.

The continued relevance of checks, even with the rise of digital banking, speaks to their adaptability and enduring practicality. For many, checks offer a sense of security and control over their finances. The ability to physically write out the amount and recipient's information provides a level of tangibility often missing in digital transactions.

Furthermore, checks can bridge the gap for individuals who might not have easy access to online banking or prefer a more traditional payment method. Certain businesses and organizations may also prefer checks, particularly for large transactions where a physical record is desired.

Navigating the world of checks, however, can feel like stepping back in time, particularly for those new to the experience. From ordering your first set of checks to understanding the different types available, there's a learning curve involved. That's where this comprehensive guide comes in. We'll demystify the process of using checks with Bank of America, equipping you with the knowledge and resources needed to navigate this traditional payment method with confidence.

Advantages and Disadvantages of Using Checks with Bank of America

While Bank of America offers checks as a payment option, it's essential to weigh both the advantages and disadvantages to determine if they are the right fit for your needs.

| Advantages | Disadvantages |

|---|---|

| Familiarity and ease of use for many | Can be slower than electronic payment methods |

| Tangible record of transactions | Risk of loss or theft |

| Widely accepted by businesses and individuals | Requires maintaining a checkbook and stamps |

Common Questions About Bank of America Checks

Here are answers to some frequently asked questions about using checks with Bank of America:

1. How do I order checks from Bank of America?

You can order checks online through your Bank of America online banking account, by phone, or by visiting a local branch.

2. How long does it take to receive my checks?

Delivery time varies depending on the ordering method and shipping option chosen. Standard delivery typically takes 7-10 business days.

3. Is there a fee for ordering checks?

Fees for checks vary based on your account type and the style of checks you choose. Check with Bank of America for specific pricing.

4. Can I use mobile check deposit with Bank of America?

Yes, Bank of America allows you to deposit checks using their mobile app, providing a convenient alternative to visiting an ATM or branch.

5. What should I do if I lose my checks?

If your checks are lost or stolen, report it to Bank of America immediately to prevent unauthorized use. They can assist you with placing a stop payment and ordering new checks.

6. Are there alternatives to using checks with Bank of America?

Yes, Bank of America offers numerous alternatives, including online bill pay, mobile payments, wire transfers, and debit cards.

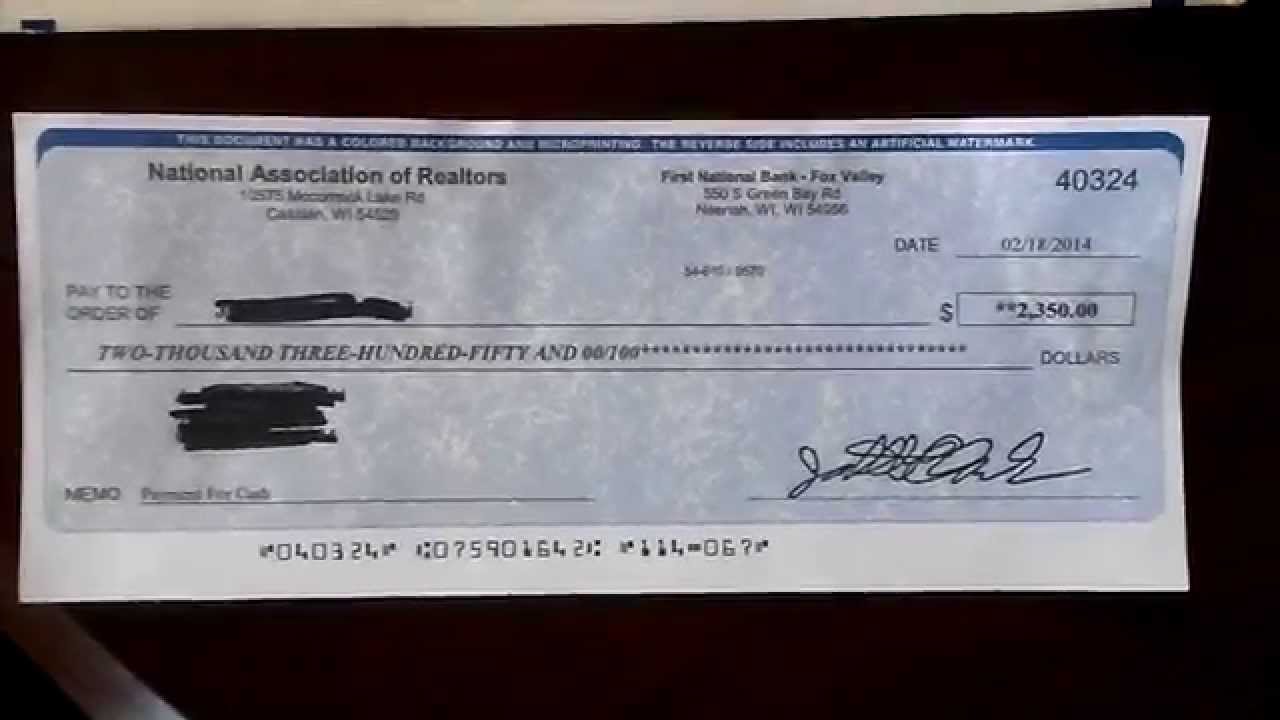

7. What is the difference between a cashier's check and a personal check?

A cashier's check is a check drawn on the bank's funds, offering guaranteed payment. A personal check is drawn on your personal account funds.

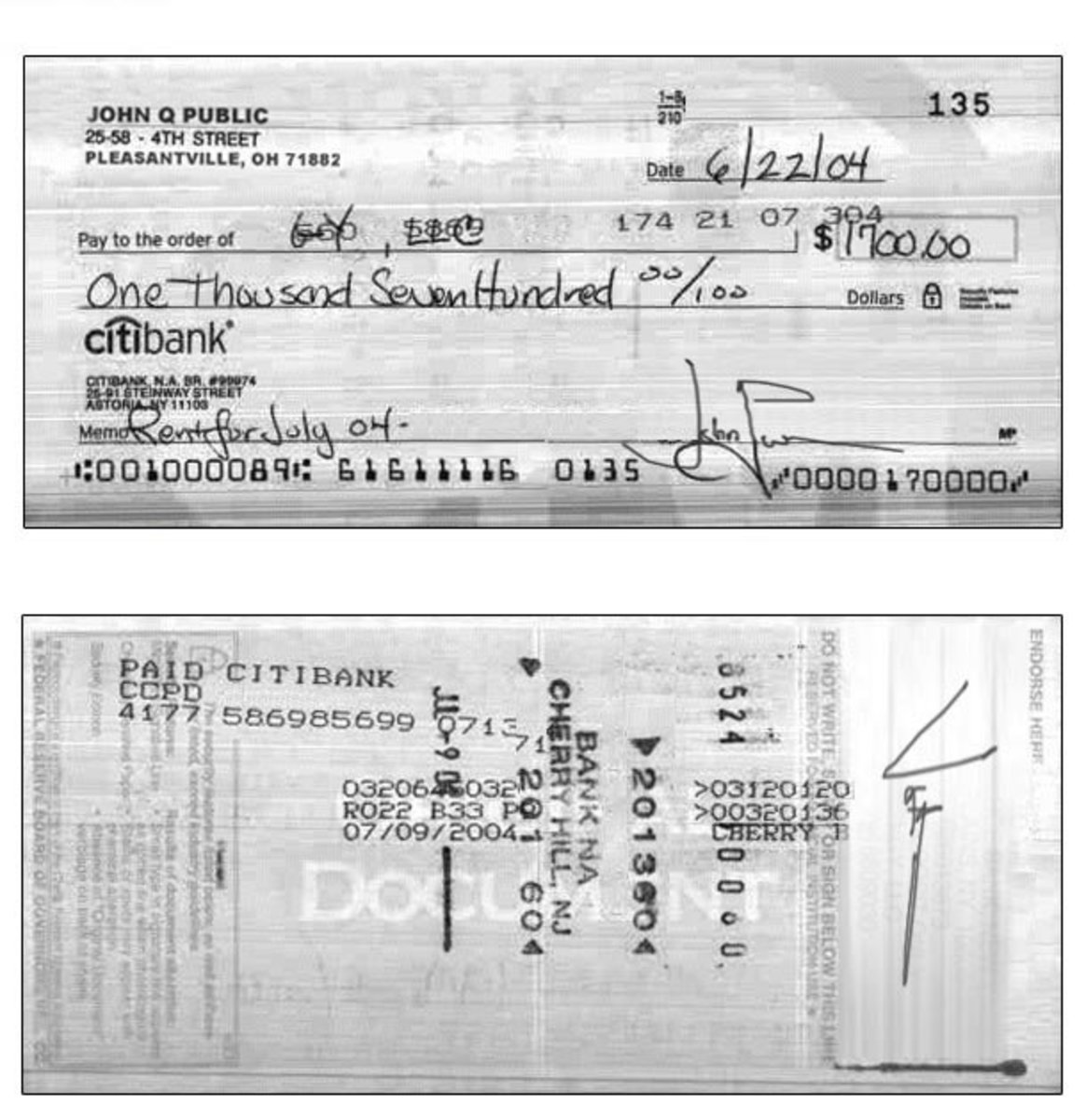

8. How do I write a check correctly?

Bank of America provides resources on their website and through their customer service to guide you on correctly filling out a check.

Tips for Using Bank of America Checks

Keep these tips in mind when using checks with Bank of America:

- Always use a pen with blue or black ink to prevent fading or alteration.

- Double-check the accuracy of the payee's name, amount, and your signature before handing over a check.

- Keep your checkbook in a safe and secure place to prevent loss or theft.

- Record all transactions in your check register to maintain accurate account balances and avoid overdrafts.

- Consider using online bill pay or other digital payment methods for recurring payments to streamline your finances.

While the era of digital transactions is undoubtedly upon us, checks continue to hold their place as a familiar and reliable payment method. Bank of America recognizes this and provides its customers with the resources and options needed to continue utilizing checks effectively. By understanding the process of ordering, writing, and tracking checks, you can navigate this traditional payment method with confidence while also taking advantage of the digital banking tools Bank of America offers.

Unlocking home your guide to rental harmony in hopkinsville

Unmasking the mystery what is badtz maru personality

Mastering wheel lug nut torque your guide to safe secure wheels