Does Chase Bank Accept Third Party Checks? What You Need to Know

You've just received a third-party check, and you're eager to deposit it. But a wave of uncertainty hits – will your bank even accept it? Third-party checks can be a bit tricky, often raising flags due to potential fraud. So, what's the deal with Chase Bank? Do they accept third-party checks?

Let's dive into the details about third-party checks at Chase, addressing the ins and outs, potential hurdles, and tips for a smoother transaction.

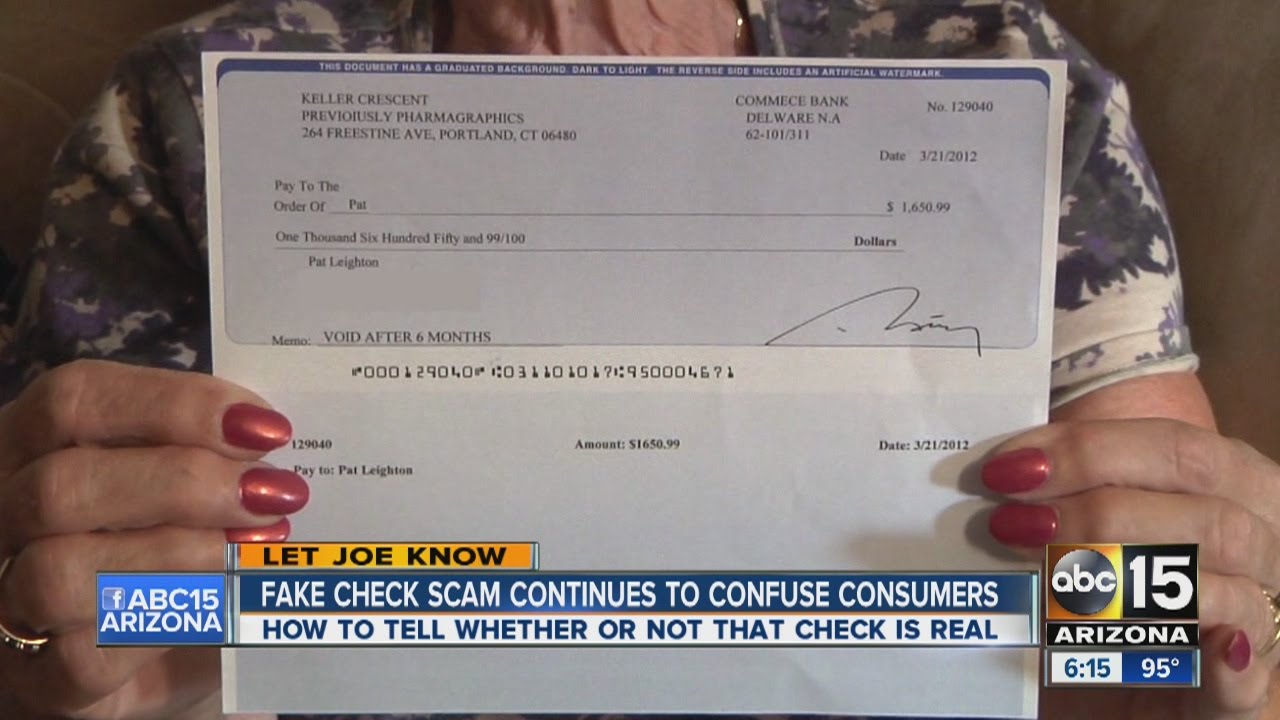

Understanding third-party checks is crucial in today's financial landscape. They differ from standard checks as they are made payable to someone other than the person depositing them. This "third party" then endorses the check to you, allowing you to deposit or cash it. While seemingly straightforward, this extra step introduces a layer of complexity, making banks like Chase extra cautious.

Historically, financial institutions have been wary of third-party checks. This stems from the inherent difficulty in verifying the check's legitimacy and the increased risk of fraud or bounced checks. Chase Bank, like many others, has policies to mitigate these risks.

While Chase Bank doesn't outrightly prohibit third-party checks, they handle them with extra care. This may involve additional verification steps, longer processing times, or even potential holds on funds. Understanding these nuances is crucial for anyone dealing with third-party checks at Chase.

Advantages and Disadvantages of Accepting Third-Party Checks

| Advantages | Disadvantages |

|---|---|

| Convenience for receiving funds | Increased risk of fraud |

| Accessibility for those without traditional bank accounts | Potential for delays in funds availability |

| Can be used for larger transactions | May be subject to additional fees |

Best Practices for Depositing Third-Party Checks at Chase

1. Contact Chase Directly: Before heading to the bank, reach out to Chase customer service or visit their website to confirm their current policies on third-party checks.

2. Gather Necessary Documentation: Be prepared to provide identification, the check endorser's information, and any supporting documentation related to the check's origin.

3. Endorse the Check Correctly: Ensure the third party endorses the check correctly in your presence. This typically involves signing the back and writing "Pay to the order of [Your Name]."

4. Be Transparent: When depositing the check, inform the teller that it's a third-party check. This allows them to guide you through any specific procedures.

5. Consider Alternative Options: If possible, explore alternative payment methods like mobile payments or direct transfers to avoid potential hurdles associated with third-party checks.

Common Questions and Answers about Third-Party Checks at Chase

1. Can I deposit a third-party check at a Chase ATM? It's generally not recommended to deposit third-party checks at ATMs. These transactions often require additional verification that can be best handled by a teller.

2. How long does it take for a third-party check to clear at Chase? The clearing time for third-party checks at Chase can vary depending on the check amount and other factors. It's best to check with the bank for an estimated timeframe.

3. What are the fees for depositing a third-party check at Chase? Chase may have fees associated with depositing third-party checks, especially if they are for large amounts or require additional verification. Check their fee schedule for details.

4. Can I mobile deposit a third-party check with Chase? Chase's mobile deposit policies for third-party checks can be restrictive. It's best to contact them or check their app for the latest guidelines.

5. What happens if a third-party check bounces after I deposit it at Chase? If a third-party check bounces after you've deposited it, you'll likely be responsible for the amount of the check, any fees incurred, and potential damage to your credit score.

6. Can I cash a third-party check at Chase? Cashing a third-party check at Chase is generally more difficult than depositing one. They are more likely to accept a deposit due to the reduced risk.

7. Does Chase have a limit on the amount of third-party checks I can deposit? Chase may have limits on the amount or frequency of third-party check deposits, especially for new customers. Consult their policies for specific details.

8. How can I protect myself from fraud when dealing with third-party checks? Only accept third-party checks from trusted sources, verify the payer's information, and consider using alternative payment methods if you have concerns about fraud.

Tips and Tricks for Dealing with Third-Party Checks

- Communication is key: Stay in contact with Chase to clarify any doubts and ensure a smooth transaction.

- Explore alternatives: Consider mobile payment apps or direct bank transfers for more straightforward transactions.

- Document everything: Keep records of the check, endorser information, and communication with the bank for future reference.

In conclusion, while Chase Bank does not explicitly prohibit third-party checks, they approach them with caution due to potential risks. Understanding the bank's policies, following best practices, and being prepared for potential delays is essential for anyone dealing with these types of checks. When in doubt, reach out to Chase directly for the most up-to-date information and guidance. By being informed and prepared, you can navigate the intricacies of third-party checks and ensure your financial transactions go smoothly.

The enduring power of douglas macarthurs old soldiers never die speech

Navigating construction disputes your guide to avocat droit de la construction rennes

The allure of the long brown hair actor