Making Sense of CIMB Bank Account Templates

Have you ever felt overwhelmed by the sheer number of options when opening a bank account? It's like standing in the cereal aisle — too many choices, and you end up leaving with something familiar but not necessarily the best fit. When it comes to banking in Malaysia, CIMB Bank is a household name, but navigating their different account types can feel like its own hurdle. This is where understanding "CIMB Bank account templates" can be incredibly helpful. Now, while the term "template" might make you think of pre-designed formats, it's more about understanding the key features, requirements, and benefits associated with each type of CIMB account. Think of it as a shortcut to deciphering the banking jargon and finding an account that truly suits your needs.

Choosing the right bank account can be a game-changer, especially in today's fast-paced world. Whether you're a student just starting out, a young professional climbing the career ladder, or someone looking to manage their finances more effectively, having the right account can make all the difference.

CIMB Bank, with its extensive range of financial products, has something for everyone. But that's also where the confusion might set in. How do you know which account aligns best with your financial goals? What are the key differences between a savings account and a current account? And what about all the additional perks and features they offer?

This is where familiarizing yourself with the different "CIMB Bank account templates" becomes essential. By understanding the blueprint of each account type, you can break down the complexities and gain clarity on which option complements your lifestyle and aspirations.

In this comprehensive guide, we'll demystify the world of CIMB Bank accounts. We'll explore the different account options available, their unique features, and the benefits they offer. We'll delve into common questions, provide helpful tips, and ultimately empower you to make an informed decision when choosing your perfect CIMB Bank account.

Advantages and Disadvantages of Different CIMB Bank Account Types

While specific details may vary, understanding these broad categories will give you a good starting point:

| Account Type | Advantages | Disadvantages |

|---|---|---|

| CIMB Basic Savings Account | Easy to open, low initial deposit, ATM access | Limited transactions, lower interest rates |

| CIMB Current Account | Convenient for daily transactions, checkbook facility, higher transaction limits | Usually requires a minimum balance, might have monthly fees |

| CIMB Fixed Deposit Account | Higher interest rates compared to savings accounts, safe investment option | Funds are locked in for a fixed period, penalty for early withdrawal |

Best Practices for Choosing a CIMB Bank Account

Here are five best practices to consider:

- Identify Your Needs: Are you looking to save, invest, or manage daily expenses? Your financial goals will determine the type of account you need.

- Compare Interest Rates: Look for accounts that offer competitive interest rates to maximize your earnings.

- Check for Fees and Charges: Be aware of any monthly fees, transaction charges, or penalties associated with the account.

- Consider Accessibility and Convenience: Choose an account that offers convenient access to your funds through online banking, mobile apps, and a wide ATM network.

- Read the Fine Print: Before opening an account, carefully review the terms and conditions to understand all the details.

Common Questions and Answers about CIMB Bank Accounts

Get answers to some frequently asked questions about CIMB bank accounts:

- Q: What documents do I need to open a CIMB Bank account?

A: Typically, you'll need a valid MyKad (for Malaysian citizens) or passport (for foreigners), proof of address, and initial deposit.

- Q: Can I open a CIMB Bank account online?

A: Yes, CIMB Bank offers online account opening facilities for select account types. You can visit their website or use their mobile app to apply.

- Q: How do I check my CIMB Bank account balance?

A: You can check your balance through CIMB Clicks (online banking), the CIMB Clicks app, ATMs, or by requesting a balance inquiry at a CIMB branch.

- Q: Can I have multiple accounts with CIMB Bank?

A: Yes, you can have multiple accounts with CIMB Bank to suit your different financial needs.

Tips for Managing Your CIMB Bank Account

Here are a few helpful tips:

- Set up SMS or email alerts to track your account activity.

- Take advantage of CIMB's online and mobile banking platforms for convenient transactions and account management.

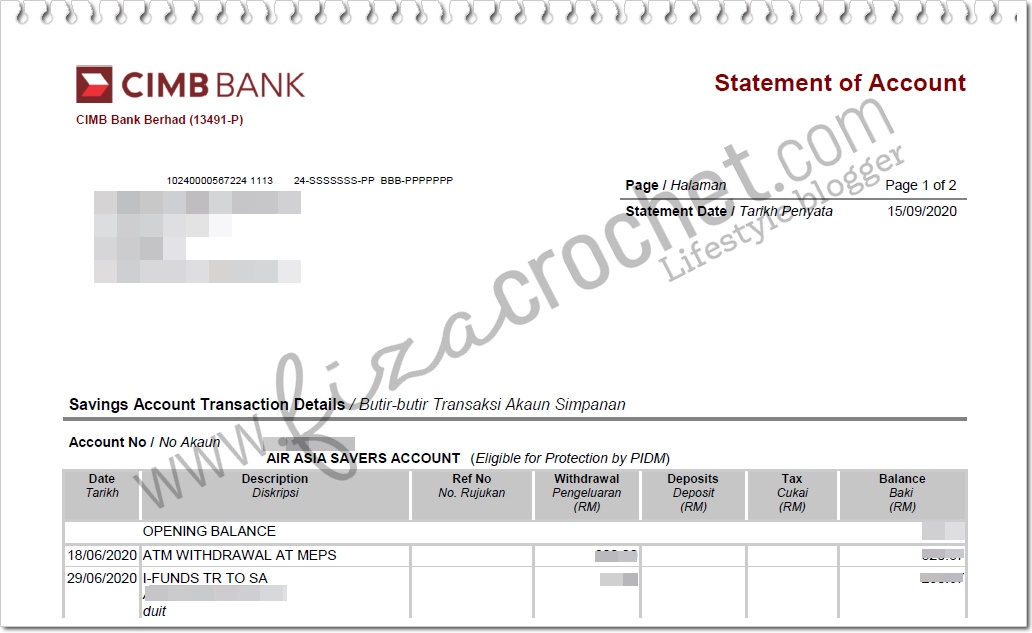

- Regularly review your account statements to monitor your spending and savings progress.

Choosing the right bank account is a personal decision, and what works best for your friend or family member might not be the ideal choice for you. By understanding the basic "templates" of CIMB accounts, you can confidently narrow down your options and ultimately select an account that aligns with your financial aspirations. Remember, knowledge is power, especially when it comes to managing your hard-earned money.

Unlocking your opm pay a guide to step increases

Decoding energy price caps your guide to unit rates

Awesome cool drawings exploring the world of chido imagery