Market Cap Mayhem: A Deep Dive into Global Company Rankings

Ever wonder how companies are sized up on the global stage? It's not about physical footprint or employee count. It's all about market capitalization, a thrilling metric that constantly shifts and shapes the financial landscape. This deep dive explores the wild world of market cap world ranking, uncovering its secrets and significance.

The market capitalization world ranking is like a constantly updating leaderboard for companies worldwide. It provides a snapshot of a company's overall value at a specific moment, as perceived by the market. This ranking, a dynamic and ever-changing spectacle, offers crucial insights into the perceived health and potential of businesses across the globe.

The history of tracking global market cap is intertwined with the rise of stock exchanges and the increasing interconnectedness of global finance. As capital markets expanded and information flowed more freely, the need to compare and rank companies across borders became paramount. This ranking system, born from the need for clarity in a complex world, has become a crucial tool for investors and analysts.

The importance of market cap world ranking stems from its ability to provide a quick and relatively straightforward comparison of company size and perceived value. It's a shorthand for understanding a company's standing within its industry and on the global stage. However, this powerful tool isn't without its quirks and caveats. Relying solely on market cap can be misleading, as it reflects market sentiment, which can be influenced by factors beyond a company's underlying fundamentals. Bubbles, speculation, and short-term market fluctuations can all distort the true picture.

Market capitalization, often shortened to "market cap," is calculated by multiplying a company's current share price by the total number of outstanding shares. For example, if a company has 100 million shares outstanding and a share price of $50, its market cap is $5 billion. This deceptively simple calculation provides a powerful metric for understanding a company’s size and influence.

One benefit of following market cap rankings is gaining insight into market trends and investor sentiment. Another advantage is its use as a screening tool for investment opportunities. Finally, it can be used as a benchmark for portfolio diversification. For example, an investor might aim to balance their portfolio with companies across different market cap categories (large-cap, mid-cap, small-cap).

Understanding market cap can help you make more informed investment decisions. Start by researching companies that interest you, paying attention to their market cap and how it compares to their competitors. Next, consider the potential risks and rewards of investing in companies of different sizes. Finally, remember that market cap is just one piece of the puzzle; it's crucial to conduct thorough due diligence and consider other factors before making investment decisions.

Advantages and Disadvantages of Market Cap World Ranking

| Advantages | Disadvantages |

|---|---|

| Easy comparison of company size | Subject to market volatility and speculation |

| Insight into market trends | Doesn't reflect underlying company fundamentals |

| Useful for portfolio diversification | Can be misleading for companies with limited trading volume |

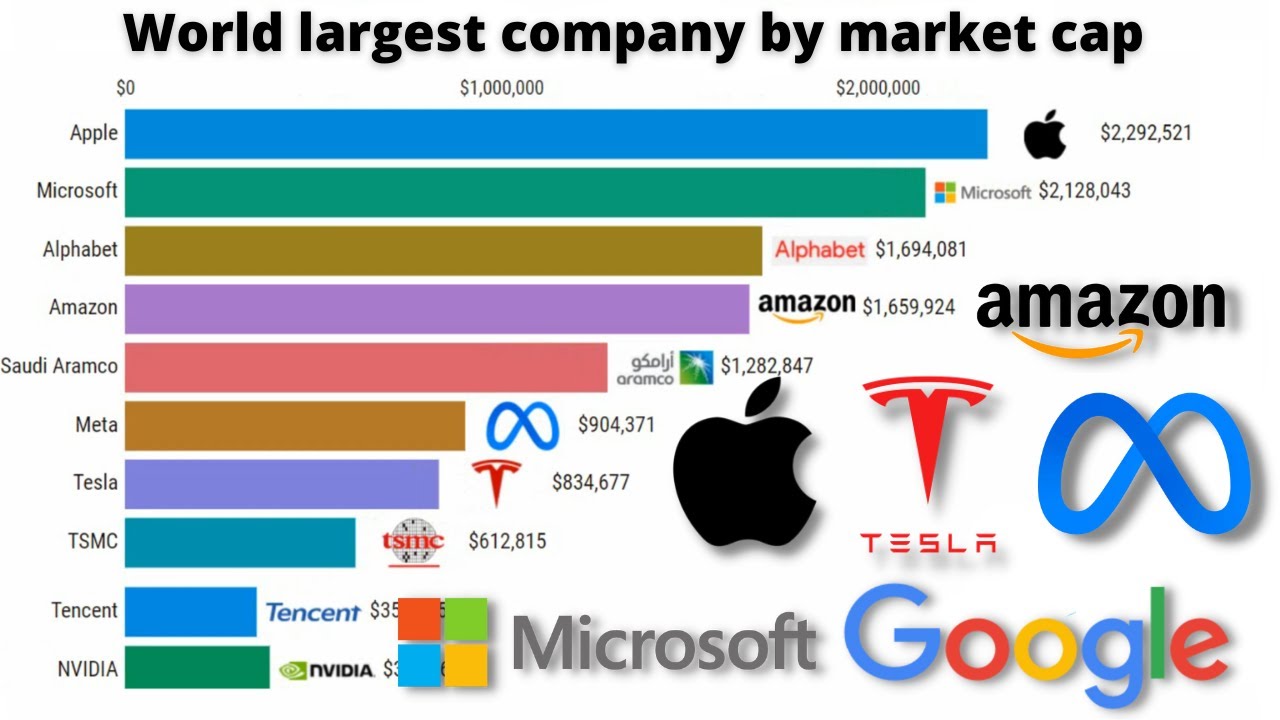

Five real-world examples of companies with large market capitalizations (as of late 2023): Apple, Microsoft, Saudi Aramco, Alphabet (Google), and Amazon. These companies consistently rank among the top globally, demonstrating the power and influence of large market cap entities.

Frequently Asked Questions about market cap ranking include: What is market cap? How is it calculated? Why does it matter? What are the limitations? How is it used in investing? Where can I find this information? What are the different market cap categories? How often does the ranking change?

One helpful tip is to use reputable financial websites and resources to track market cap rankings and stay informed about changes in the global landscape. Don't rely solely on market cap when making investment decisions, and always consider other factors, such as a company's financial performance, industry trends, and competitive landscape.

In conclusion, understanding market cap world ranking is crucial for navigating the complex world of finance. From its origins in the burgeoning global marketplace to its role as a key metric for investors, market cap provides a snapshot of company value and market sentiment. While it's essential to acknowledge its limitations, such as its susceptibility to market fluctuations and inability to reflect underlying fundamentals, the benefits of understanding this ranking are undeniable. By using market cap as one factor in a comprehensive investment strategy, individuals and institutions can make more informed decisions and potentially achieve their financial goals. Take the time to explore the intricacies of global market cap, and unlock a deeper understanding of the financial world. Remember to research and compare companies, diversify your portfolio, and always consider the broader market context. Stay informed, stay curious, and navigate the world of market capitalization with confidence.

Unlocking efficiency mastering industrial motor control documentation

Unlocking the secrets of italian sugar cookies

Unlocking benjamin moore paint colors in rgb