Mastering JPMorgan Chase Bank Wire Transfers: Your Ultimate Guide

Sending or receiving money via wire transfer can seem daunting, especially when dealing with a large institution like JPMorgan Chase. Where do you even start? This guide will demystify the process, providing you with the essential information you need to navigate JPMorgan Chase bank wire transfers effectively.

First, let's clarify what we mean by "JPMorgan Chase bank address for wire." This isn't a physical address like the one you'd use to mail a letter. Instead, it refers to a combination of specific codes and information required to route your wire transfer correctly. This typically includes the bank's SWIFT code, routing number, and potentially a specific branch address for certain types of transactions.

Locating this information can be tricky. While a general online search might yield some results, the most reliable approach is to contact JPMorgan Chase directly. Their customer service can provide the precise information you need for your specific transfer type (domestic or international). You can also often find this information by logging into your online banking account or referring to your account statements.

Why is accuracy so crucial when it comes to JPMorgan Chase bank wire information? Incorrect details can lead to significant delays, returned funds, or even lost money. Double-checking every piece of information before initiating a transfer is paramount.

Wire transfers have become increasingly common in today's globalized world. They allow for fast, secure, and often high-value transactions across borders. JPMorgan Chase, being a major financial institution, plays a significant role in facilitating these transfers. Understanding their specific requirements and procedures ensures smooth and efficient transactions.

For international wire transfers, the SWIFT code (Society for Worldwide Interbank Financial Telecommunication) is crucial for identifying JPMorgan Chase's international branch. For domestic transfers within the United States, you'll typically use the bank's routing number. It's essential to differentiate between these two and use the correct code for your transfer type.

One major issue associated with wire transfers is security. While generally secure, there's always a risk of fraud. Always verify the recipient's details and be wary of unsolicited requests for wire transfers.

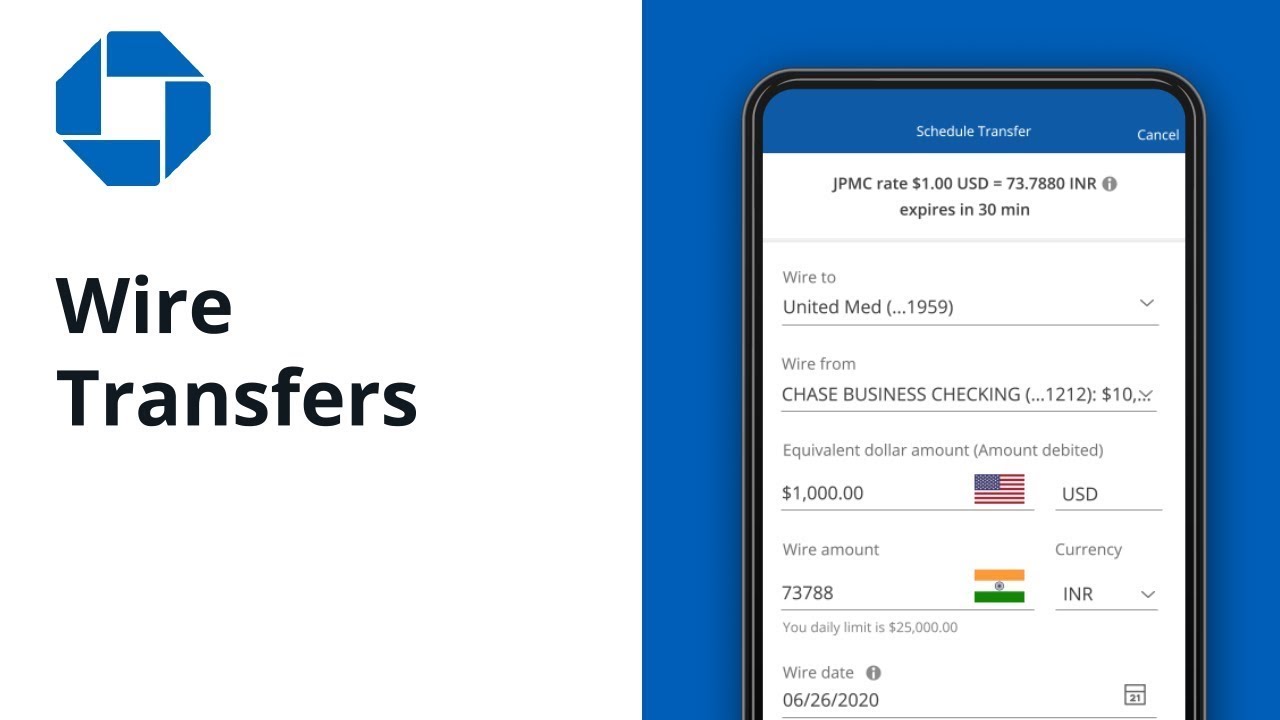

Here's a step-by-step guide to initiating a wire transfer with JPMorgan Chase: 1. Gather the recipient's information (name, account number, bank name and address, SWIFT code if international). 2. Contact JPMorgan Chase to confirm the necessary wire transfer details. 3. Initiate the transfer through your online banking platform or by visiting a branch. 4. Keep a record of the confirmation number for your reference.

Advantages and Disadvantages of Wire Transfers

| Advantages | Disadvantages |

|---|---|

| Fast Transfer Speed | Higher Fees Compared to Other Transfer Methods |

| High Security | Irreversible Transactions (Increased Risk of Fraud) |

| Large Transfer Amounts Possible | Requires Precise Information (Potential for Delays) |

Best Practices: 1. Double-check all recipient information. 2. Use strong passwords and two-factor authentication for your online banking. 3. Be cautious of phishing scams related to wire transfers. 4. Contact JPMorgan Chase directly for any clarification. 5. Keep records of all your wire transfer transactions.

FAQ:

1. How do I find the JPMorgan Chase SWIFT code? Contact customer service or check your online banking.

2. What is the JPMorgan Chase routing number for domestic transfers? It varies by branch; contact customer service or check your account statement.

3. How long does a wire transfer take with JPMorgan Chase? Typically 1-3 business days.

4. What are the fees associated with JPMorgan Chase wire transfers? This varies depending on the type and amount of transfer. Contact Chase for specific fee information.

5. Can I cancel a wire transfer? Contact Chase immediately; it may be possible if the transfer hasn't been processed yet.

6. How can I protect myself from wire transfer fraud? Verify recipient details carefully and report suspicious activity.

7. What do I do if my wire transfer is delayed? Contact JPMorgan Chase customer service.

8. Can I send a wire transfer internationally with JPMorgan Chase? Yes, they offer international wire transfer services.

Tips: Always initiate wire transfers through secure channels. Be wary of unsolicited emails or calls requesting wire transfer information. Regularly review your account statements for any unauthorized transactions.

In conclusion, navigating JPMorgan Chase bank wire transfers requires accurate information and a clear understanding of the process. By following the guidelines outlined in this guide, you can confidently manage your wire transfers efficiently and securely. Understanding the specifics of SWIFT codes, routing numbers, and security measures empowers you to avoid potential pitfalls and take advantage of the speed and convenience that wire transfers offer. Remember to always prioritize security and verify all details meticulously. Don't hesitate to contact JPMorgan Chase directly for any questions or concerns. Taking these steps will ensure your wire transfers are smooth, secure, and hassle-free. Utilizing online resources and staying informed about best practices will further enhance your ability to navigate the world of wire transfers effectively.

Finding peace in the city your guide to jadwal sholat di jakarta barat

Groan worthy gold unleashing the power of dad jokes for kids

Spice up your discord server description copy paste magic