Mastering Your Finances: A Guide to Understanding Indonesian Income Tax Calculations

Navigating the world of taxes can seem like venturing into a foreign land, full of complex rules and unfamiliar terms. But fear not, conquering your Indonesian income tax, or "pajak penghasilan," doesn't have to be an overwhelming ordeal. This guide is your passport to understanding the latest calculation methods and ensuring you're financially prepared throughout the year.

Let's start by acknowledging the significance of staying updated on the latest tax regulations, often referred to as "cara hitung pajak penghasilan terbaru" in Indonesian. These updates can significantly impact your tax obligations, and being in the loop empowers you to make informed financial decisions.

Imagine this: you're planning a dream vacation or eyeing that designer handbag you've been wanting. Understanding your tax liabilities in advance allows you to budget wisely and indulge in those well-deserved treats without the stress of unexpected tax burdens.

Whether you're a seasoned professional, a budding entrepreneur, or just starting your career journey, grasping the fundamentals of Indonesian income tax calculation is crucial. This knowledge empowers you to plan your finances effectively, maximize savings, and even explore potential investment opportunities.

This guide will equip you with the knowledge and tools to demystify the Indonesian income tax landscape. We'll delve into the intricacies of calculating your taxes, explore the latest regulations, and empower you to take control of your financial well-being.

Advantages and Disadvantages of Understanding Indonesian Income Tax Calculations

| Advantages | Disadvantages |

|---|---|

| Accurate tax filing, avoiding penalties | Time investment required to learn and stay updated |

| Financial planning and budgeting optimization | Complexity of regulations for certain income types |

| Identification of potential tax deductions and benefits | Potential for changes in tax laws, requiring adaptation |

While staying informed about Indonesian income tax calculation methods offers numerous benefits, it's essential to acknowledge the time investment required to understand the regulations and the possibility of future changes.

Best Practices for Managing Your Indonesian Income Tax

Here are some valuable tips to simplify your tax journey:

- Stay Updated: Regularly check for updates from the Indonesian tax authority (Direktorat Jenderal Pajak/DJP) to stay informed about any changes in tax rates, regulations, or deadlines.

- Maintain Accurate Records: Keep detailed records of your income, expenses, and any supporting documents related to your tax filing. This organized approach simplifies the tax calculation process and helps prevent errors.

- Utilize Technology: Explore online tax calculators and accounting software to assist you in accurately calculating your income tax. These tools can streamline the process and reduce the risk of errors.

- Seek Professional Advice: If you encounter complexities or have questions about your specific tax situation, don't hesitate to consult with a qualified tax advisor. They can provide personalized guidance and ensure compliance with Indonesian tax laws.

- Meet Deadlines: Mark your calendar with important tax deadlines and file your tax return on time. Late filings can result in penalties and unnecessary complications.

By implementing these best practices, you can navigate the Indonesian income tax landscape with confidence and ensure timely and accurate tax compliance.

Frequently Asked Questions (FAQs)

Here are some common queries regarding Indonesian income tax:

- Q: What is the income tax rate in Indonesia?

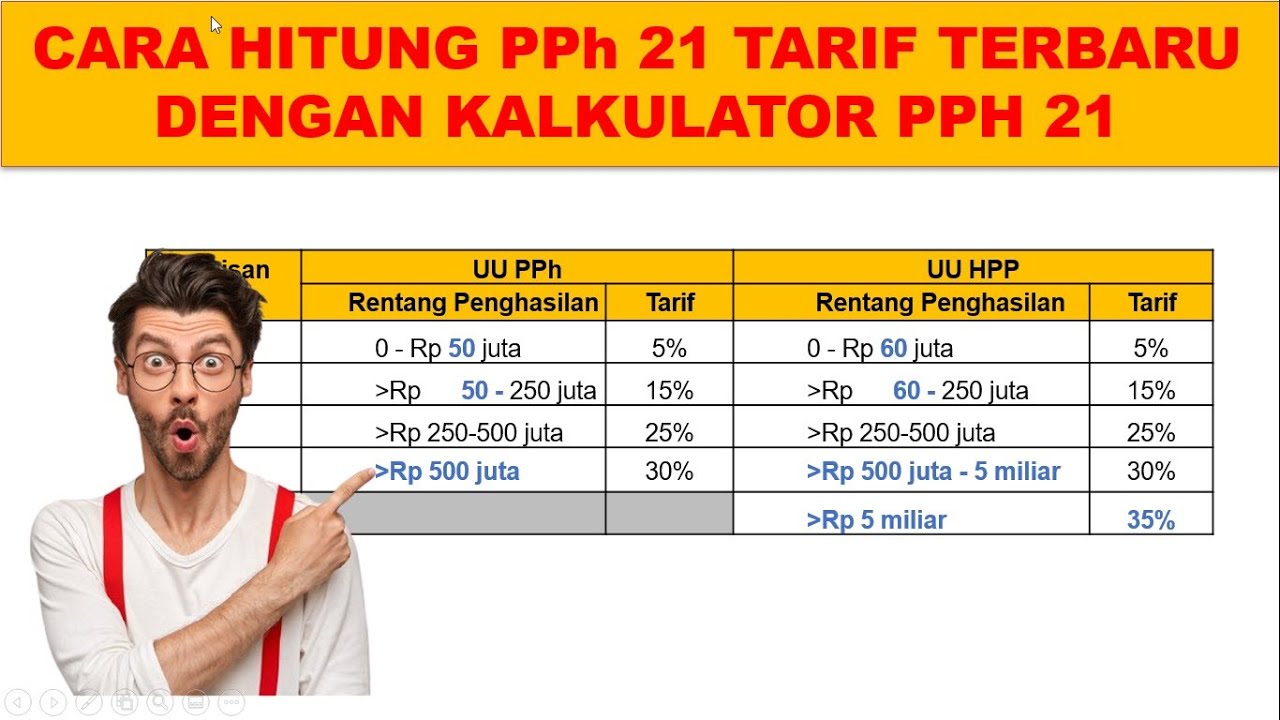

A: Indonesia follows a progressive tax system, meaning the tax rate increases as your income rises. The rates range from 5% to 30%. - Q: What are some common tax deductions available in Indonesia?

A: Common deductions include expenses related to work, healthcare, education, and certain donations. - Q: When is the deadline to file my annual tax return in Indonesia?

A: The deadline for individual taxpayers is typically March 31st each year. - Q: What are the penalties for late tax filing or payment in Indonesia?

A: Late filing or payment can lead to penalties, including fines and interest charges. - Q: What is a Tax Identification Number (NPWP), and why do I need one?

A: An NPWP is a unique identification number issued to taxpayers in Indonesia. You need it for various financial transactions, including filing taxes, opening bank accounts, and conducting business. - Q: Can foreigners working in Indonesia be taxed?

A: Yes, foreigners working in Indonesia are subject to income tax on income earned within the country. - Q: Are there online resources available to help me understand Indonesian income tax?

A: Yes, the official website of the Indonesian tax authority (DJP) provides comprehensive information on tax regulations, procedures, and forms. You can also find helpful resources on online tax portals and government websites. - Q: What happens if I have overpaid my taxes in Indonesia?

A: If you've overpaid your taxes, you are eligible for a tax refund. You can claim this refund by filing the necessary documentation with the tax authorities.

Conclusion

Mastering your Indonesian income tax, or "cara hitung pajak penghasilan terbaru," is an ongoing journey of learning and adaptation. As tax regulations evolve, staying informed ensures accurate filing, optimal financial planning, and peace of mind. While the process may seem daunting, remember that resources and guidance are available to support you every step of the way. By embracing this journey, you're not only fulfilling your civic duty but also empowering yourself to make informed decisions that contribute to your overall financial well-being.

The story behind cody rhodes iconic dark hair

Master your week effective scheduling for daily activities

Showering in style your diy guide to home depot shower installation