Navigating Housing Loans for Malaysian Civil Servants: Pinjaman Perumahan Kakitangan Kerajaan

The pursuit of a place to call one's own, a sanctuary built on stability and dreams, is a universal human desire. For many Malaysian civil servants, this desire is intertwined with the aspiration for homeownership. In Malaysia, a nation known for its robust civil service, a unique pathway exists for government employees to realize this dream: the "Pinjaman Perumahan Kakitangan Kerajaan," a housing loan program specifically designed for them. This program stands as a testament to the government's commitment to the well-being of its dedicated workforce.

Imagine a young teacher, fresh out of university, filled with the noble ambition to educate the next generation. As they embark on their career, the prospect of owning a home might seem like a distant goal. This is where the Pinjaman Perumahan Kakitangan Kerajaan comes in, offering a helping hand, a bridge to cross the chasm between aspiration and reality. The program acknowledges the vital role civil servants play in the nation's progress and seeks to provide them with the security and stability that come with homeownership.

The historical underpinnings of this program are rooted in the recognition of the unique challenges faced by civil servants, particularly in the realm of housing affordability. As cities grow and urban populations swell, the dream of owning a home can feel increasingly out of reach. The Pinjaman Perumahan Kakitangan Kerajaan emerged as a response to these challenges, a tangible symbol of the government's commitment to supporting its workforce.

This program isn't merely about bricks and mortar; it's about fostering a sense of belonging, of being deeply rooted in the fabric of Malaysian society. For the teacher, the police officer, the nurse, and countless other civil servants, the ability to own a home represents not just financial security but also the fulfillment of a fundamental human need for a place to call their own.

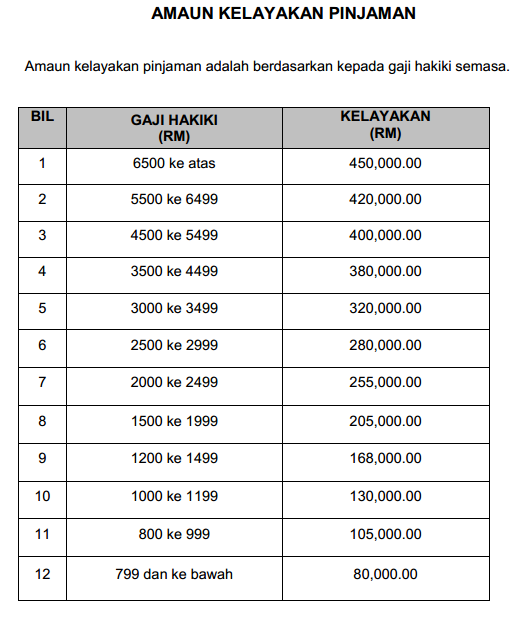

Navigating the complexities of housing loans can be a daunting task for anyone, and civil servants are no exception. Understanding the intricacies of the Pinjaman Perumahan Kakitangan Kerajaan, its eligibility criteria, application process, and the various benefits it offers is crucial. This knowledge empowers civil servants to make informed decisions, ensuring that this program serves its intended purpose – to pave the way for a brighter future, one home at a time.

Advantages and Disadvantages of Pinjaman Perumahan Kakitangan Kerajaan

| Advantages | Disadvantages |

|---|---|

| Lower interest rates compared to commercial banks | May have stricter eligibility requirements |

| Longer loan tenures, leading to lower monthly payments | May have limitations on property types or locations |

| Potential for government subsidies or grants | Processing time for loan approvals may be longer |

Five Best Practices for Navigating Pinjaman Perumahan Kakitangan Kerajaan

1. Thoroughly Understand Eligibility Criteria: Before applying, ensure you meet all the requirements related to your employment status, income level, and age. 2. Research and Compare Loan Packages: Different financial institutions may offer varying interest rates, loan tenures, and terms. 3. Seek Financial Advice: Consult with a financial advisor to assess your financial situation and determine the most suitable loan amount and repayment plan. 4. Prepare Documentation in Advance: Gather all necessary documents, including income statements, bank statements, and identification documents. 5. Stay Informed About Policy Updates: Be aware of any changes in government policies or regulations related to the program.

As we delve deeper into the intricacies of the Pinjaman Perumahan Kakitangan Kerajaan, it becomes evident that this program represents more than just a financial instrument. It's a testament to the value placed on public service in Malaysia. It's a recognition of the dedication and sacrifices made by those who devote their lives to serving the nation.

Giant leap for mankind who went to the moon qui est aller sur la lune

Navigating grief understanding tallahassee florida funeral homes

Que significa la palabra bts unraveling the meaning behind the global phenomenon