Navigating Islamic Finance: Understanding Surat Pengesahan Bank Islam

In the realm of financial transactions, adherence to religious principles is paramount for many individuals and businesses. This is where Islamic finance emerges as a significant alternative, guided by the principles of Shariah law. Within this system, the "Surat Pengesahan Bank Islam" plays a crucial role, serving as a testament to a financial institution's compliance with Islamic tenets.

This exploration aims to shed light on the concept of "Surat Pengesahan Bank Islam," often referred to as the "Islamic Bank Confirmation Letter" in English. We'll delve into its significance, implications, and the benefits it offers to individuals and businesses seeking financial solutions aligned with their faith.

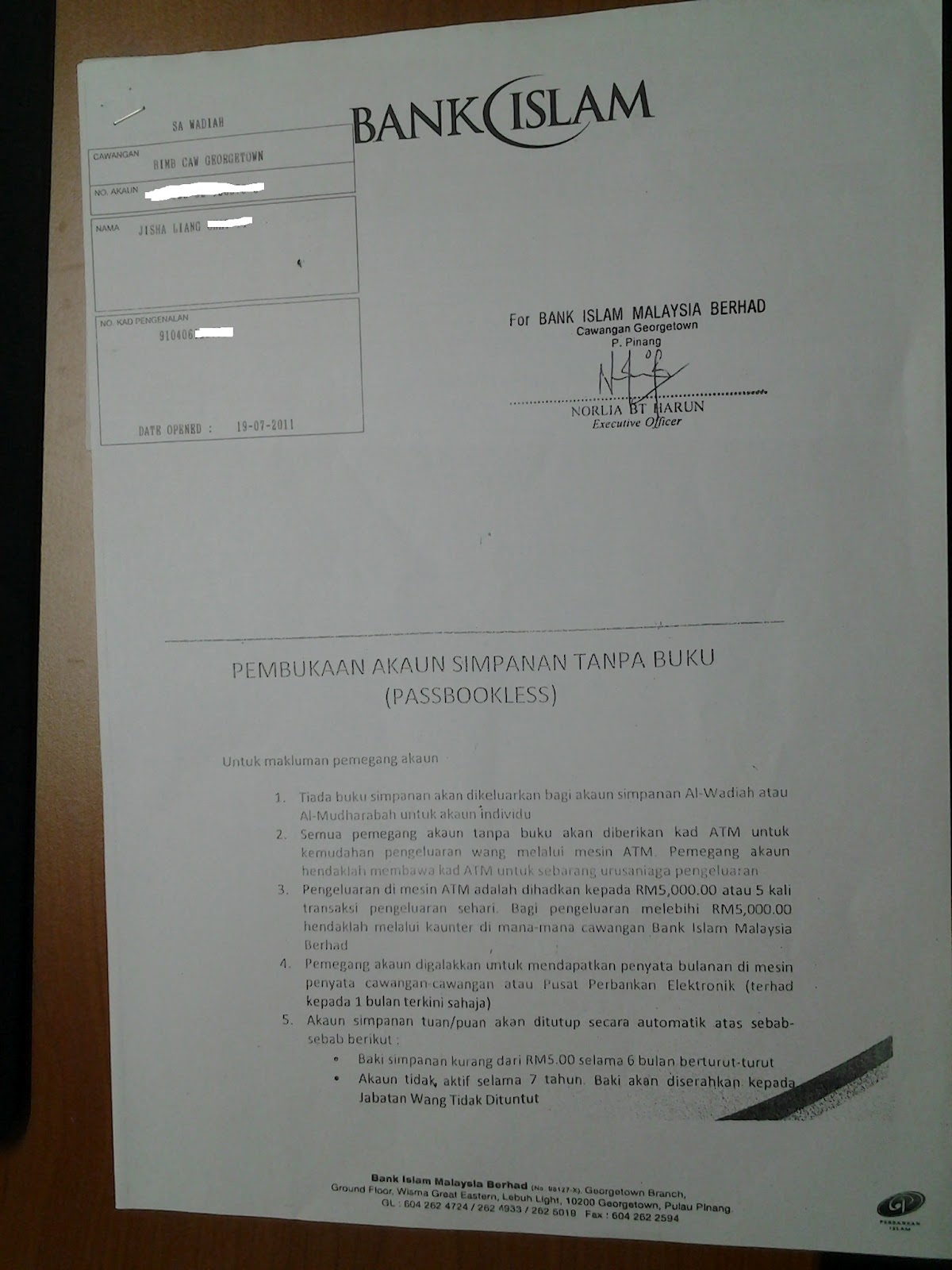

Imagine engaging in financial activities with the confidence that your transactions are not only ethically sound but also spiritually aligned. This assurance is precisely what the "Surat Pengesahan Bank Islam" provides. It essentially acts as a certification from an Islamic bank, verifying that the financial products and services offered are in complete harmony with Shariah principles.

This document is crucial for individuals and businesses seeking to navigate the world of Islamic finance with transparency and peace of mind. It eliminates any ambiguity surrounding the permissibility of financial dealings, ensuring that every transaction adheres to the ethical guidelines of Islam.

Whether you are considering a mortgage, an investment opportunity, or simply opening a bank account, understanding the role of the "Surat Pengesahan Bank Islam" is essential. It empowers individuals and businesses to make informed financial decisions that are both financially sound and spiritually fulfilling.

Understanding Islamic Finance

Islamic finance distinguishes itself from conventional banking by adhering to a set of ethical principles. These principles prohibit activities such as charging interest (riba), engaging in speculation (maysir), and investing in industries deemed harmful (haram).

The Importance of Ethical Banking

For many individuals and businesses, aligning their financial dealings with their faith is a top priority. This is where Islamic finance steps in, providing an alternative that resonates with their values. The "Surat Pengesahan Bank Islam" acts as a guarantee, assuring customers that the financial institution operates under the watchful eye of Shariah scholars.

Navigating the Financial Landscape

The world of finance can be complex, and navigating it while adhering to religious principles can present unique challenges. This is where the "Surat Pengesahan Bank Islam" proves invaluable. It simplifies decision-making by providing clarity and assurance, enabling individuals and businesses to engage in financial activities with confidence and peace of mind.

Conclusion

In a world where financial decisions hold significant weight, the "Surat Pengesahan Bank Islam" provides a beacon of transparency and trust for those seeking financial solutions aligned with their faith. It represents the commitment of Islamic financial institutions to uphold the principles of Shariah law, offering individuals and businesses the opportunity to pursue financial well-being without compromising their values. As the demand for ethical and faith-based financial solutions continues to rise, understanding the role of the "Surat Pengesahan Bank Islam" becomes increasingly crucial for individuals and businesses alike.

Navigating the logistics labyrinth your guide to online freight center quotes

Remember spray on clothing a blast from the 80s and 90s

Towing power at your fingertips pickup truck rental guide