Navigating Loan Closure: A Guide to 'Contoh Surat Pelunasan Pinjaman Bank'

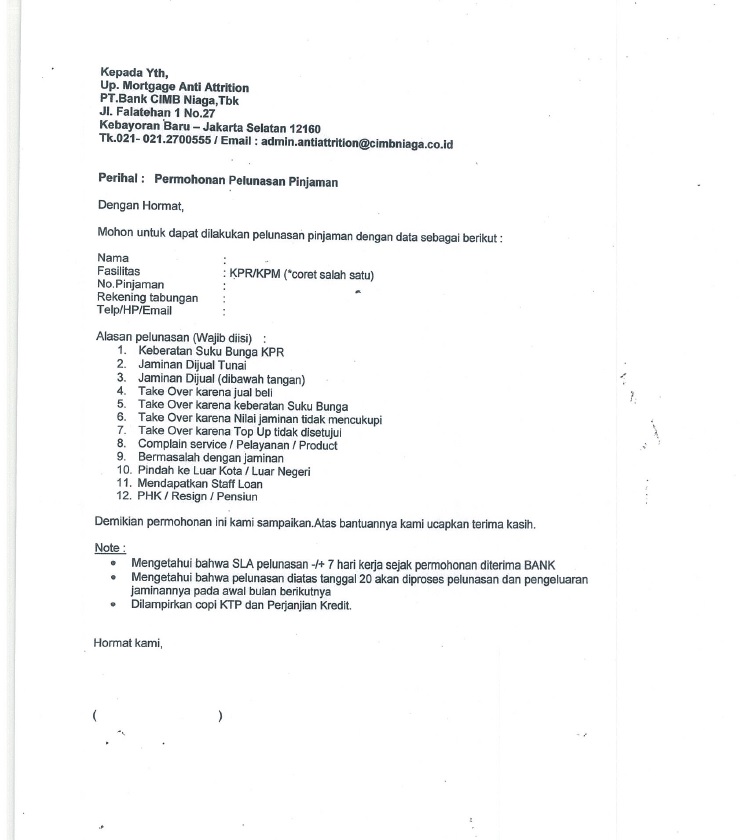

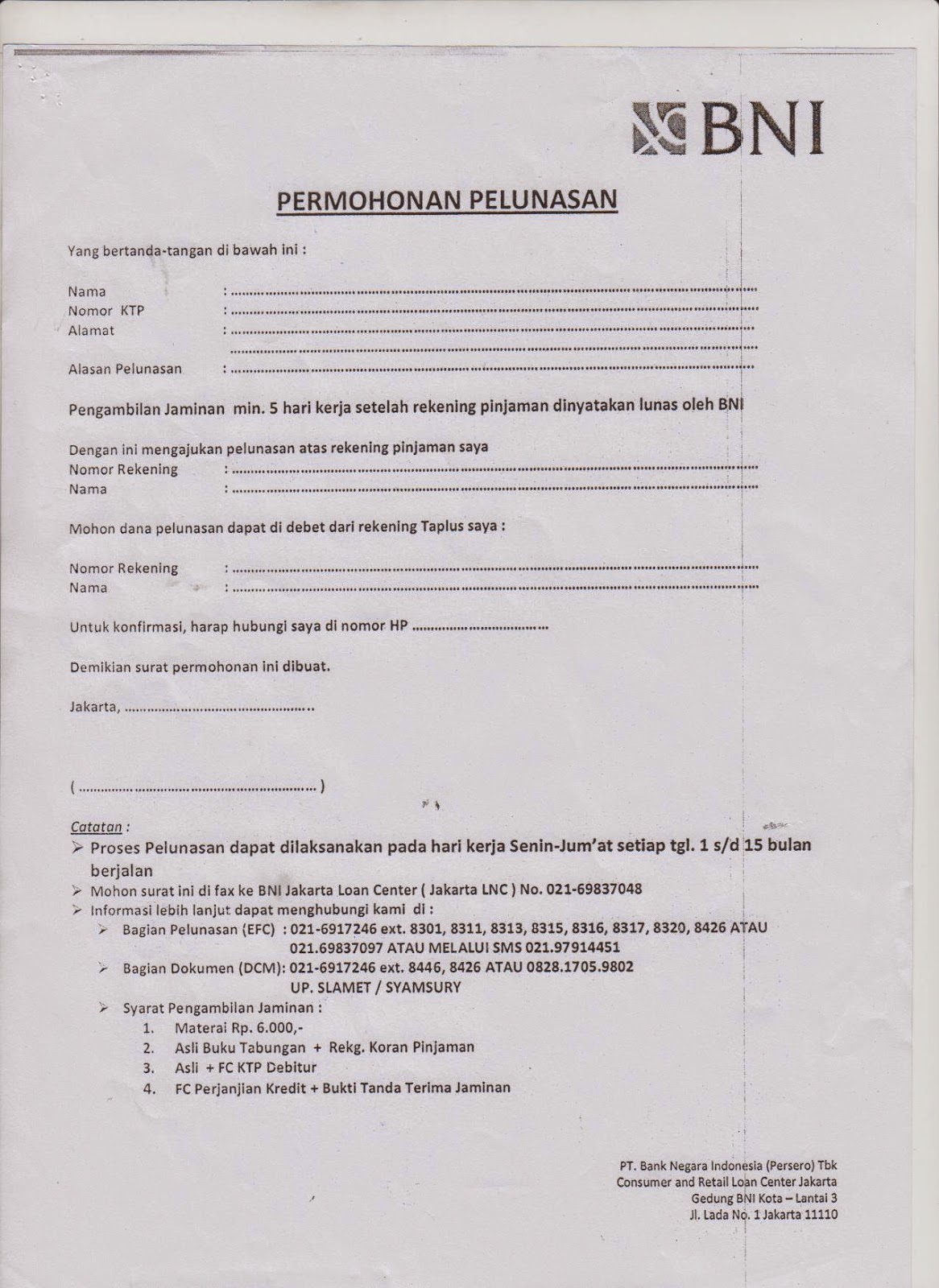

Imagine this: you've diligently paid off your bank loan in Indonesia, breathing a sigh of relief. But your financial journey isn't over yet. You need official confirmation, a document proving you've fulfilled your financial obligation. This is where the "contoh surat pelunasan pinjaman bank," or loan closure certificate, comes in.

This document, though seemingly simple, is crucial. It signifies the end of your loan agreement, freeing you from further obligations and potential disputes. It's not just a piece of paper; it's peace of mind, a symbol of your financial responsibility.

While the concept of a loan closure certificate is universally relevant, "contoh surat pelunasan pinjaman bank" specifically refers to the Indonesian context. This phrase, directly translating to "example of a bank loan closure letter," highlights the Indonesian language's role in official documentation within the country.

Navigating the administrative side of loans can be daunting, especially in a different language. That's why understanding "contoh surat pelunasan pinjaman bank" is vital for anyone who has taken a loan from an Indonesian bank. This article acts as your guide, demystifying the process and highlighting the importance of this document.

Whether you're planning to apply for a new loan, need proof of your financial standing for visa applications, or simply want to ensure all your financial records are in order, having a "contoh surat pelunasan pinjaman bank" is non-negotiable. It's a testament to your financial responsibility, a tool for clarity, and a stepping stone towards future financial endeavors.

Advantages and Disadvantages of a Loan Closure Certificate

| Advantages | Disadvantages |

|---|---|

| Provides legal proof of loan repayment. | May require time and effort to obtain. |

| Essential for credit history and future loan applications. | Potential for delays or complications from the bank's side. |

| Prevents future disputes over outstanding balances. | |

| Necessary for various legal and financial procedures. | |

| Offers peace of mind and closure on a financial obligation. |

While obtaining a "contoh surat pelunasan pinjaman bank" offers numerous benefits, it's important to be aware of potential hurdles, such as processing times and administrative procedures. However, the advantages far outweigh the minor inconveniences, making it a crucial step after loan repayment.

Navigating the world of finance requires diligence and awareness, especially in a globalized context. "Contoh surat pelunasan pinjaman bank" serves as a prime example of how understanding local practices, even in something as seemingly simple as a loan closure certificate, is crucial for ensuring smooth and successful financial interactions in Indonesia. By being informed and proactive, you can confidently approach your loan closure process, ensuring clarity, security, and peace of mind in your financial journey.

Unlocking the 6x55 bolt pattern your guide to wheel compatibility

Decoding the ceiling fan light blue wire your comprehensive guide

Finding balance exploring biblical wisdom on moderation