Navigating Taxes: A Guide to Income Tax Filing in Malaysia

Let's face it, talking about taxes isn't exactly the most thrilling conversation starter. It can feel like a maze of forms, deadlines, and financial jargon. But here in Malaysia, like many places around the world, paying our income tax is a crucial civic duty. It's one of those adulting things we tackle to contribute to the development of our nation. Plus, staying on top of your taxes can save you from potential headaches down the line.

If you're new to the workforce in Malaysia, or perhaps you've just been feeling a little lost in the world of income tax, you've come to the right place. This guide is here to break down the essentials of income tax filing in Malaysia – think of it as your friendly, approachable guide to navigating this important financial responsibility.

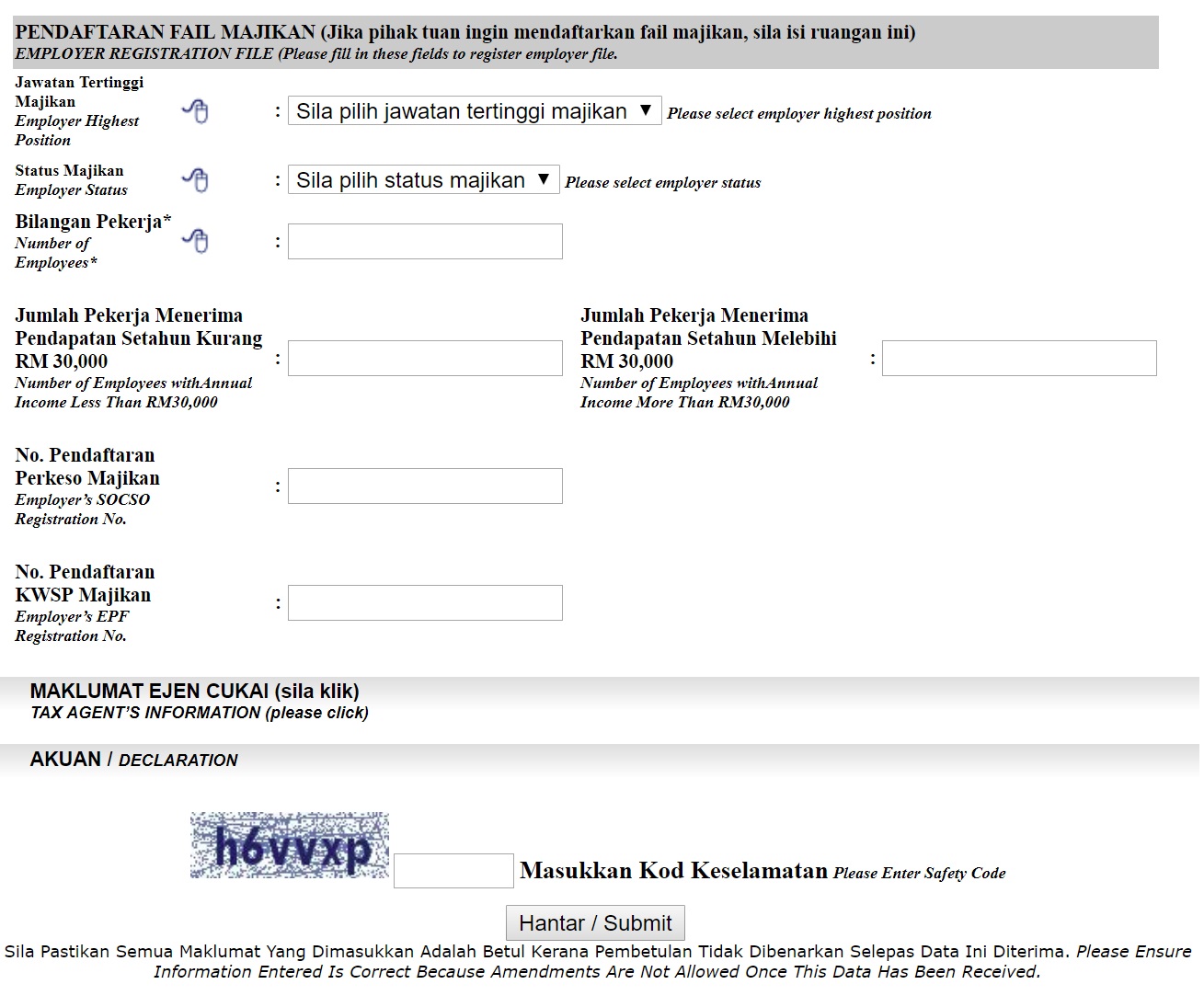

Before we dive into the nitty-gritty, let's address the elephant in the room: "pendaftaran fail cukai pendapatan." This phrase, which translates directly to "income tax filing registration" in Malay, is the cornerstone of your tax journey in Malaysia. It's the process of getting yourself officially recognized by the Inland Revenue Board of Malaysia (LHDN), the governing body overseeing taxation.

The history of income tax in Malaysia dates back to the early 20th century, introduced during the British colonial era. Over the decades, the system has evolved, with the LHDN (formerly known as the IRB) playing a pivotal role in modernizing and streamlining tax administration.

But why is income tax such a big deal, and why should you care about "pendaftaran fail cukai pendapatan?" Well, here's the heart of it: the taxes we pay are essential for the government to fund vital public services. We're talking healthcare, education, infrastructure, and more. When you fulfill your tax obligations, you're contributing to the well-being of the nation.

Advantages and Disadvantages of Timely Tax Registration and Filing

| Advantages | Disadvantages |

|---|---|

| Avoidance of penalties for late filing or non-filing. | The process might seem complicated for first-time filers. |

| Opportunity to claim tax refunds (if applicable). | Gathering and organizing financial documents can be time-consuming. |

| Building a good tax record, which can be beneficial for future financial transactions like loans. |

Best Practices for Income Tax Filing in Malaysia

1. Keep Track of Important Dates: The LHDN typically sets deadlines for tax filing. Mark these dates on your calendar to avoid late submissions.

2. Organize Your Financial Documentation: Gather your income statements (EA Forms or B Forms), receipts for deductible expenses, and any other relevant financial records.

3. Explore Available Filing Methods: The LHDN offers both online and offline filing options. Familiarize yourself with these methods and choose the one that suits you best.

4. Consider Seeking Professional Assistance: If you find the tax filing process overwhelming, don't hesitate to seek guidance from a qualified tax consultant.

5. Review Before Submitting: Double-check all information entered before submitting your tax return to ensure accuracy.

We've covered a lot of ground here, but remember, this is just a starting point for your journey with income tax in Malaysia. Just like learning a new recipe or mastering a skill, it takes a bit of time and effort.

So, take a deep breath, gather your documents, and remember, you've got this! And hey, if you ever need a reminder about deadlines or want to brush up on specific tax rules, the LHDN website is a fantastic resource.

Scrub tops with logo the unsung heroes of branding

Elevating your essays the power of precise language

Finding the right neurologist in humble tx a guide