Navigating the Maze AARP Medicare Insurance Options

Are you approaching retirement and feeling overwhelmed by the complexities of Medicare? You're not alone. Millions of Americans turn to AARP, a trusted advocate for seniors, for guidance on navigating the Medicare landscape. AARP doesn't offer Medicare insurance directly, but it collaborates with UnitedHealthcare to offer plans bearing the AARP name. These plans, encompassing Medicare Advantage (Part C), Medicare Supplement (Medigap), and Part D prescription drug coverage, are designed to help seniors find coverage tailored to their healthcare needs and budgets.

Understanding the nuances of AARP Medicare plans can seem daunting, but it’s crucial for securing your healthcare future. This comprehensive guide breaks down the different AARP Medicare plan types, helping you understand their benefits, costs, and eligibility requirements. We'll explore the advantages and disadvantages of each, empowering you to make informed decisions about your healthcare coverage.

AARP's association with Medicare plans dates back to the organization's recognition of the need for accessible and affordable healthcare for seniors. Since then, AARP-branded plans have become a popular choice, reflecting the organization's reputation for advocating for the interests of older Americans. The main issue surrounding these plans, as with any Medicare plan, is finding the right balance between coverage, cost, and personal healthcare needs. Each individual's health situation is unique, so what works for one person may not be suitable for another.

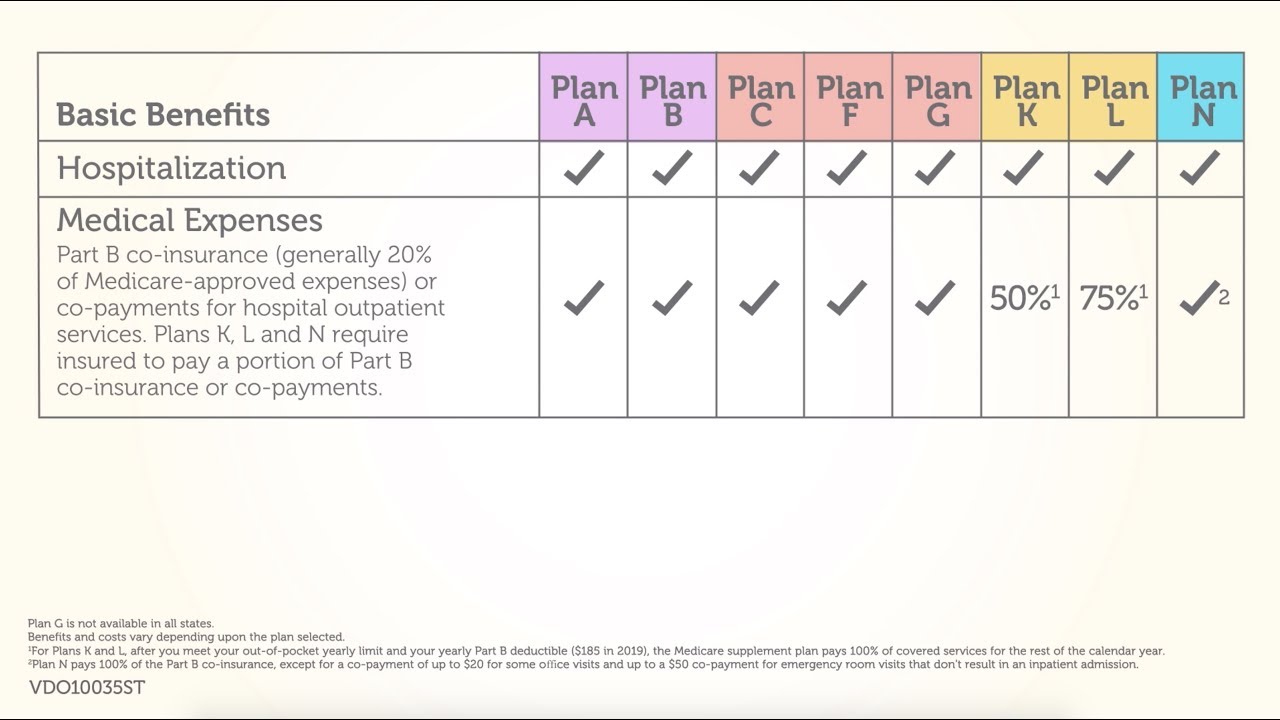

AARP Medicare Advantage plans, for example, offer an alternative to Original Medicare, combining Parts A and B (and often Part D) into a single plan. These plans usually include extra benefits not covered by Original Medicare, such as vision, hearing, and dental. Medigap plans, on the other hand, work alongside Original Medicare, helping to cover costs like copayments, coinsurance, and deductibles. AARP also offers stand-alone Part D prescription drug plans for those who want coverage for their medications.

Choosing the right plan requires careful consideration of your current health status, expected future needs, and budget. Factors to consider include your prescription drug needs, whether you prefer a network of providers, and how much you're willing to pay in monthly premiums. Navigating these choices can be complex, but resources like the official Medicare website (Medicare.gov) and AARP's own resources can help simplify the process.

Several benefits can be derived from AARP Medicare plans. They often include extra coverage, such as dental and vision, and may offer lower out-of-pocket costs compared to Original Medicare. Also, access to a broad network of healthcare providers can be a significant advantage.

Deciding on an AARP Medicare plan involves understanding your needs, comparing plan options, and enrolling during the appropriate periods. Use online resources to compare plans or consult with a licensed insurance agent specializing in Medicare.

Advantages and Disadvantages of AARP Medicare Insurance Plans

| Advantages | Disadvantages |

|---|---|

| Extra benefits (e.g., vision, dental) | Network restrictions |

| Potential for lower out-of-pocket costs | Varying premiums and cost-sharing |

| Access to a wide provider network | Plan availability may vary by location |

Best practices for implementing an AARP plan include reviewing your current coverage, comparing plans annually during open enrollment, understanding the plan’s formulary (list of covered drugs), and maximizing preventive care benefits.

Several real-world examples exist of individuals benefitting from AARP plans. Some have experienced reduced prescription drug costs, while others appreciate the added coverage for vision or dental care.

Common challenges include understanding plan details and navigating the enrollment process. Solutions include utilizing online resources and consulting with insurance agents.

Frequently asked questions often revolve around plan eligibility, costs, and coverage details. Consulting official resources can provide answers to these common queries.

Tips and tricks for managing AARP plans include understanding your plan’s formulary and utilizing wellness programs offered by the plan.

In conclusion, navigating the world of AARP Medicare insurance plans requires careful planning and consideration. By understanding the different types of plans available – Medicare Advantage, Medicare Supplement, and Part D prescription drug coverage – you can make informed decisions about your healthcare future. Weighing the advantages and disadvantages, researching specific plan details, and utilizing available resources are crucial steps in selecting a plan that aligns with your individual needs and budget. AARP Medicare plans, backed by the trusted reputation of AARP and provided through UnitedHealthcare, offer valuable options for seniors seeking comprehensive and affordable healthcare coverage. Don’t wait; start exploring your options today to ensure a secure and healthy tomorrow. Take the first step by visiting the official Medicare website and AARP’s resources to learn more and compare plans. Your health and peace of mind are worth it.

Unlocking creativity the magic of free png to vector conversion

Conquering mondays the german secret to a killer week

Plus ultra a look into the world of my hero academia