Navigating the Maze: Your Guide to "Contoh Surat Permohonan Ke Bank" (Bank Application Letters)

Stepping into the often intimidating world of finance can feel like entering a whole new universe. There's a certain language, a specific etiquette, and procedures that might seem daunting at first. This is especially true in a country like Indonesia, where tradition and formality often go hand in hand, particularly when dealing with institutions like banks. One such instance where this blend of tradition and finance intersects is the "contoh surat permohonan ke bank" – the quintessential bank application letter.

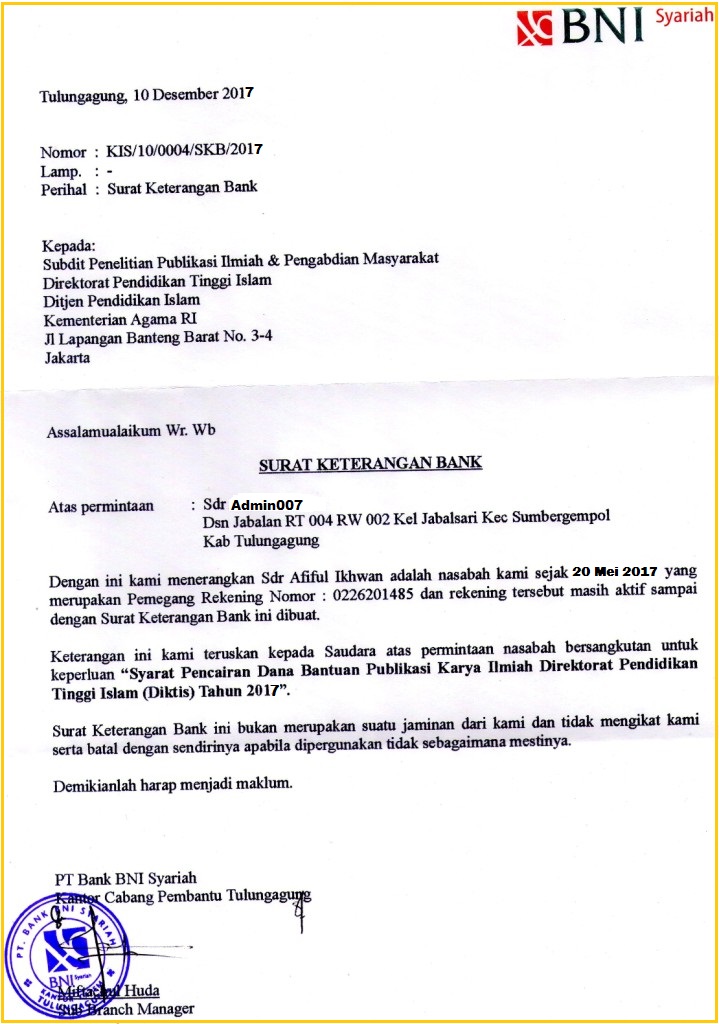

Imagine this: you're brimming with excitement, ready to finally launch your dream business. Or maybe you've found the perfect piece of land to build your future home. These aspirations often involve securing financial support, and that's where the "contoh surat permohonan ke bank" comes into play. This formal letter acts as your introduction, your first impression, when requesting financial assistance from a bank.

While the digital age has brought about numerous changes, the significance of a well-crafted letter in Indonesia remains steadfast. It reflects your seriousness, respect for tradition, and understanding of the local customs. Think of it as a key that unlocks the door to a successful interaction with your bank.

But what exactly makes a "contoh surat permohonan ke bank" stand out? What elements should be included? What mistakes should be avoided? We'll delve into all these aspects and more, providing you with a comprehensive guide to navigate this crucial aspect of your financial journey.

Whether you're a seasoned entrepreneur or just starting, understanding the intricacies of a "contoh surat permohonan ke bank" can be invaluable. It's about more than just filling in blanks; it's about presenting your case clearly, respectfully, and persuasively. It's about building a bridge of communication with your bank, paving the way for a potentially fruitful partnership.

Advantages and Disadvantages of Using a "Contoh Surat Permohonan Ke Bank"

While traditional, using a formal letter has its pros and cons in today's digital age:

| Advantages | Disadvantages |

|---|---|

| Demonstrates respect for tradition and formality | Can be time-consuming to draft and format correctly |

| Provides a tangible record of your request | May not be as efficient as online applications in some cases |

| Allows for personalized explanations and justifications | Requires physical delivery or postage |

Best Practices for Writing a Compelling "Contoh Surat Permohonan Ke Bank"

To make your application stand out, consider these best practices:

- Clarity is Key: Use concise language and avoid jargon. Clearly state your purpose for requesting financial assistance.

- Respectful Tone: Address the recipient appropriately and maintain a professional tone throughout the letter.

- Detailed Information: Provide specific details about your financial situation, the amount requested, and your repayment plan.

- Supporting Documents: Always enclose relevant documents like financial statements, business plans, or proof of income.

- Proofread Meticulously: Errors in grammar and spelling can make a negative impression. Double-check everything before submitting.

Common Questions and Answers about "Contoh Surat Permohonan Ke Bank"

Let's address some frequently asked questions:

- Q: Is a handwritten letter acceptable?

A: While handwritten letters were common in the past, typed and printed letters are now the norm, reflecting a more professional approach. - Q: Can I use a template?

A: Templates can be helpful for guidance, but ensure you personalize the content to reflect your specific circumstances. - Q: How long should the letter be?

A: Aim for conciseness. Ideally, your letter should be no longer than one page. - Q: What if my request is denied?

A: Don't be discouraged. Seek feedback from the bank to understand the reasons for rejection and explore alternative solutions.

Mastering the art of crafting a "contoh surat permohonan ke bank" is a valuable skill in Indonesia. It reflects your understanding of local customs and your commitment to building a strong relationship with your chosen financial institution. Remember, a well-written letter can be the key to unlocking a world of opportunities, bringing your dreams one step closer to reality.

Labaton sucharow llp scam

The electrifying saga exploring the latest on the rock and cody rhodes

Easy and creative unleash your inner diva with these simple costume ideas for women