Navigating Your SSPN-i Plus Account: A Guide to Understanding Your Education Savings

Thinking about the future, especially when it comes to education, can feel like juggling a million things at once. As parents or guardians, we want the best for our children, and that includes a solid educational foundation. But education costs can feel overwhelming. That's where a dedicated education savings plan can make all the difference, providing peace of mind and a path towards those future aspirations. In Malaysia, the National Education Savings Scheme, known as SSPN-i, offers exactly that, with its enhanced version, SSPN-i Plus, providing a structured way to save for your child's education while enjoying valuable benefits.

Imagine this: you have a dedicated savings account specifically designed for education, growing steadily over time, and offering you financial relief when it comes time for tuition fees or other educational expenses. That's the core idea behind SSPN-i Plus. It's a government-guaranteed savings plan introduced by the National Higher Education Fund Corporation (PTPTN) in Malaysia. But it's not just about saving; it's about smart saving. SSPN-i Plus goes beyond a traditional savings account by offering features like tax relief incentives, competitive dividend rates, and takaful coverage, making it a holistic approach to securing your child's educational future.

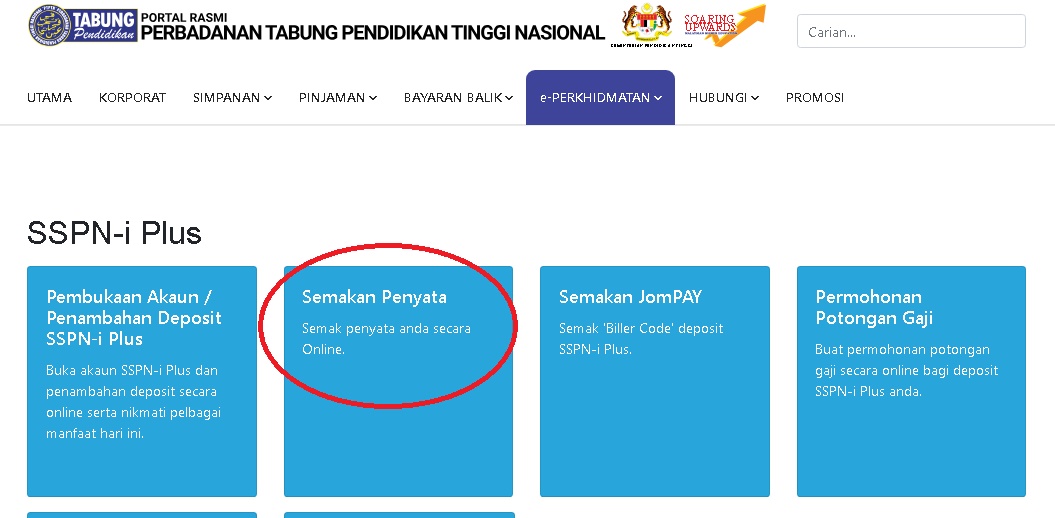

Navigating the world of financial products can sometimes feel like learning a new language. But with SSPN-i Plus, accessing and understanding your account information is made simple, especially with your SSPN-i Plus statement, often referred to as "Penyata" in Malay. This statement is your roadmap to your savings journey. It provides a detailed breakdown of your account activity, including deposits, withdrawals, dividend earnings, and takaful contributions. Regularly reviewing your SSPN-i Plus Penyata empowers you to stay informed about your savings progress and make informed decisions about your child's education fund.

Whether you're already an SSPN-i Plus account holder or just starting to explore your options, understanding the ins and outs of this scheme can provide valuable peace of mind. Think of this article as your friendly guide, walking you through the key features, benefits, and practical tips for making the most of your SSPN-i Plus account. From understanding your account statement to exploring the various benefits, we'll break it all down into easy-to-digest pieces.

Together, let's delve into the world of SSPN-i Plus and empower ourselves with the knowledge to make informed decisions about our children's future, ensuring they have the resources they need to pursue their dreams and reach their full potential. Because when it comes to education, every little bit of planning and saving can make a world of difference.

Advantages and Disadvantages of SSPN-i Plus

| Advantages | Disadvantages |

|---|---|

| Competitive dividend rates on your savings. | Limited withdrawal flexibility, as funds are primarily intended for education. |

| Tax relief benefits for your contributions. | Returns may be lower compared to higher-risk investment options. |

Beyond reality exploring pablo picasso obras cubistas

Unleash your inner artist with traditional tattoo coloring pages

Cracking the code unlocking literacy with the alphabet