Need Guaranteed Funds? Bank of America Certified Checks Explained

Imagine this: you're about to close on your dream home, a major life milestone. You've meticulously saved up, negotiated a great deal, and you're finally ready to sign the paperwork. But then, the seller throws you a curveball - they only accept a guaranteed form of payment, like a certified check. What do you do?

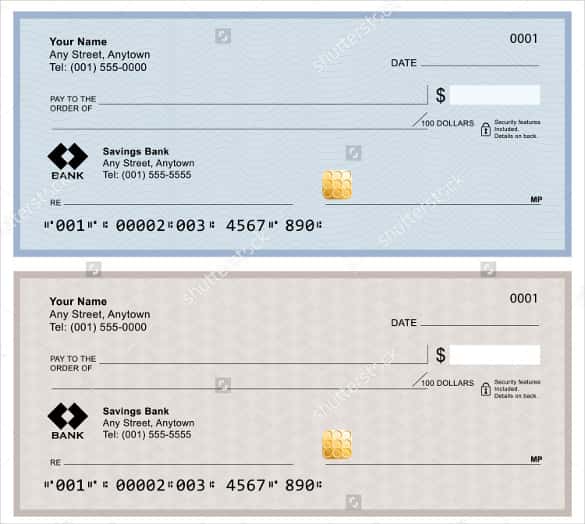

This is where a Bank of America certified check, or more broadly, certified checks in general, come into play. Unlike personal checks that can bounce due to insufficient funds, certified checks offer a higher level of security and assurance for both the payer and the payee. In essence, they act as a promise backed by the bank itself, guaranteeing that the funds are available.

Certified checks have been a cornerstone of financial transactions for decades, offering a reliable way to handle large sums of money, particularly in situations where trust is paramount. Their history is intertwined with the evolution of banking and the need for secure payment methods in high-value transactions.

But how exactly do certified checks work? Let's break down the process. When you request a Bank of America certified check, the bank verifies the available funds in your account and then sets aside that specific amount. This essentially "certifies" that the check will clear, giving the payee peace of mind that they will receive their payment.

While in our digital age, various online payment methods are gaining traction, certified checks continue to hold their ground, especially for significant purchases like real estate, vehicles, or even for making tax payments. Their enduring relevance speaks volumes about their inherent value in ensuring secure and reliable transactions.

Let's dive into some common questions about Bank of America certified checks:

Bank of America Certified Checks: Advantages and Disadvantages

| Advantages | Disadvantages |

|---|---|

| Guaranteed Payment | Limited Availability |

| Increased Trust | Potential Fees |

| Ideal for Large Transactions | Requires a Bank Visit |

While this table provides a basic overview, let's delve deeper into potential benefits:

Benefits of Using Bank of America Certified Checks:

1. Guaranteed Payment: The most significant advantage is the guarantee of payment. Once the bank certifies the check, the funds are locked in, eliminating the risk of the check bouncing. This is particularly crucial for large transactions where the payee needs absolute certainty of receiving the money.

2. Enhanced Trust and Credibility: In transactions where trust is a factor, presenting a certified check can inspire confidence. It demonstrates your financial readiness and commitment to fulfilling your payment obligation.

3. Streamlined Transactions: In scenarios like closing on a house, where time is of the essence, a certified check can expedite the process. The guaranteed funds mean fewer delays and a smoother completion of the transaction.

Understanding the benefits is just the first step. Here are some practical tips for utilizing Bank of America certified checks effectively:

Best Practices for Using Bank of America Certified Checks:

1. Plan Ahead: Obtaining a certified check usually requires a visit to your local branch. Factor in potential wait times and bank processing time. It's always advisable to call your branch ahead of time.

2. Verify Details: Before leaving the bank, double-check the accuracy of all information on the check, including the payee's name, the amount, and the date.

3. Request a Receipt: Always obtain a receipt for your certified check. This serves as proof of payment if any discrepancies arise later.

4. Track the Check: Keep a record of the check number and monitor your account to confirm when the funds are debited.

5. Explore Alternatives: Depending on the transaction, consider other secure payment options like wire transfers or cashier's checks. Discuss with the payee to determine the most suitable method.

While certified checks offer numerous advantages, like any financial instrument, they come with their share of potential challenges. Let's explore some common issues and their solutions:

Challenges and Solutions:

Challenge 1: Lost or Stolen Check: Losing a certified check can be stressful. Solution: Immediately contact your bank and report the lost or stolen check. They will guide you through the process of canceling the original check and issuing a replacement, if necessary.

To address some of the most common queries, let's look at some frequently asked questions about Bank of America certified checks:

Bank of America Certified Check FAQs:

1. How do I get a certified check from Bank of America? You can typically obtain one by visiting a local Bank of America branch.

2. Is there a fee for certified checks? Fees vary, so it's best to check with your bank for their current fee schedule.

3. Can I get a certified check online? Bank of America's online services do not currently offer certified checks.

4. What if the payee loses the certified check? The payee would need to contact their bank and follow their procedures for handling lost or stolen checks.

5. How long does it take to clear a certified check? Typically, certified checks clear quickly, often on the next business day.

6. What's the difference between a certified check and a cashier's check? While both guarantee funds, cashier's checks are drawn against the bank's funds, whereas certified checks use the payer's funds.

7. Is there a limit on the amount for a certified check? Limits vary by bank, so it's advisable to contact your branch for specifics.

8. Can I stop payment on a certified check? Stopping payment on a certified check can be complex and often involves fees. Contact Bank of America directly to discuss your options.

Navigating the world of financial instruments can seem daunting, but having a clear understanding of your options is crucial. Bank of America certified checks, with their inherent security and guaranteed payment, provide a reliable solution for high-value transactions. Whether you're purchasing a property, a vehicle, or simply need a secure payment method, understanding the ins and outs of certified checks can give you peace of mind.

Ultimately, choosing the right payment method depends on your specific needs and the nature of the transaction. Consulting with a Bank of America representative can help determine if a certified check is the optimal choice for your financial situation.

The skin is a shield a deep dive into its protective embrace on your muscles

Unleash your creativity the power of a 60 pack of bic ballpoint pens in assorted colors

Navigating lifes challenges therapy in oshkosh wi

:max_bytes(150000):strip_icc()/what-difference-between-cashiers-check-and-money-order-FINAL-9a54f3bddd144fd8af92fbe3aed9512b.png)

:max_bytes(150000):strip_icc()/certified-check-vs-cashiers-check-which-safer-final-46f80549d89e41d9ae86fd5728692052.jpg)