PTPTN Bila Masuk Duit: Navigating Student Loans in Malaysia

For many Malaysians, pursuing higher education is a significant step towards a brighter future. However, the financial burden of tuition fees and living expenses can be daunting. This is where the National Higher Education Fund Corporation (PTPTN) plays a crucial role, providing financial assistance to eligible students through its loan scheme.

Understanding the ins and outs of PTPTN loans, particularly the disbursement process and repayment options, is crucial for students to manage their finances effectively and plan for a secure financial future. This article will delve into the details of PTPTN, exploring its significance, benefits, and challenges, while providing valuable insights for students navigating the landscape of student loans in Malaysia.

The phrase "PTPTN bila masuk duit" translates to "when does PTPTN money come in?" This simple question reflects a common concern among students who rely on PTPTN loans to fund their education. Timely disbursement of loan money is crucial for students to cover their tuition fees, accommodation, and living expenses, ensuring a smooth and uninterrupted academic journey.

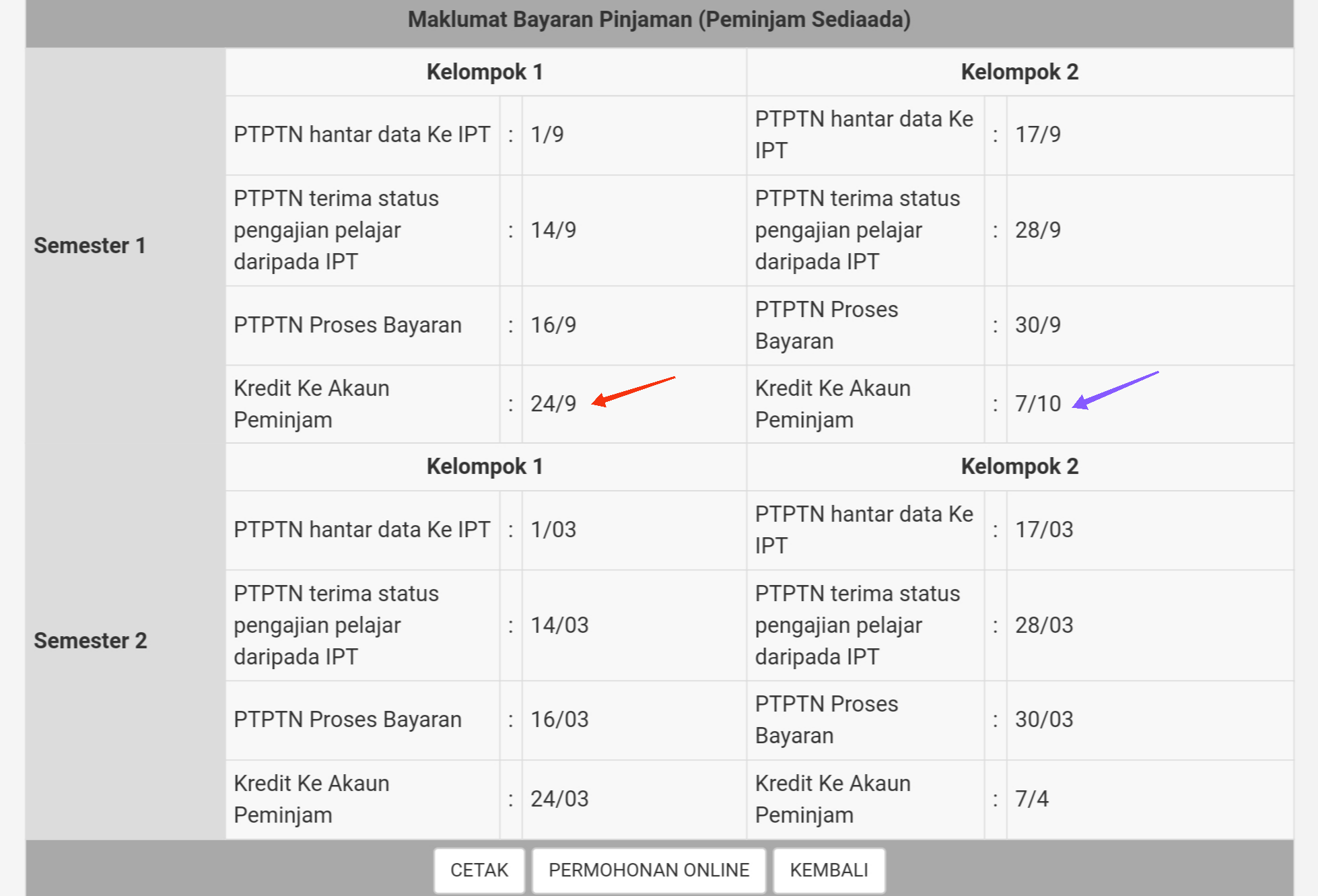

PTPTN loan disbursements typically follow a structured schedule, often coinciding with the start of each semester or academic term. However, the exact disbursement date can vary depending on factors such as the student's institution, program of study, and the processing time taken by PTPTN and the respective institutions. Delays in disbursement can cause financial strain and anxiety among students, highlighting the importance of understanding the disbursement process and any potential issues that might arise.

To ensure timely disbursement, students are advised to submit their loan applications well in advance and to promptly provide any required documentation or information to PTPTN and their institutions. Regularly checking the PTPTN online portal for updates on loan status and disbursement schedules is also highly recommended.

Advantages and Disadvantages of PTPTN Loans

While PTPTN loans provide a lifeline for many students, it's essential to weigh the advantages and disadvantages before committing to a loan:

| Advantages | Disadvantages |

|---|---|

| Access to Higher Education: PTPTN loans make higher education accessible to a wider range of students, regardless of their financial background. | Debt Burden: Taking on a PTPTN loan means starting your career with debt, which can impact financial planning and lifestyle choices. |

| Low Interest Rates: PTPTN loans generally offer lower interest rates compared to commercial loans, making them a more affordable option for students. | Repayment Obligations: Monthly loan repayments can strain finances, especially during the initial years of employment. |

| Flexible Repayment Options: PTPTN provides various repayment options, including income-contingent plans, to ease the financial burden on borrowers. | Potential for Travel Restrictions: Failure to repay the loan according to the agreed terms can lead to travel restrictions. |

Navigating the world of student loans can be complex, but understanding the intricacies of PTPTN, its disbursement process, and repayment options is vital for Malaysian students seeking to pursue higher education without excessive financial burdens.

From boomboxes to bucket hats how hip hop clothing defined the 80s

Unveiling tourism trends revista estudios y perspectivas en turismo

Jung hoo lee sf giants jersey will it be a reality in 2024