Skip the Line: Your Guide to Using Wells Fargo Mobile Deposit

In today's fast-paced world, who has time for antiquated banking methods like physically visiting a bank branch? The convenience of online and mobile banking has revolutionized the way we manage our finances, and one of the most significant advancements is mobile check deposit. No longer do you need to carve time out of your day to deposit a check – with just a few taps on your smartphone, you can deposit funds directly into your account.

Wells Fargo, a major player in the financial industry, offers its customers a secure and efficient mobile deposit feature through its highly-rated mobile app. This service provides a streamlined approach to managing your checks, eliminating the need for in-person visits or cumbersome ATM deposits. But how exactly does this modern banking marvel work?

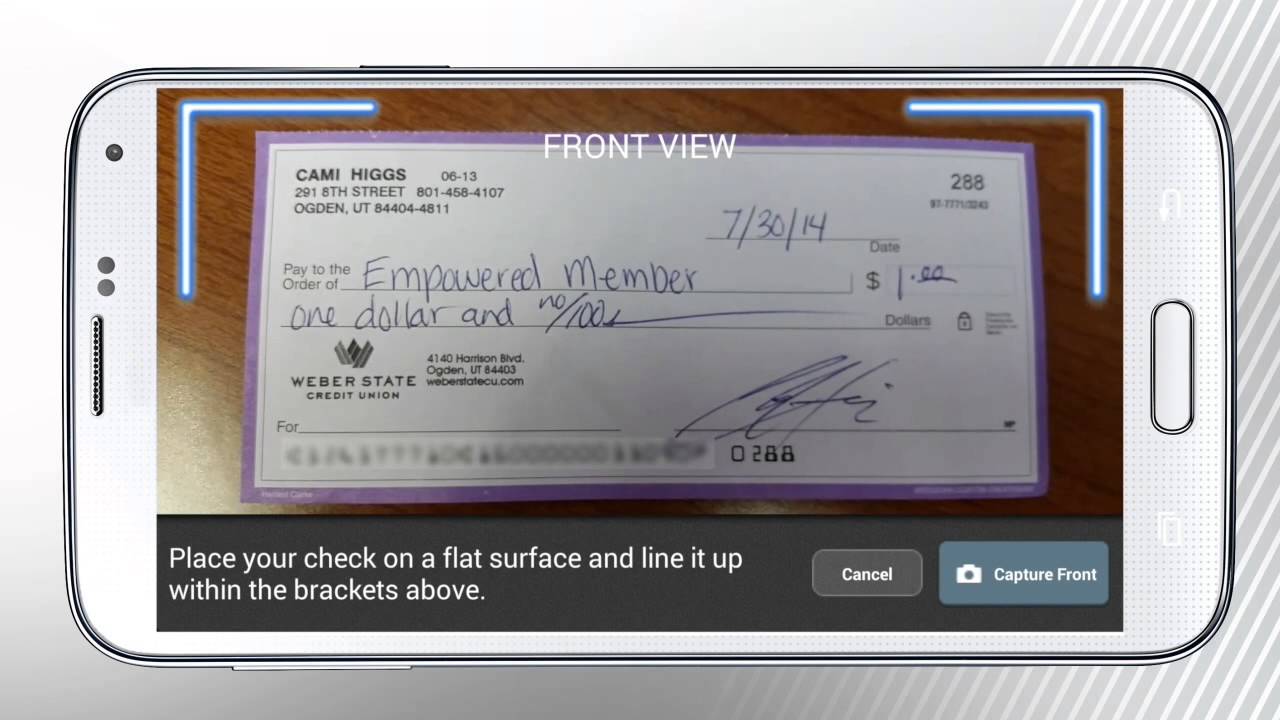

Mobile deposit through the Wells Fargo app harnesses the power of your smartphone's camera to capture and securely transmit check images for processing. This technology has become increasingly sophisticated, ensuring the security and accuracy of your transactions. While incredibly convenient, there are important aspects of mobile deposit to be aware of, such as deposit limits, processing times, and potential fees.

Understanding the ins and outs of Wells Fargo mobile deposit empowers you to make the most of this technology while navigating its nuances confidently. Whether you're a seasoned mobile banking enthusiast or a newcomer eager to explore the convenience it offers, this guide will provide the knowledge you need to make seamless mobile deposits.

In the following sections, we'll delve into the specifics of how to use Wells Fargo mobile deposit, covering everything from eligibility requirements to troubleshooting common issues. We'll explore the advantages and potential drawbacks of this service, equipping you to determine if it aligns with your banking preferences.

Advantages and Disadvantages of Wells Fargo Mobile Deposit

| Advantages | Disadvantages |

|---|---|

| Convenience of depositing checks anytime, anywhere | Potential deposit limits |

| Saves time compared to visiting a branch or ATM | Possible delays in funds availability depending on deposit type |

| Secure and reliable technology | Requires a smartphone and internet connection |

Best Practices for Wells Fargo Mobile Deposit

To ensure smooth and successful mobile deposits, consider these best practices:

- Endorse Your Check Properly: Sign the back of your check and write "For Mobile Deposit Only at Wells Fargo" to prevent any processing issues.

- Capture Clear Images: Place your check on a well-lit, flat surface and ensure your camera lens is clean. Take clear, focused photos of the front and back of the check.

- Verify Deposit Details: Double-check the deposit amount, account number, and any other relevant information before submitting your deposit.

- Keep Your Check Until Funds Are Available: While rare, issues can arise with mobile deposits. Hold onto your physical check for a few days after the funds are available in your account, then dispose of it securely.

- Monitor Your Account: Regularly review your account statements and transaction history to ensure the deposit was processed correctly and that there are no discrepancies.

By adhering to these best practices and understanding the features and limitations of Wells Fargo mobile deposit, you can simplify your banking experience and enjoy the convenience of managing your finances on the go.

The power of simplicity a heart on white background

Uniball signo white pen comparison the ultimate guide

Toyota rav4 prime xse premium the ultimate guide