Surat Pengesahan Majikan Kepada Bank Islam: A Guide

In the realm of Islamic finance in Malaysia, transparency and adherence to Shariah principles are paramount. One crucial document that exemplifies this is the "Surat Pengesahan Majikan Kepada Bank Islam," essentially an employer verification letter for Bank Islam. This document plays a vital role in various financial transactions, particularly for individuals seeking financing facilities. Let's delve into the significance of this letter and its implications.

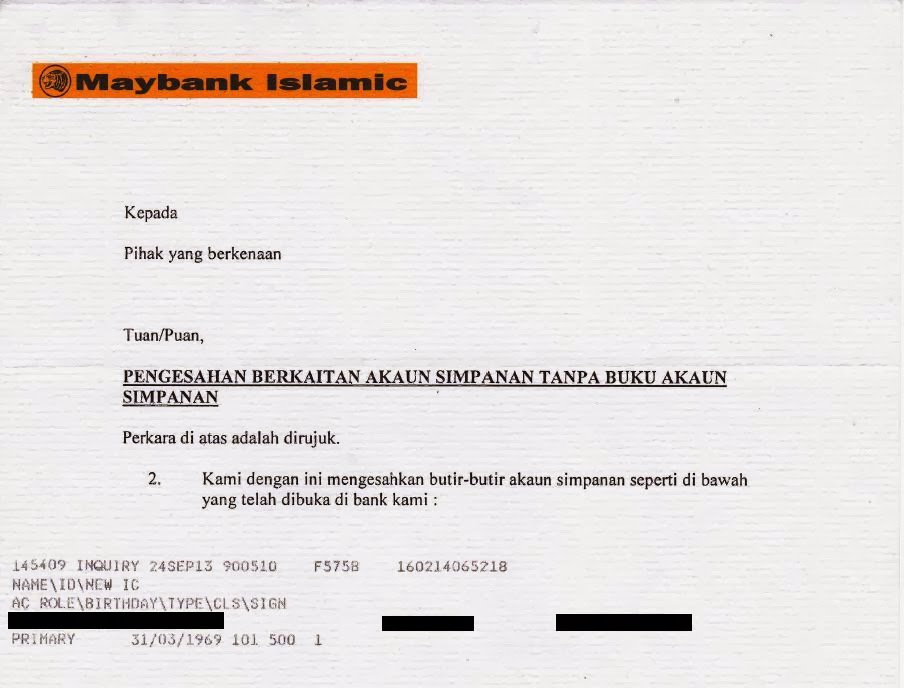

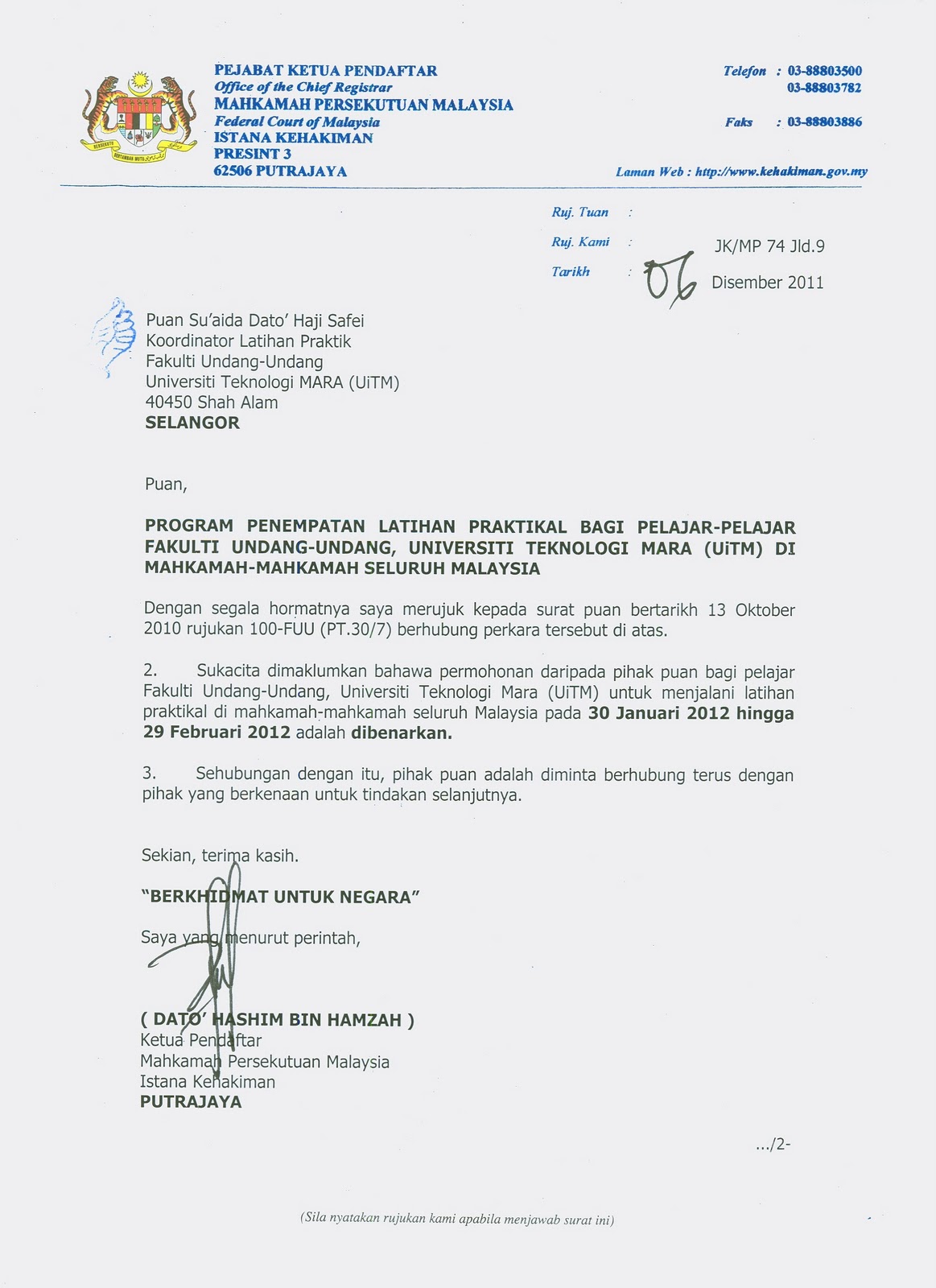

Imagine applying for a home financing facility that aligns with your faith-based values. You've found a property that ticks all the boxes, and now, the bank requires assurance of your employment and income stability. This is where the Surat Pengesahan Majikan comes in. It acts as a formal acknowledgment from your employer, verifying your employment status, salary, and other relevant details, giving the bank the confidence to process your application.

The requirement for this letter stems from the principles of Islamic finance, which emphasize transparency and risk mitigation. By verifying your employment and income, Bank Islam ensures that the financing provided is used for its intended purpose and that you have the financial capacity to meet your obligations. This process aligns with the Islamic prohibition of riba (interest) and promotes ethical and responsible lending practices.

The history of this practice is intertwined with the development of Islamic banking in Malaysia. As the industry gained momentum, so did the need for Shariah-compliant mechanisms to assess creditworthiness. Borrowers and lenders alike recognized the importance of transparency, leading to the adoption of the Surat Pengesahan Majikan as a standard requirement for various financial products.

While the Surat Pengesahan Majikan is crucial for both the bank and the applicant, challenges can arise. One common issue is obtaining the letter promptly, especially for individuals in fast-paced work environments or those whose employers might not be familiar with the specific requirements of Islamic banking. Misunderstandings regarding the letter's purpose can also lead to delays or complications. Effective communication between all parties involved is key to a smooth and efficient process.

Advantages and Disadvantages of Surat Pengesahan Majikan

Let's take a look at the advantages and disadvantages:

| Advantages | Disadvantages |

|---|---|

| Enhanced transparency and trust | Potential delays in obtaining the letter |

| Shariah-compliant verification process | Possible miscommunication between parties |

| Facilitates access to Islamic financing | Additional paperwork for employers |

Navigating the intricacies of Islamic finance requires a clear understanding of its principles and practices. The Surat Pengesahan Majikan Kepada Bank Islam, though seemingly a simple document, embodies the commitment to transparency and ethical conduct that underpins Islamic banking in Malaysia. By grasping its significance and purpose, both individuals and employers can contribute to a more robust and equitable financial system.

The rise of tamil web series your guide to online streaming

Unlocking the nespresso experience your guide to the italian official website

Unlocking the magic of up on the housetop chords a festive deep dive