Understanding Indonesian Employee Tax Calculations

Navigating the complexities of a country's tax system can be daunting, especially for newcomers. In Indonesia, understanding the process of calculating employee income tax, often referred to as "cara menghitung pajak karyawan bulanan" in Indonesian, is crucial for both employers and employees. This article aims to demystify the process, providing clarity on its importance and implications.

Imagine receiving your monthly paycheck, only to find a significant portion deducted for taxes. While taxes are essential for funding public services, knowing how your income tax is determined provides peace of mind and ensures you're being taxed accurately. In Indonesia, the income tax system operates on a progressive scale, meaning higher earners pay a larger percentage of their income as tax.

The historical development of Indonesia's employee income tax calculation is rooted in its evolving economic landscape and social welfare objectives. As the nation progressed, the tax system adapted to meet the demands of a growing workforce and changing economic conditions. Today, "cara menghitung pajak karyawan bulanan" is not merely a technical procedure but a cornerstone of the nation's revenue generation and redistribution framework.

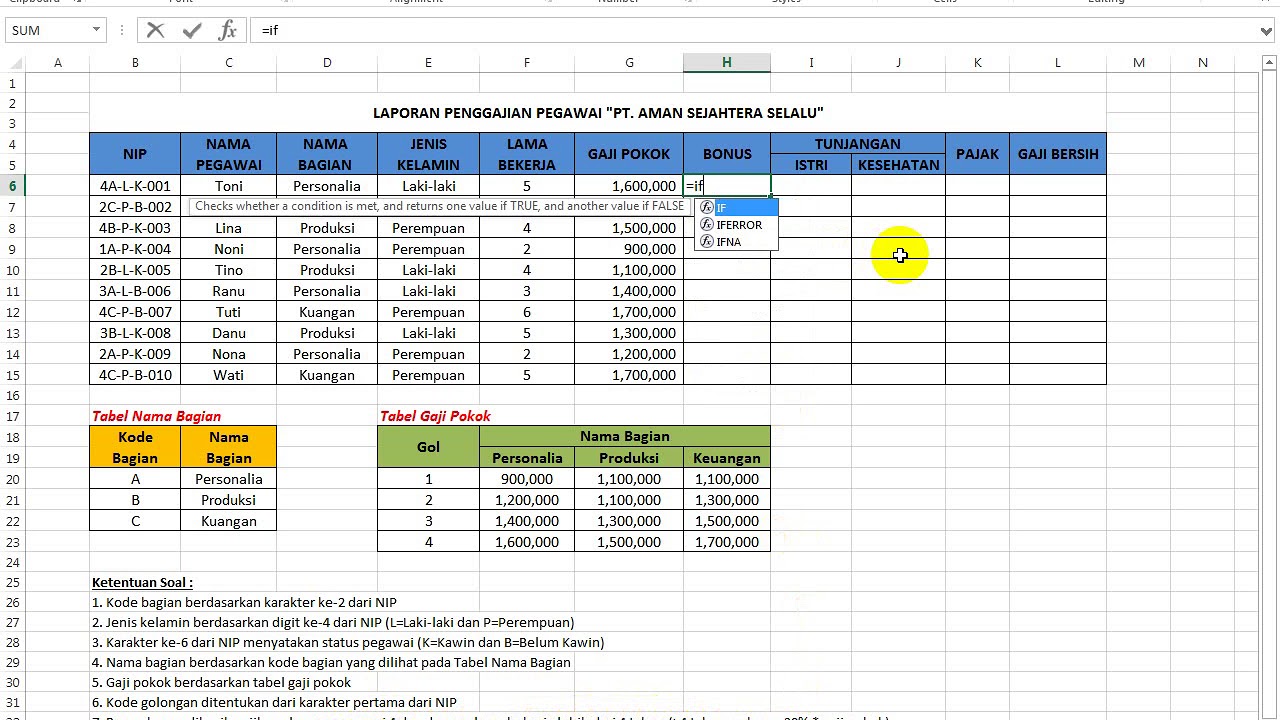

At the heart of this calculation lies the concept of taxable income. This isn't simply your gross salary but considers various deductions and allowances permitted by Indonesian tax law. Factors like marital status, number of dependents, and contributions to social security programs all play a role in determining your final taxable income.

The importance of accurately calculating employee income tax cannot be overstated. For employees, it ensures they fulfill their tax obligations, avoiding potential penalties and legal complications. Conversely, employers must execute these calculations diligently to comply with regulations and avoid discrepancies that could lead to audits and fines. Moreover, a transparent and well-understood tax system fosters trust between employers, employees, and the government.

Advantages and Disadvantages of the Indonesian Tax System

While the Indonesian tax system aims for fairness, it's not without its pros and cons. Here's a closer look:

| Advantages | Disadvantages |

|---|---|

| Progressive tax rates aim for greater income equality. | The complexity of regulations can be challenging for some individuals and businesses. |

| Various deductions and allowances help reduce the tax burden for eligible individuals. | Potential loopholes within the system could be exploited for tax avoidance. |

| Revenue collected funds essential public services like healthcare and education. | Lack of awareness and understanding of tax laws can lead to compliance issues. |

While pinpointing specific real-world examples of tax calculations can be tricky due to privacy concerns, the core principles remain consistent. The Indonesian tax authority, known as the Direktorat Jenderal Pajak (DJP), provides comprehensive resources, including online calculators and guidelines, to assist both employers and employees in understanding and fulfilling their tax obligations.

In conclusion, "cara menghitung pajak karyawan bulanan" is an integral part of Indonesia's financial landscape. By grasping the fundamentals of employee income tax calculation, both employers and employees can navigate the system confidently, ensuring compliance and contributing to the nation's overall well-being.

Decoding p0440 gm code causes and solutions

Unlocking the allure of ju ji hoons dramatic performances

Unlocking the secrets of jaguar bolt pattern wheels