Understanding Your EPF Account 3: A Guide to Calculation and Benefits

Planning for a secure retirement in Malaysia often involves understanding the intricacies of the Employees' Provident Fund (EPF). While many are familiar with Account 1 and Account 2, Account 3 remains a topic shrouded in some mystery. This comprehensive guide delves into the details of EPF Account 3, equipping you with the knowledge to make informed decisions about your financial future.

The EPF, a social security institution, plays a crucial role in ensuring the financial well-being of Malaysians upon retirement. Contributions from both employees and employers are channeled into this fund, accumulating over the years to provide a financial safety net. However, the EPF isn't just a single entity; it comprises different accounts, each serving a distinct purpose. Account 1, holding 70% of your contributions, forms the bedrock of your retirement savings. Account 2, with 30%, allows for specific withdrawals related to housing, education, and healthcare, among others. Then, there's Account 3.

Introduced to offer greater financial flexibility and security, Account 3 serves as a supplementary savings avenue within the EPF framework. Unlike its counterparts, Account 3 allows members to tap into a portion of their savings for specific purposes, even before retirement. This unique feature sets it apart, providing a valuable resource for those seeking financial assistance for specific life events.

The introduction of Account 3 signified a crucial shift in Malaysia's retirement planning landscape. It acknowledged that financial needs extend beyond retirement, encompassing critical events throughout an individual's life. By enabling access to a portion of retirement savings for specific purposes, Account 3 empowers individuals to address these needs without derailing their long-term financial goals.

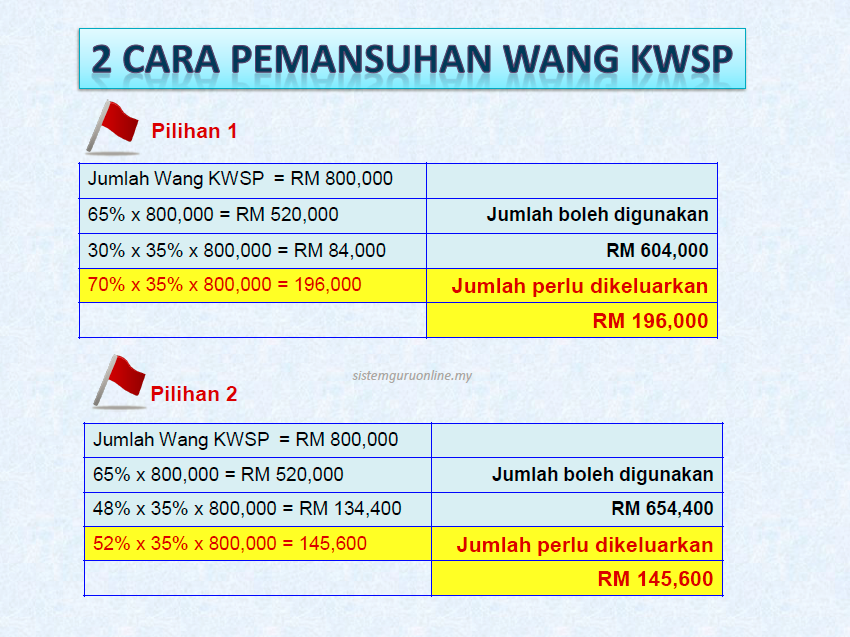

However, navigating the complexities of Account 3 can be challenging, particularly regarding the calculation of funds available for withdrawal. Understanding these calculations is paramount in leveraging the benefits of this account effectively. Factors such as age, total EPF savings, and the intended purpose of withdrawal all come into play. This guide aims to demystify these calculations, providing clarity and guidance for informed decision-making.

Advantages and Disadvantages of Utilizing EPF Account 3

While EPF Account 3 presents a valuable financial tool for specific situations, it's crucial to weigh the advantages and disadvantages before tapping into these funds.

| Advantages | Disadvantages |

|---|---|

| Access to funds for specific needs before retirement | Potential reduction in retirement savings |

| Flexibility in managing finances for healthcare and family needs | Limited withdrawal amounts based on specific criteria |

Understanding the nuances of EPF Account 3 empowers individuals to make sound financial decisions aligned with their long-term goals. By carefully considering the advantages and disadvantages, individuals can leverage this valuable resource to navigate various life events while safeguarding their financial future.

Decoding the wind exploring nws wind direction maps

Unleash creativity with nessie loch ness monster crafts for kids

When does the smackdown beatdown end your guide to friday night wrestling