Unlock Your Financial Insights: Accessing Your Wells Fargo Balance

In today's fast-paced world, having instant access to your financial information is crucial. Knowing your Wells Fargo account balance is more than just a number; it's a gateway to informed financial decisions. This article will delve into the various ways you can access your Wells Fargo balance, ensuring you're always in control of your finances.

Checking your Wells Fargo balance is fundamental to effective money management. It allows you to track spending, identify potential issues, and stay on top of your budget. Whether you prefer online banking, mobile apps, or other convenient methods, understanding the available options empowers you to make smarter financial choices.

From the early days of handwritten passbooks to today's digital age, the process of accessing account balances has evolved significantly. Wells Fargo, a long-standing financial institution, has been at the forefront of this transformation, offering customers various ways to view their account information. Understanding this evolution provides context for the current landscape of account access.

The importance of readily accessing your Wells Fargo balance cannot be overstated. It's the foundation of responsible financial planning. Knowing your available funds allows you to avoid overdrafts, plan for upcoming expenses, and make informed investment decisions. This knowledge translates to greater financial security and peace of mind.

However, like any technological system, accessing your Wells Fargo balance can present occasional challenges. From forgotten passwords to technical glitches, understanding potential issues and their solutions is key to a smooth banking experience. This article will address these common hurdles and provide practical advice for overcoming them.

Accessing your Wells Fargo account balance provides numerous benefits. First, it allows for real-time monitoring of your funds, enabling quick identification of any unauthorized transactions. Second, readily available balance information empowers you to make informed spending decisions, preventing overdrafts and promoting budget adherence. Third, it facilitates proactive financial planning by providing a clear picture of your available resources.

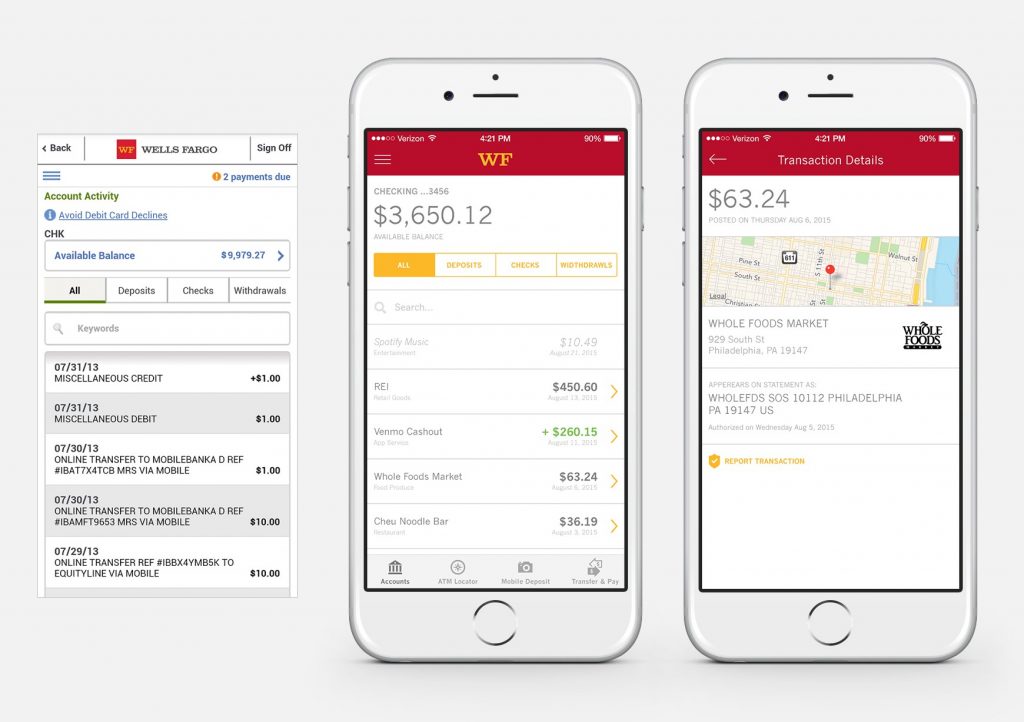

To access your Wells Fargo balance online, visit the Wells Fargo website and locate the "Sign On" button. Enter your username and password to securely log in. Once logged in, your account balance will be prominently displayed on your account dashboard.

If you prefer mobile banking, download the Wells Fargo mobile app. After launching the app, log in using your credentials. Similar to the online platform, your balance will be readily visible upon successful login.

Advantages and Disadvantages of Online Account Access

| Advantages | Disadvantages |

|---|---|

| 24/7 Access | Security Risks (if precautions are not taken) |

| Convenience | Requires Internet Access |

| Transaction History | Potential for Technical Issues |

Best practices for secure online banking include using strong passwords, avoiding public Wi-Fi for transactions, and regularly monitoring your account for suspicious activity.

Common challenges include forgotten passwords and technical issues. Solutions include utilizing the password recovery process and contacting customer support for technical assistance.

Frequently Asked Questions:

1. How do I reset my Wells Fargo password?

Answer: Visit the Wells Fargo website and use the "Forgot Password" link.

2. What should I do if I suspect unauthorized activity on my account?

Answer: Contact Wells Fargo customer support immediately.

3. Can I access my Wells Fargo balance internationally?

Answer: Yes, through online banking and the mobile app.

4. How often should I check my balance?

Answer: As frequently as needed to stay informed.

5. What are the fees associated with online banking?

Answer: Generally, there are no fees for basic online banking services.

6. How can I set up account alerts?

Answer: Log in to your account and navigate to the "Alerts" section.

7. Can I view my transaction history online?

Answer: Yes, you can access a detailed transaction history.

8. What if I have trouble logging in?

Answer: Contact customer support or use the online help resources.

Tips for managing your Wells Fargo account include setting up account alerts for low balances and unusual activity. Regularly review your transaction history to identify potential errors or unauthorized transactions.

In conclusion, accessing your Wells Fargo balance is an essential aspect of modern financial management. Whether you choose the convenience of online banking, the flexibility of the mobile app, or other available methods, staying informed empowers you to make sound financial decisions. By understanding the available options, implementing best practices for security, and proactively addressing potential challenges, you can take control of your finances and achieve your financial goals. Regularly checking your Wells Fargo balance, utilizing account management tools, and staying informed about your financial status are key steps toward a secure and prosperous financial future. Take the time to explore the available resources and tools to maximize the benefits of your Wells Fargo account.

Unleashing creativity with rainbow friends blue coloring pages

Unlocking style a deep dive into gacha life hair editing

Beyond words the power of martin luther king jr drawings