Unlock Your Financial Power: Mastering Your Wells Fargo Profile

Ever feel like you’re leaving money on the table? You diligently sock away your savings, clip coupons, and even brew your own coffee. But what if I told you there’s a hidden treasure trove of financial insights right at your fingertips? Your Wells Fargo personal profile is more than just a place to check your balance. It’s a powerful tool for taking control of your financial life, and today we're diving deep into how to wield it.

Accessing your Wells Fargo personal profile information offers a comprehensive view of your financial landscape. Think of it as your financial command center, providing access to account details, transaction history, and a wealth of tools to help you budget, save, and invest. Ignoring this resource is like leaving a valuable toolbox unopened in the garage. You might be able to get by without it, but you're missing out on a whole lot of potential.

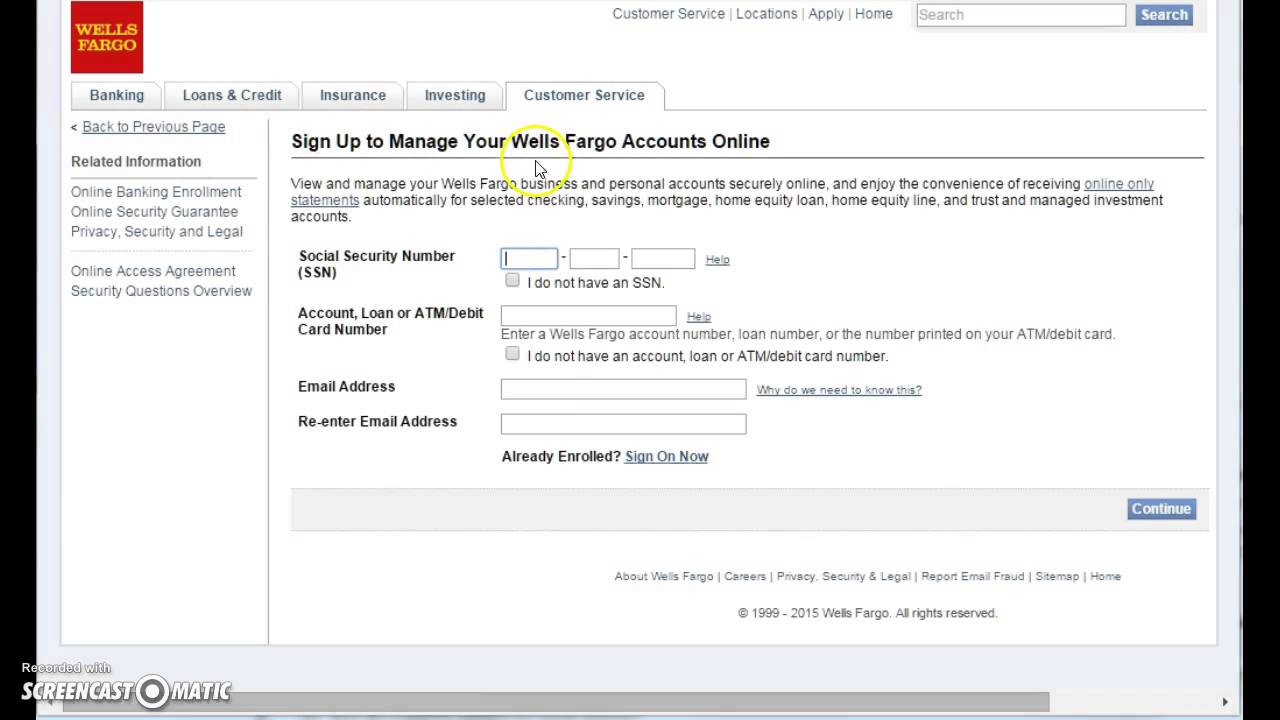

The ability to access and manage your Wells Fargo profile details online emerged with the rise of internet banking. This evolution revolutionized personal finance, allowing customers unprecedented access and control over their accounts. Before online banking, managing your finances meant trips to the branch, phone calls, and paper statements. Now, with a few clicks, you can check your balance, transfer funds, pay bills, and even invest, all from the comfort of your own home (or, let's be honest, from the bus stop). This shift towards digital banking has made managing personal finances significantly more efficient.

Understanding your Wells Fargo profile access is crucial for anyone serious about financial independence. Why? Because knowledge is power. By understanding your spending habits, tracking your progress towards financial goals, and utilizing the tools available within your profile, you can make informed decisions that propel you towards a richer life – both literally and figuratively. Whether you’re saving for a down payment, paying down debt, or building a retirement nest egg, your Wells Fargo profile provides the insights you need to stay on track.

The main issue some people face is simply not utilizing their Wells Fargo profile to its full potential. They might check their balance and call it a day, missing out on valuable features and opportunities to optimize their finances. Others struggle with navigating the platform itself, feeling overwhelmed by the sheer volume of information available. This article aims to demystify the process and empower you to take control of your financial destiny.

One of the key benefits of utilizing your Wells Fargo online profile is enhanced security. Two-factor authentication and other security measures protect your sensitive financial information from unauthorized access. By regularly reviewing your account activity through your profile, you can quickly identify and address any suspicious transactions.

Another significant advantage is the convenience. Need to transfer money to a friend? Pay a bill on the go? Accessing your Wells Fargo personal financial information through your profile allows you to manage your finances anytime, anywhere, eliminating the need for time-consuming trips to the bank or ATM.

Finally, your Wells Fargo profile empowers you to make informed financial decisions. By tracking your spending, setting budget alerts, and utilizing financial planning tools, you can gain a clear understanding of your financial health and make adjustments as needed.

Advantages and Disadvantages of Regularly Reviewing Your Wells Fargo Profile

| Advantages | Disadvantages |

|---|---|

| Enhanced security | Requires internet access |

| Increased convenience | Potential for technical issues |

| Improved financial awareness | Can be overwhelming for new users |

Frequently Asked Questions:

1. How do I access my Wells Fargo profile? Visit the Wells Fargo website and log in using your username and password.

2. What if I forget my password? You can reset your password through the Wells Fargo website.

3. How can I update my personal information? Log in to your profile and navigate to the "Profile Settings" section.

4. How can I set up account alerts? Within your profile, you can customize alerts for various account activities.

5. How do I view my transaction history? Your transaction history is readily available within your account details.

6. Can I access my Wells Fargo profile on my mobile device? Yes, through the Wells Fargo mobile app.

7. Is my information secure? Wells Fargo utilizes advanced security measures to protect your information.

8. Who can I contact for assistance? Wells Fargo customer service is available to help with any questions.

One simple trick for maximizing your Wells Fargo profile is to set up automatic bill pay. This not only saves you time and hassle, but also helps you avoid late payment fees.

In conclusion, your Wells Fargo personal profile is a powerful tool for achieving financial success. By understanding its features, benefits, and best practices, you can take control of your finances, make informed decisions, and build a brighter financial future. Regularly reviewing and utilizing your profile’s tools is not just about managing your money – it’s about empowering yourself to live a richer, more fulfilling life. Don't let this valuable resource gather digital dust – log in today and unlock the potential within your Wells Fargo profile. Start small, explore the different features, and watch your financial confidence grow. Taking control of your finances doesn't have to be daunting. With the right tools and a proactive approach, you can achieve your financial goals and build the life you've always dreamed of. So, what are you waiting for? Dive in and start exploring!

Mesmerizing combinations celebrities with blue eyes and brown hair

Is my name written in the book of life exploring eternal significance

Leaving on a laugh the art of the funny last day at work meme