Unlocking Bill Pay: The Power of Payment Authorization Letters

Ever been stuck in a situation where you need someone else to pay your bills? Whether it’s a family emergency, a business trip, or simply delegating financial tasks, the need to grant someone access to your accounts can arise. This is where the often-overlooked but incredibly useful payment authorization letter comes into play. It's the key to smoothly managing your finances, even when you're not directly handling the payments.

A payment authorization letter, sometimes called a letter of authorization for bill payment, is a formal document that grants a third party the authority to make payments on your behalf. This simple yet powerful tool can be used for various purposes, from authorizing a family member to pay your utility bills while you're away to allowing a business associate to handle invoices during your absence. It’s a critical component of efficient financial management, providing both convenience and control.

While the precise origins of these letters are difficult to pinpoint, they likely evolved alongside the development of modern banking and billing systems. As the complexity of financial transactions increased, the need for clear, documented authorization became more apparent. Today, payment authorization letters are used extensively in both personal and business contexts, playing a vital role in ensuring secure and efficient financial operations.

The importance of a well-crafted authorization letter cannot be overstated. It acts as a safeguard against unauthorized access and potential fraud. By clearly specifying the scope of the authorization, you maintain control over your finances and minimize the risk of misuse. This document serves as a crucial piece of evidence in case of any disputes or discrepancies, offering protection for both the payer and the payee.

One common issue associated with payment authorization letters is the lack of clarity or specificity. A vaguely worded letter can lead to confusion and potential problems down the line. It’s essential to be precise about the types of bills the authorized party can pay, the payment methods allowed, and the duration of the authorization. A well-defined letter minimizes ambiguity and ensures that all parties are on the same page.

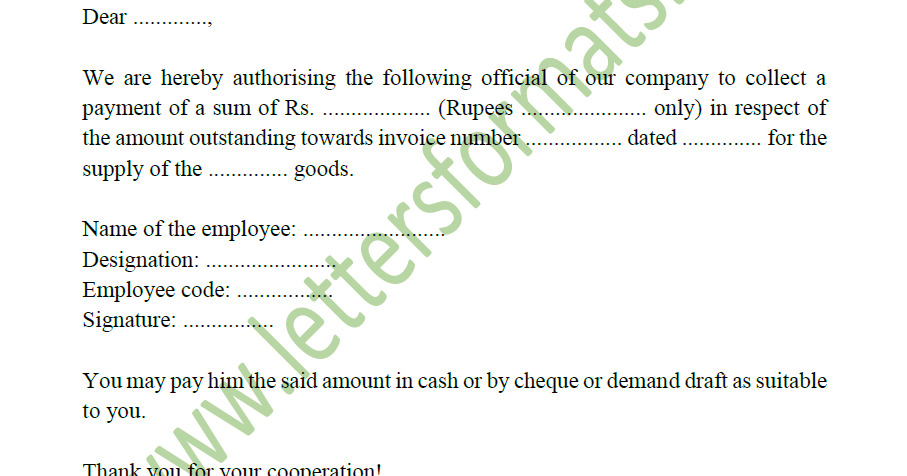

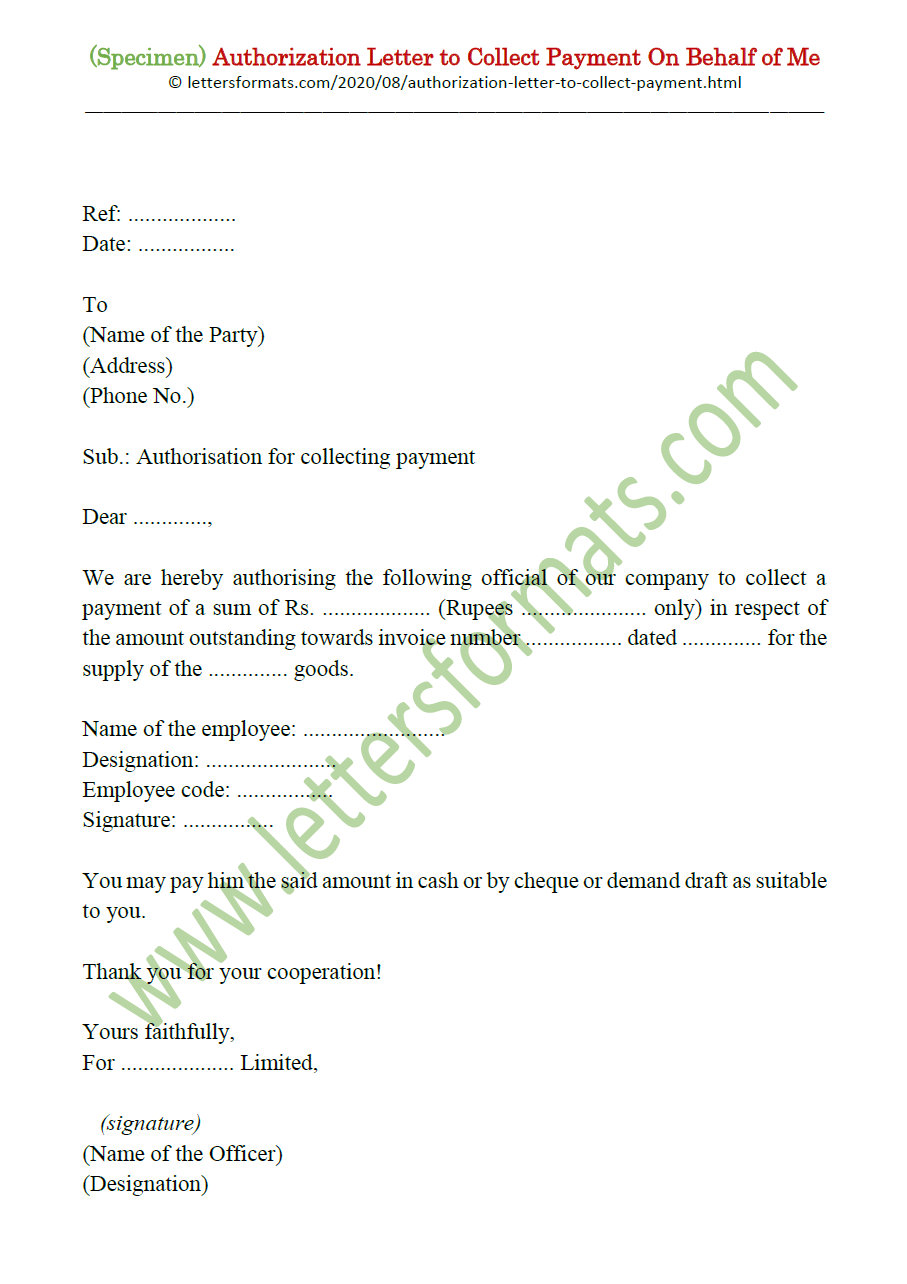

A payment authorization letter typically includes the following information: the payer’s name and contact information, the authorized party’s name and contact information, a clear statement granting payment authorization, details of the bills to be paid (e.g., account numbers, utility company names), the authorized payment methods (e.g., check, online transfer), the effective date and duration of the authorization, and the payer’s signature.

Benefits of using a payment authorization letter include: peace of mind knowing your bills are being paid while you're unavailable, preventing late payment fees and potential service interruptions, and maintaining a positive credit history by ensuring timely bill payments.

Example: John authorizes his sister, Mary, to pay his electricity bill while he is traveling. He provides Mary with a letter specifying the account number, the amount due, and the due date, along with his signature.

To create a payment authorization letter, list your information, the authorized party's details, the specific bill details, the payment method, the timeframe, and sign the letter. Make a copy for your records.

Advantages and Disadvantages of Payment Authorization Letters

| Advantages | Disadvantages |

|---|---|

| Convenience | Potential for misuse if not clearly defined |

| Prevents late payments | Requires careful record-keeping |

| Protects credit score | Can be time-consuming to create |

Best practices include being specific, setting clear limits, keeping copies of the letter, regularly reviewing authorizations, and revoking authorizations when no longer needed.

Frequently Asked Questions:

1. What is a payment authorization letter? (Answered above)

2. Why do I need one? (Answered above)

3. What information should it include? (Answered above)

4. How long should the authorization be valid? This depends on your individual needs, but it's recommended to set a specific timeframe.

5. Can I revoke the authorization? Yes, you can revoke the authorization at any time by providing written notice to the authorized party and the relevant billing companies.

6. What happens if the authorized party misuses the authorization? You should immediately revoke the authorization and contact the relevant billing companies to report the misuse.

7. Are there any legal implications? A validly signed authorization letter is a legally binding document.

8. Where can I find a template? You can find various templates online.

In conclusion, the payment authorization letter, though seemingly simple, is a powerful tool for managing your financial obligations effectively. It provides a secure and convenient way to delegate payment responsibilities while maintaining control over your finances. From ensuring timely bill payments to protecting your credit score, the benefits are significant. By following best practices and understanding the potential challenges, you can harness the full potential of this often-overlooked document. Don’t underestimate the power of a well-crafted authorization letter; it’s a key component of responsible financial management in today's fast-paced world. Take the time to understand its nuances, and you'll be well-equipped to navigate the complexities of bill payments with ease and confidence.

The modern mullet meets the low taper a fresh take on a classic style

Epic 15th birthday cakes for guys

Understanding your wells fargo current month financial picture