Unlocking Financial Clarity: Your Guide to Understanding Pay Statements

In the whirlwind of modern life, where wellness routines meet overflowing inboxes, taking charge of our finances is paramount. At the heart of this financial journey lies a seemingly mundane document that holds immense power: your pay statement.

Imagine this: you're manifesting abundance, setting intentions for financial freedom, and then, a digital slip arrives in your inbox, detailing your monthly earnings. This, my friend, is no ordinary document; it's a roadmap to understanding your financial flow, a crystal ball revealing the secrets of your income.

Whether you're a seasoned entrepreneur or just starting your career, deciphering the nuances of your pay statement is essential. It's about more than just knowing how much you earned; it's about taking control of your financial narrative.

Think of it as a monthly financial health check-up. By carefully examining your pay statement, you gain insights into your income, deductions, and ultimately, your spending power. This knowledge empowers you to make informed decisions about your money, aligning your financial goals with your values.

Let's delve into the world of pay statements, exploring their components, benefits, and how they can empower you on your journey to financial well-being. We'll uncover the secrets hidden within those lines and empower you to become the ultimate financial guru of your own life.

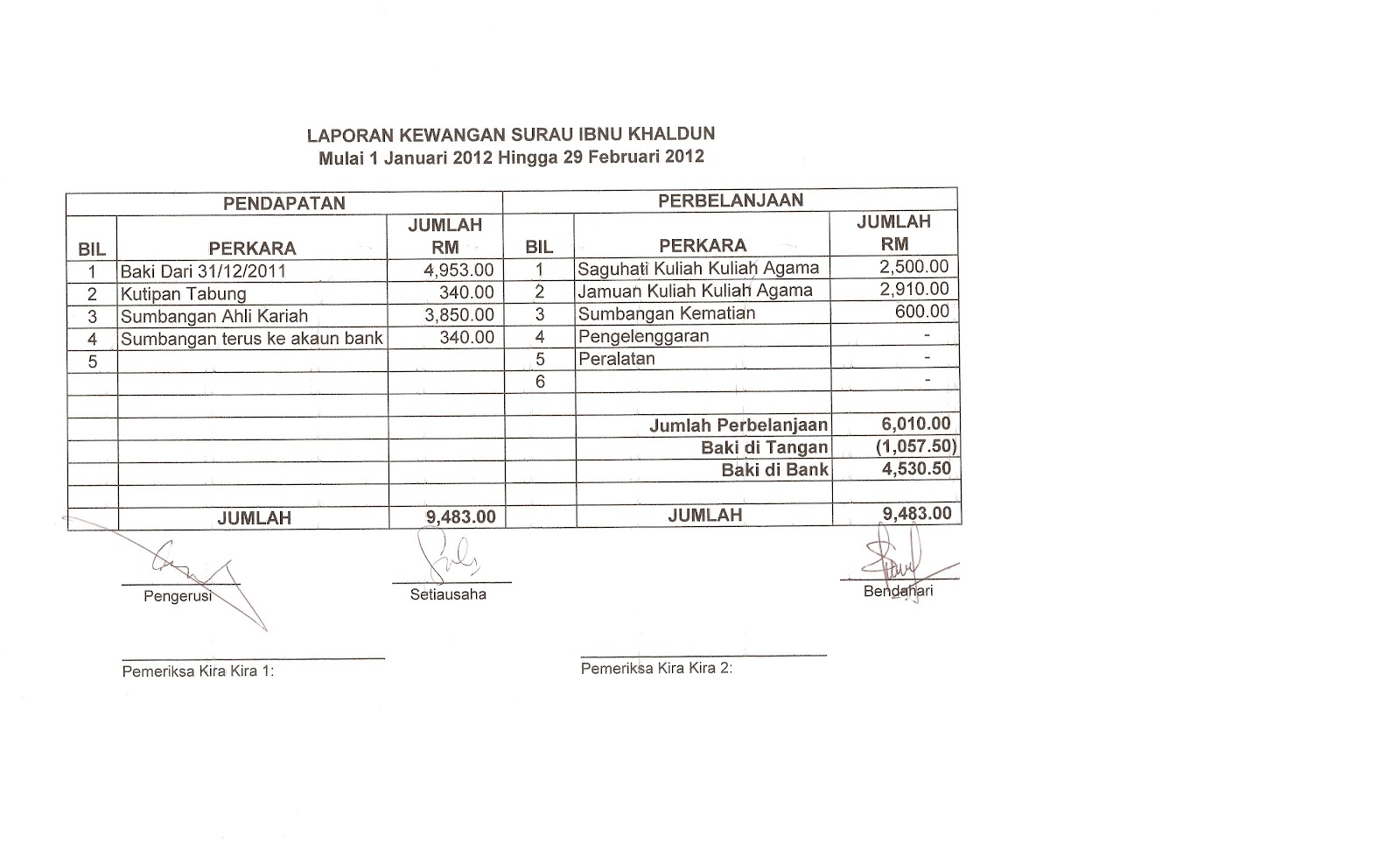

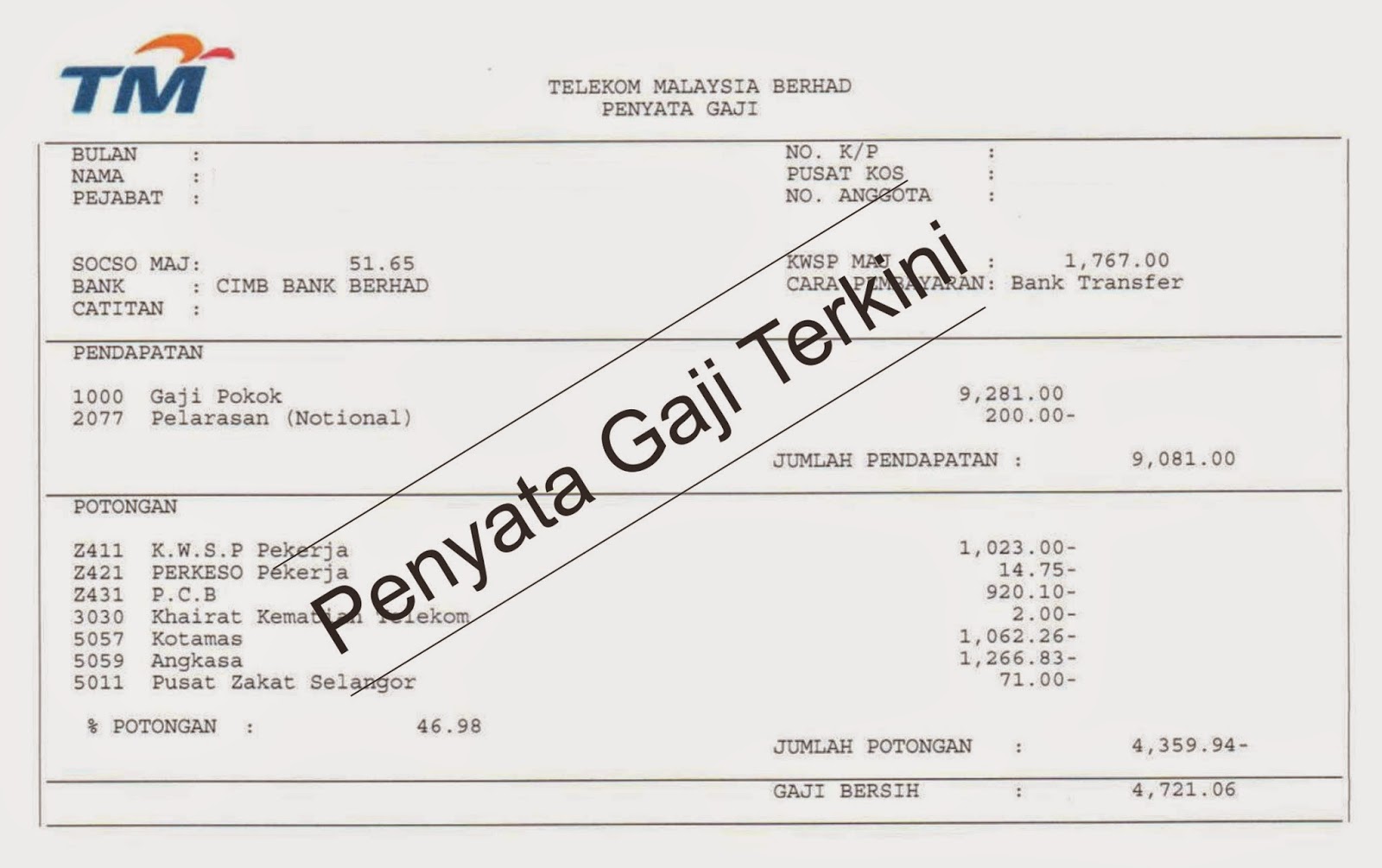

While the term 'contoh penyata gaji bulanan' may seem like a foreign language to some, it simply translates to 'monthly salary statement' in Malay. This unassuming document, often overlooked in the hustle and bustle of life, plays a crucial role in personal finance, particularly in Malaysia and other Southeast Asian countries where Malay is spoken.

Historically, pay statements have evolved from handwritten ledgers to digital formats, reflecting the advancements in technology and accounting practices. Their importance, however, remains unchanged. They serve as legal proof of income, essential for securing loans, renting apartments, and even applying for visas.

One of the main issues surrounding pay statements is the lack of understanding among employees about their components. From basic salary and allowances to deductions for taxes and retirement contributions, each element contributes to the final amount deposited into your account. Without a clear grasp of these elements, employees risk misinterpreting their earnings and potentially overlooking discrepancies.

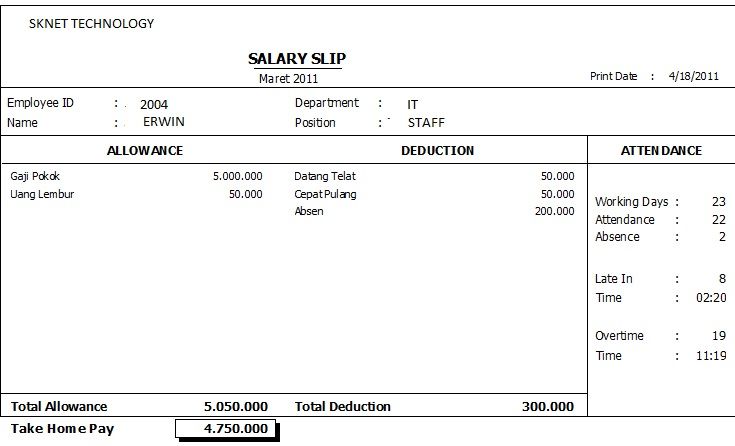

Let's break down some key components of a typical pay statement:

Basic Salary: This is the foundation of your earnings, the agreed-upon amount you receive for your work, before any additions or deductions. Allowances: These are additional payments on top of your basic salary, often provided for transportation, housing, or other work-related expenses. Deductions: These represent amounts subtracted from your gross pay, encompassing income tax, social security contributions, and sometimes, employee benefits like health insurance or retirement plans. Net Pay: This is the final amount you receive after all deductions, reflecting the actual money deposited into your bank account.

Understanding these components is key to deciphering your pay statement and gaining a holistic view of your earnings.

Advantages and Disadvantages of Detailed Pay Statements

| Advantages | Disadvantages |

|---|---|

| Increased financial transparency | Potential for information overload |

| Improved budgeting and financial planning | Risk of privacy concerns if not handled securely |

| Easier identification of errors or discrepancies | May require additional time for review and understanding |

To further enhance your understanding of pay statements, consider these best practices:

1. Review Regularly: Don't let your pay statements pile up unread. Make it a habit to review them upon receipt, ensuring accuracy and understanding. 2. Question Discrepancies: If you notice any errors or inconsistencies, don't hesitate to contact your HR department or payroll provider for clarification. 3. Leverage Technology: Embrace digital tools and apps designed to help you track income, expenses, and manage your finances effectively. 4. Seek Professional Guidance: If you're overwhelmed or have complex financial questions, consult with a financial advisor to receive personalized advice. 5. Prioritize Financial Literacy: Continuously educate yourself about personal finance, including topics like budgeting, investing, and retirement planning.

Navigating the world of pay statements may seem daunting at first, but armed with the right knowledge and tools, you can transform these documents into powerful allies in your financial journey. Remember, understanding your income is the first step towards building a secure and abundant financial future.

Unlock the power of connection your guide to engaging on tiktok live

Navigating the world of travel a look at passport gov mm pdf

Obsessed elevating your travel game with a flight tracker stream deck