Unlocking Financial Responsibility: Your Guide to Individual Tax Registration

Imagine a world where roads crumble, schools lack resources, and essential services dwindle. It's a world without the financial backbone provided by taxes. While no one jumps for joy at the thought of paying taxes, it's the bedrock of a functioning society, funding everything from healthcare to infrastructure. In Malaysia, individual income tax registration, or *pendaftaran cukai pendapatan individu* in Malay, plays a crucial role in this system.

But what does it actually mean to be tax registered? It's like joining a club, but instead of enjoying perks like exclusive access to a swimming pool, you're contributing to the well-being of your nation. When you register and file your taxes, you're essentially giving the government a report card of your income. Based on this information, they determine your tax liability, the amount you owe in taxes. Think of it as your financial contribution to keeping the wheels of society turning.

Now, you might be wondering if you even need to go through this whole process. After all, dealing with paperwork and deadlines isn't exactly a walk in the park. In Malaysia, individual income tax registration is mandatory for those who meet certain income thresholds. This ensures everyone contributes their fair share to support the nation's growth.

Delving into the history of taxation in Malaysia, it's a journey that reflects the nation's own evolution. From its early forms during British colonial rule to its current structure, the system has adapted to meet the demands of a developing nation. The introduction of individual income tax marked a significant milestone, emphasizing the importance of individual contributions to national revenue. Today, the system is administered by the Inland Revenue Board of Malaysia (LHDN), also known as Hasil in Malay. This body plays a pivotal role in ensuring the smooth functioning of the income tax system, from registration to collection.

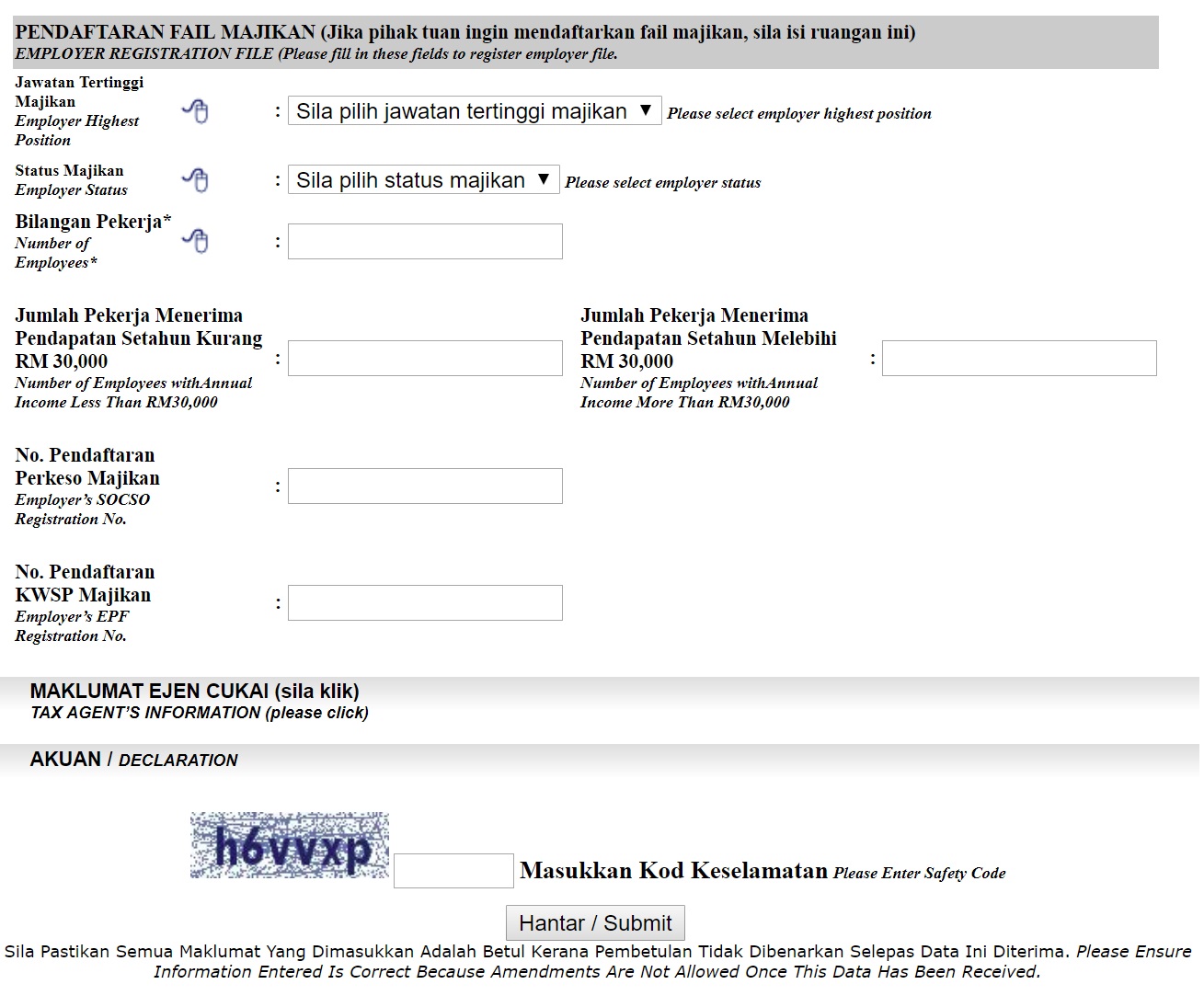

However, the process of individual income tax registration is not without its challenges. One of the main hurdles faced by many is a lack of awareness and understanding of the process itself. The intricacies of tax regulations can seem daunting, especially for those unfamiliar with financial jargon. This can lead to individuals missing deadlines, making errors in their filings, or even avoiding registration altogether, resulting in potential penalties. Addressing these challenges requires a multi-pronged approach, including simplifying tax information, raising awareness through educational campaigns, and providing accessible support channels for taxpayers.

Advantages and Disadvantages of Individual Tax Registration

Let's weigh the pros and cons:

| Advantages | Disadvantages |

|---|---|

|

|

While there are clear benefits to fulfilling your tax obligations, it's important to be aware of the potential downsides and seek assistance if needed. Navigating the world of taxes may seem like venturing into uncharted territory, but remember, understanding the basics of individual income tax registration is an essential step towards becoming a responsible citizen.

Maximize space and style your guide to twin bed bedroom ideas

Crystal clear vision the ultimate guide to cleaning your car windshield inside

Unlocking the fun a deep dive into ruleta de la suerte programa