Unlocking the Secrets of JPMorgan Chase Bank Check Deposit Addresses

Sending a check through the mail might seem like a relic of the past, but for many, it remains a vital part of managing finances. If you're a JPMorgan Chase customer, knowing the correct mailing address for your check deposits is crucial for avoiding delays and ensuring your funds are properly credited. This comprehensive guide will navigate you through the intricacies of JPMorgan Chase check deposit addresses, offering clarity and practical advice.

Navigating the world of financial institutions can be complex. When it comes to depositing checks with JPMorgan Chase, using the correct mailing address is paramount. This seemingly simple task can become a source of frustration if not handled properly. Incorrect addresses can lead to processing delays, returned checks, and even potential financial losses. Understanding the nuances of JPMorgan Chase's deposit address system is key to ensuring smooth and efficient transactions.

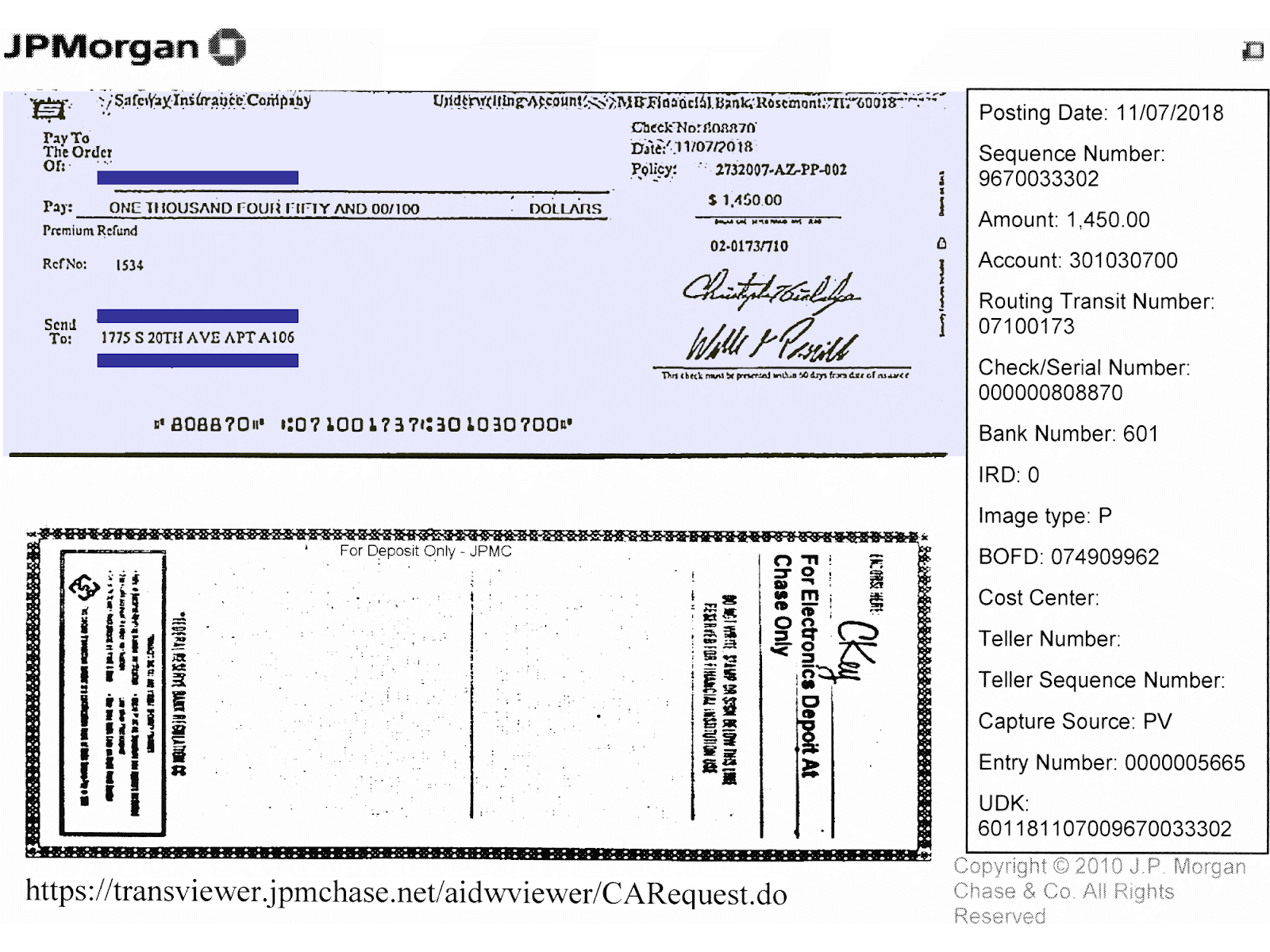

JPMorgan Chase, one of the largest financial institutions in the United States, offers various methods for depositing checks, including mobile deposit, ATM deposit, and in-branch transactions. However, mailing a check remains a preferred option for many customers. The bank's history with check processing stretches back decades, evolving alongside technological advancements. Initially, physical bank branches were the primary locations for check deposits. Over time, centralized processing centers emerged, streamlining operations and improving efficiency.

The importance of using the correct JPMorgan Chase check deposit address cannot be overstated. It's the linchpin that connects your payment to your account. Just like sending a letter to the wrong street address can result in misdelivery, using an incorrect deposit address can lead to your check being lost, delayed, or even returned. This can disrupt your financial planning, cause missed payments, and create unnecessary stress.

Determining the correct JPMorgan Chase check deposit address can sometimes be a challenge, as it can vary depending on your account type, geographic location, and the specific type of check being deposited. While a general address may be available for standard check deposits, specialized addresses might exist for mortgage payments, auto loan payments, or other specific transactions. This guide aims to clarify the process and provide you with the resources you need to locate the correct address for your individual needs.

Finding the correct address is often specific to the type of account and can be found on your monthly statement or by contacting customer service. For specific inquiries related to your account, contacting JPMorgan Chase customer support directly is the best way to obtain the most accurate and up-to-date information regarding your check deposit address.

Benefits of Mailing Checks:

1. Convenience: Mailing a check offers flexibility, especially for those who may not have convenient access to a branch or prefer not to use mobile banking.

2. Record Keeping: A physical check provides a tangible record of payment.

3. Accessibility: Mailing checks is a readily available option for most account holders.

Tips and Tricks for Mailing Checks:

Always double-check the address before sending. Ensure the check is properly endorsed and includes your account number. Consider using certified mail for important payments.

Advantages and Disadvantages of Mailing Checks

| Advantages | Disadvantages |

|---|---|

| Convenience | Slower processing time |

| Record Keeping | Potential for mail delays or loss |

Frequently Asked Questions:

1. What if I use the wrong address? Contact JPMorgan Chase customer service immediately.

2. Where can I find my specific deposit address? Check your monthly statement or contact customer service.

3. How long does it take for a mailed check to clear? Processing times vary but typically range from a few days to a week.

4. Can I mail a check to any JPMorgan Chase branch? No, using the correct designated address is essential.

5. Is there a fee for mailing a check? Generally, no, but confirm with your specific account details.

6. What should I write on the memo line of the check? Your account number or a specific identifier.

7. What if my mailed check gets lost? Contact customer service and consider placing a stop payment on the check.

8. Is it safe to mail a check? While generally safe, taking precautions like using certified mail can minimize risks.

In conclusion, understanding the intricacies of JPMorgan Chase check deposit addresses is vital for seamless financial management. Utilizing the correct address ensures timely processing, prevents potential delays or losses, and provides peace of mind. While alternative deposit methods exist, mailing a check remains a valuable option for many. By following best practices, utilizing available resources, and staying informed about your specific account details, you can navigate the process with confidence. Take the time to verify the appropriate address, whether through your monthly statement or by contacting JPMorgan Chase customer service, to ensure your funds are deposited accurately and efficiently. Your financial well-being depends on it.

Women smoke swisher sweets little cigars ads a marketing perspective

Taming the beast mastering the art of flag clip attachment

Finding an incarcerated person in new york state