Unlocking Your Finances: Understanding "Berapa Peratus Potongan Cukai Pendapatan"

Navigating the world of taxes can often feel like venturing into a labyrinth of complex rules and regulations. One phrase that frequently pops up, especially for those new to personal finance in Malaysia, is "berapa peratus potongan cukai pendapatan," which translates to "what percentage is the income tax deduction" in English. Understanding this concept is crucial for managing your finances effectively and potentially saving a significant amount of money.

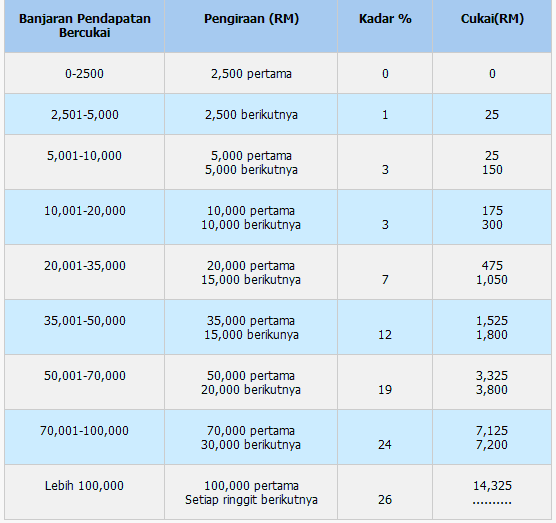

Essentially, "berapa peratus potongan cukai pendapatan" refers to the specific percentage of your taxable income that you are allowed to deduct to reduce your overall tax burden. These deductions are designed to provide relief to taxpayers and often target specific expenses or investments deemed beneficial by the government. Think of it as a reward for making certain financial decisions that contribute to your well-being or the nation's economic growth.

While the idea of reducing your tax liability is undoubtedly appealing, the intricacies of tax deductions can seem daunting. Determining the exact percentage applicable to you depends on various factors, including your income bracket, employment status, and the specific deductions you qualify for.

This article aims to demystify the concept of "berapa peratus potongan cukai pendapatan," providing you with the knowledge to navigate this aspect of your financial planning confidently. We will delve into the various types of deductions available in Malaysia, factors influencing your deduction percentage, and practical tips to maximize your savings. By understanding this crucial element of the Malaysian tax system, you can make informed financial decisions and potentially retain a larger portion of your hard-earned income.

Whether you are a seasoned professional, a recent graduate, or simply looking to enhance your financial literacy, comprehending "berapa peratus potongan cukai pendapatan" is essential for making sound financial decisions. This knowledge empowers you to optimize your tax liabilities and allocate your resources more effectively, paving the way for greater financial well-being.

Advantages and Disadvantages of Income Tax Deductions

While income tax deductions primarily offer a way to reduce your tax burden, it's beneficial to understand both the advantages and potential drawbacks associated with them.

| Advantages | Disadvantages |

|---|---|

| Reduced Tax Liability | Complexity and Paperwork |

| Increased Disposable Income | Potential for Errors |

| Encourages Savings and Investment | May Require Specific Financial Decisions |

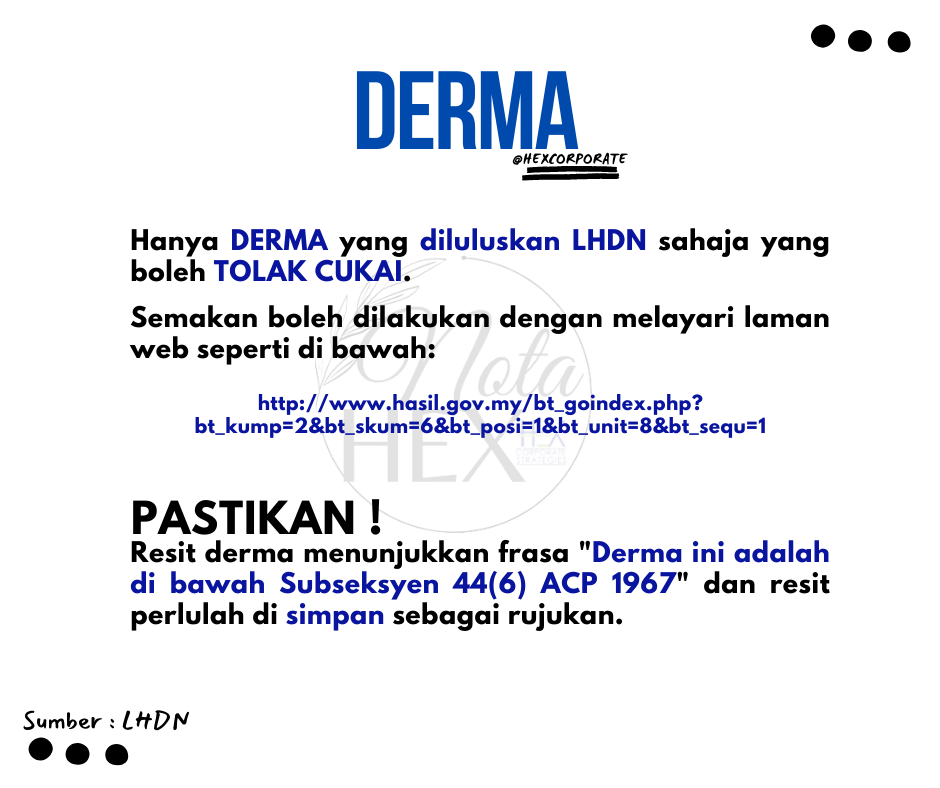

Remember, tax regulations and deduction percentages can change. It's essential to stay updated with current guidelines from the Inland Revenue Board of Malaysia (LHDN) or consult with a qualified tax professional for personalized advice tailored to your specific financial situation.

White cherry gumbo strain

Cara renew roadtax motor online your ultimate guide

Soulful style the enduring influence of black male singers in the 1960s