Unlocking Your Financial Flow: Demystifying PNC Account Numbers on Checks

Ever stared at a check, a little bewildered by that string of numbers? It's not just a random sequence – it's the key to accessing your funds, and understanding it is crucial for smooth financial management. This guide dives deep into the world of PNC account numbers on checks, equipping you with the knowledge to navigate your finances with confidence.

Specifically, we'll be focusing on PNC Bank checks. Whether you're a seasoned check writer or just starting out, knowing how to identify and use your PNC account number on a check is essential for avoiding errors and potential headaches. This seemingly small detail plays a big role in ensuring your payments reach the intended recipient and are processed correctly.

Your PNC account number, printed on your checks, is like the address of your funds. It tells the bank precisely where to withdraw the money for the check you’ve written. This crucial piece of information, along with the routing number, allows for the seamless transfer of funds from your account to the payee. Without a correctly printed and identifiable account number, your check could be rejected, leading to delays and potential fees.

The placement of the PNC account number on your check is standardized to facilitate automated processing. It’s typically located at the bottom, usually between the check number and the routing number. It's essential to keep your checks secure and avoid sharing this information carelessly to prevent unauthorized access to your account. Protecting your financial information is paramount in today's digital landscape.

In this comprehensive guide, we'll delve into the importance of understanding your PNC account number on a check, covering everything from its location and format to best practices for security. We’ll also explore potential issues, troubleshooting tips, and frequently asked questions to ensure you have a complete understanding of this essential financial tool. So, let’s dive in and unlock the secrets of those digits at the bottom of your check.

Historically, account numbers on checks have evolved from simple sequential numbering to more complex systems that incorporate security features and facilitate electronic processing. This evolution reflects the increasing complexity and volume of financial transactions.

The main issues related to PNC account numbers on checks typically involve misreading or incorrectly recording the number, leading to returned checks or payment delays. Occasionally, security concerns arise with lost or stolen checks, highlighting the importance of safeguarding your financial information.

A PNC checking account number is a unique identifier assigned to your account. It's distinct from the routing number, which identifies the bank. For example, if you see a check with the account number 1234567890, this number specifically designates your individual account at PNC Bank.

Benefits of understanding your PNC account number on a check include: 1. Accurate Payments: Ensuring funds are withdrawn from the correct account. 2. Fraud Prevention: Recognizing discrepancies and protecting yourself from unauthorized access. 3. Efficient Reconciliation: Quickly identifying transactions and balancing your checkbook.

Advantages and Disadvantages of Using Checks

| Advantages | Disadvantages |

|---|---|

| Widely accepted | Can be lost or stolen |

| Physical record of payment | Processing time can be longer than electronic payments |

| No need for internet access | Requires proper handling and storage |

Best Practices: 1. Store checks securely. 2. Review your statements regularly. 3. Shred voided or unused checks. 4. Be cautious of who you provide your account information to. 5. Contact PNC immediately if you suspect fraud.

Frequently Asked Questions:

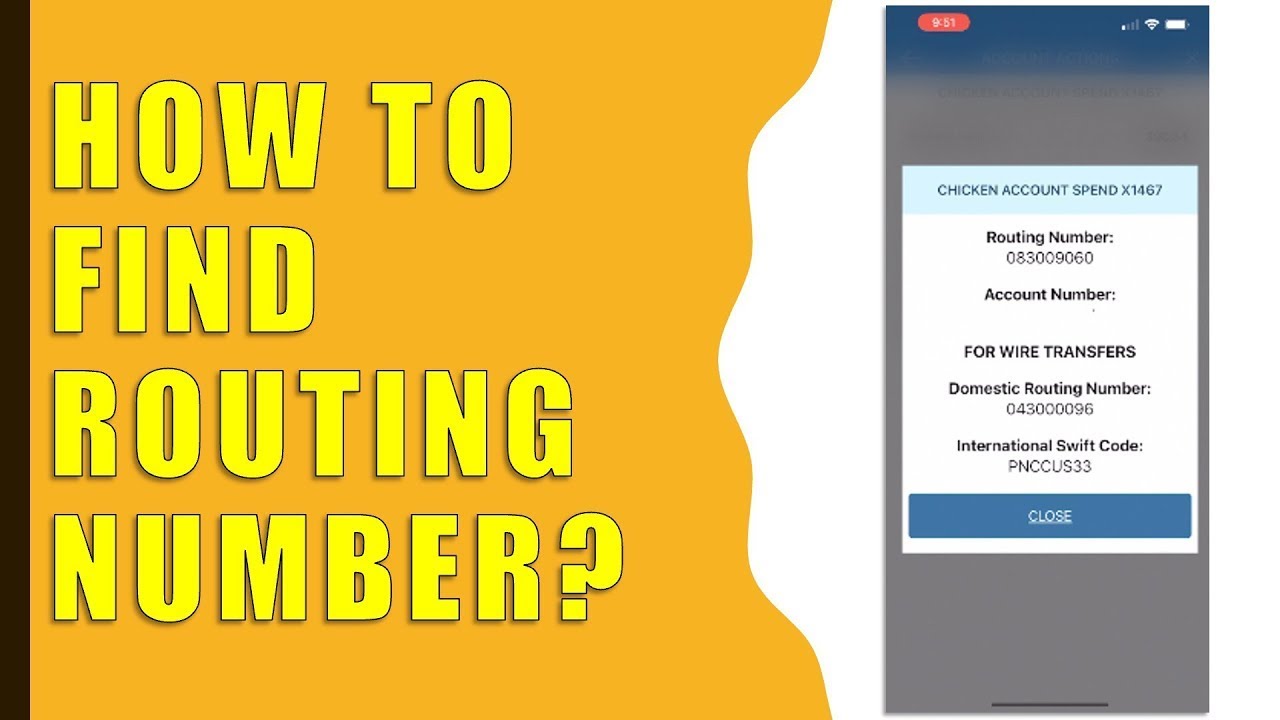

1. Where is my PNC account number on my check? (Answer: At the bottom, between the check number and the routing number)

2. What if my check is lost or stolen? (Answer: Contact PNC immediately to report it.)

3. What is the difference between the account number and the routing number? (Answer: The account number identifies your specific account, while the routing number identifies the bank.)

4. Can I access my account number online? (Answer: Yes, through PNC online banking.)

5. What if I write the wrong account number on a check? (Answer: The check may be returned unpaid.)

6. How can I protect my PNC account number? (Answer: Keep your checks secure, shred unused checks, and be cautious about sharing your information.)

7. What should I do if I notice unauthorized transactions? (Answer: Contact PNC immediately to report the suspicious activity.)

8. How can I order more checks from PNC? (Answer: Through PNC online banking or by visiting a branch.)Tips and tricks: Regularly review your bank statements to ensure all transactions are accurate. Keep your checks in a safe place to prevent loss or theft. Consider using online bill pay for added convenience and security.

Understanding your PNC account number on a check is fundamental to responsible financial management. It empowers you to control your finances, ensuring accurate payments, preventing fraud, and simplifying reconciliation. By following the best practices outlined above and staying informed, you can confidently navigate the world of personal finance and maximize the efficiency of your banking experience. Taking proactive steps to manage your finances, such as regularly reviewing statements and protecting your account information, will contribute to your overall financial well-being. Don't underestimate the power of these small details – they are the building blocks of a secure and successful financial future. Take control of your financial health today by familiarizing yourself with your PNC account number and implementing these valuable tips.

Unlocking hartfords used car secrets your guide to smart buying

Archangel michael symbol tattoo meaning designs and inspiration

Unlocking creativity the wonderful world of molde de flores de papel paper flower templates