Unlocking Your Financial Freedom: A Guide to Kiraan Potongan Cukai Berjadual

Let’s be honest, thinking about taxes isn’t exactly anyone’s idea of a good time. But what if I told you that understanding a key part of the tax system, specifically “kiraan potongan cukai berjadual” (scheduled tax deductions in Malay), could actually pave the way for a healthier financial life? It might sound intimidating at first, but trust me, it’s like discovering a hidden treasure chest of savings within the tax code.

Imagine this: You’ve been working hard all year, and suddenly it’s tax season again. Instead of dreading the thought of handing over a significant chunk of your earnings, you feel a sense of control because you understand how to legally reduce your tax burden. This is where “kiraan potongan cukai berjadual” comes in, acting as your secret weapon to potentially save money and achieve your financial goals.

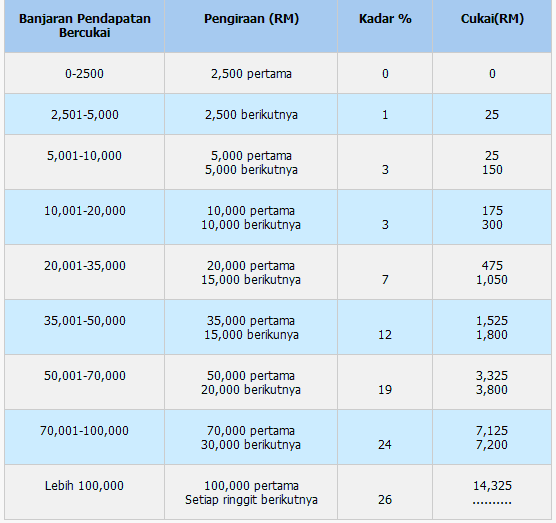

Now, before we dive into the specifics, let’s demystify what “kiraan potongan cukai berjadual” actually means. In essence, it refers to a system where your employer deducts income tax directly from your salary each month based on a predetermined schedule. This schedule takes into account various factors like your income level, number of dependents, and eligible tax reliefs.

While the concept might seem straightforward, the calculations involved can feel like navigating a maze. But don’t worry, we’re here to break it down in a way that’s easy to understand. Think of this as your comprehensive guide to navigating the world of “kiraan potongan cukai berjadual,” where we’ll uncover its significance, explore its benefits, and equip you with the knowledge to make informed financial decisions.

Throughout this article, we’ll address common questions, dispel any confusion surrounding “kiraan potongan cukai berjadual,” and provide practical tips to help you optimize your tax deductions. By the time you finish reading, you’ll feel empowered to tackle your taxes with confidence and potentially unlock hidden savings that can fuel your financial dreams. So, grab a cup of coffee, get comfortable, and let’s embark on this journey towards financial clarity together!

Advantages and Disadvantages of Kiraan Potongan Cukai Berjadual

| Advantages | Disadvantages |

|---|---|

| Easier Budgeting | Potential for Overpayment |

While "kiraan potongan cukai berjadual" offers convenience, it's important to review your tax situation annually to ensure you're not overpaying. Consult with a tax professional for personalized advice.

Best Practices for Kiraan Potongan Cukai Berjadual

Here are some practical tips to make the most of your "kiraan potongan cukai berjadual":

- Stay Informed: Keep abreast of any changes in tax laws and regulations related to "kiraan potongan cukai berjadual."

- Review Regularly: Assess your tax situation annually to ensure your deductions are still optimal.

- Maximize Reliefs: Explore all eligible tax reliefs and deductions to minimize your tax liability.

By understanding and proactively managing your "kiraan potongan cukai berjadual," you can take control of your finances and work towards a more secure future. Remember, knowledge is power, especially when it comes to navigating the complexities of the tax system.

Good night sweet dreams thursday animal gifs the perfect way to end your week

Unlock inner wisdom the power of frases de sabiduria y reflexion

Unleash your inner designer creative terrace design ideas diy