Unlocking Your Financial Future: A Guide to Cara Dapatkan No KWSP

In the bustling heart of Malaysia's economic landscape, securing your financial future is paramount. As you navigate the intricacies of savings, investments, and retirement planning, understanding the role of the Employees' Provident Fund (EPF) becomes crucial. For many, the EPF, known in Malay as Kumpulan Wang Simpanan Pekerja (KWSP), is a cornerstone of their financial security.

But what happens when you need access to those hard-earned funds? "Cara dapatkan no KWSP" - the process of obtaining your EPF account number - becomes your key to unlocking a world of possibilities. Whether you're a first-time employee, a seasoned professional, or simply seeking to understand your financial standing, obtaining your EPF number is a fundamental step.

Imagine this: you've just landed your dream job, filled with anticipation for the journey ahead. As you navigate the onboarding process, a wave of new information washes over you. Amidst the excitement, it's easy to overlook the significance of a seemingly simple 12-digit number – your EPF account number.

This unique identifier is more than just a sequence of digits; it's your gateway to a world of financial empowerment. Your EPF account, a pillar of Malaysia's social security system, plays a pivotal role in securing your financial well-being, both in the present and the future.

In this comprehensive guide, we'll delve into the world of "cara dapatkan no KWSP." We'll unravel the process, explore its significance, and equip you with the knowledge to navigate this essential aspect of your financial journey. Whether you're starting your career, changing jobs, or simply seeking clarity, understanding how to obtain and utilize your EPF account is paramount. Let's embark on this journey to unlock the full potential of your financial future.

Advantages and Disadvantages of Knowing Your KWSP Number

| Advantages | Disadvantages |

|---|---|

| Easy access to account information | Potential for scams if shared carelessly |

| Convenient online transactions | Risk of unauthorized access if security measures aren't followed |

Best Practices for Managing Your KWSP Account

1. Safeguard Your Information: Treat your KWSP number like you would any sensitive financial information. Avoid sharing it unnecessarily and be wary of phishing attempts.

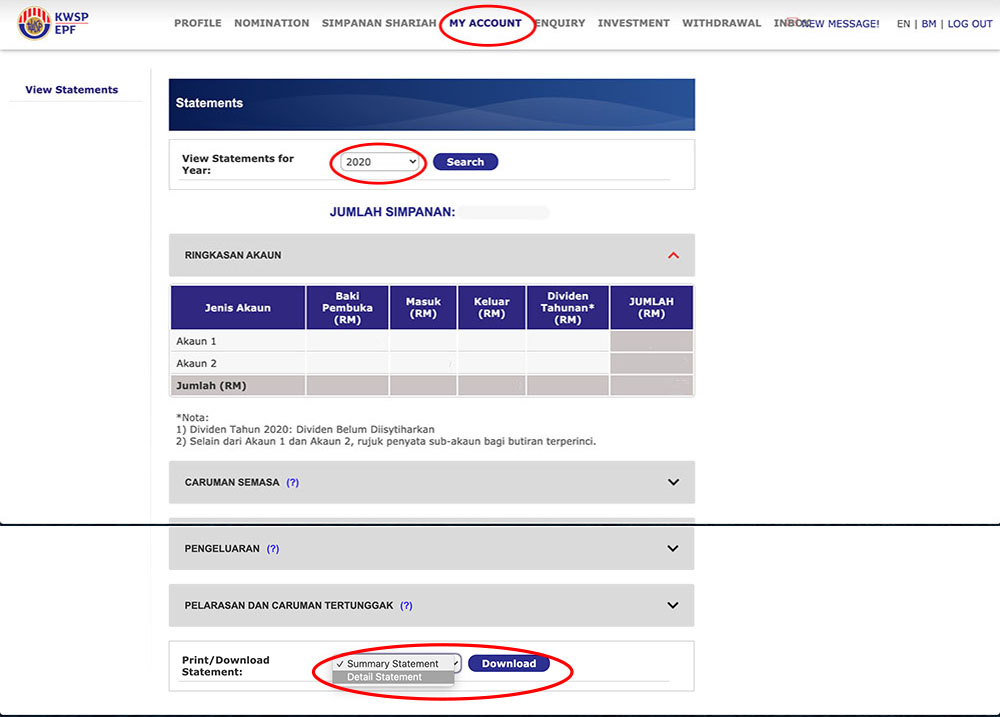

2. Regularly Check Your Account: Stay informed about your contributions, withdrawals, and investment performance by accessing your account statement online or through the i-Akaun app.

3. Update Your Details: Ensure your contact information, beneficiaries, and other relevant details are current to avoid complications in the future.

4. Explore Investment Options: Consider diversifying your savings by exploring the available investment schemes within your EPF account to potentially enhance your returns.

5. Plan for Retirement: Utilize the EPF's retirement planning tools and resources to estimate your retirement needs and adjust your contributions accordingly.

In the tapestry of life, securing your financial well-being is an ongoing journey. Your KWSP account is a valuable tool in this endeavor, providing a safety net for the future while also offering opportunities for growth. By understanding the process of "cara dapatkan no KWSP," you're taking a proactive step towards financial empowerment. Remember to safeguard your information, stay informed about your account, and explore the available resources to maximize the benefits of this essential financial tool.

Level up your look the ultimate guide to asian male short hairstyles

Unlocking young minds what are k5 math worksheets and why they matter

Giving credit where credit is due mastering the art of como citar de acuerdo al apa