Unlocking Your Numbers: A Guide to Finding Your Checking Account Number

Ever been in that awkward situation where you need your checking account number, but can’t seem to find it? It’s a common predicament, whether you're setting up direct deposit, making an online payment, or simply needing to provide your banking information. This essential number is the key to accessing and managing your funds, making it crucial to know where to locate it quickly and securely.

Locating your checking account number doesn't have to be a scavenger hunt. With a little guidance, you can quickly pinpoint this vital piece of information. This comprehensive guide will walk you through various methods to locate your checking account number, whether you have your checkbook handy, prefer online banking, or need to contact your bank directly.

The modern checking account system has evolved from paper-based transactions to sophisticated digital platforms. Initially, account numbers were primarily used for internal tracking within banks. Today, they are essential for various transactions, including direct deposits, online bill payments, and wire transfers. Knowing where to find this number is fundamental to navigating today’s financial landscape.

The most common issue related to finding a checking account number is simply not knowing where to look. Many people store their checkbooks and statements in various places, making it a challenge to locate them when needed. Additionally, remembering online banking login credentials can be difficult. This guide aims to address these challenges by providing clear and concise instructions.

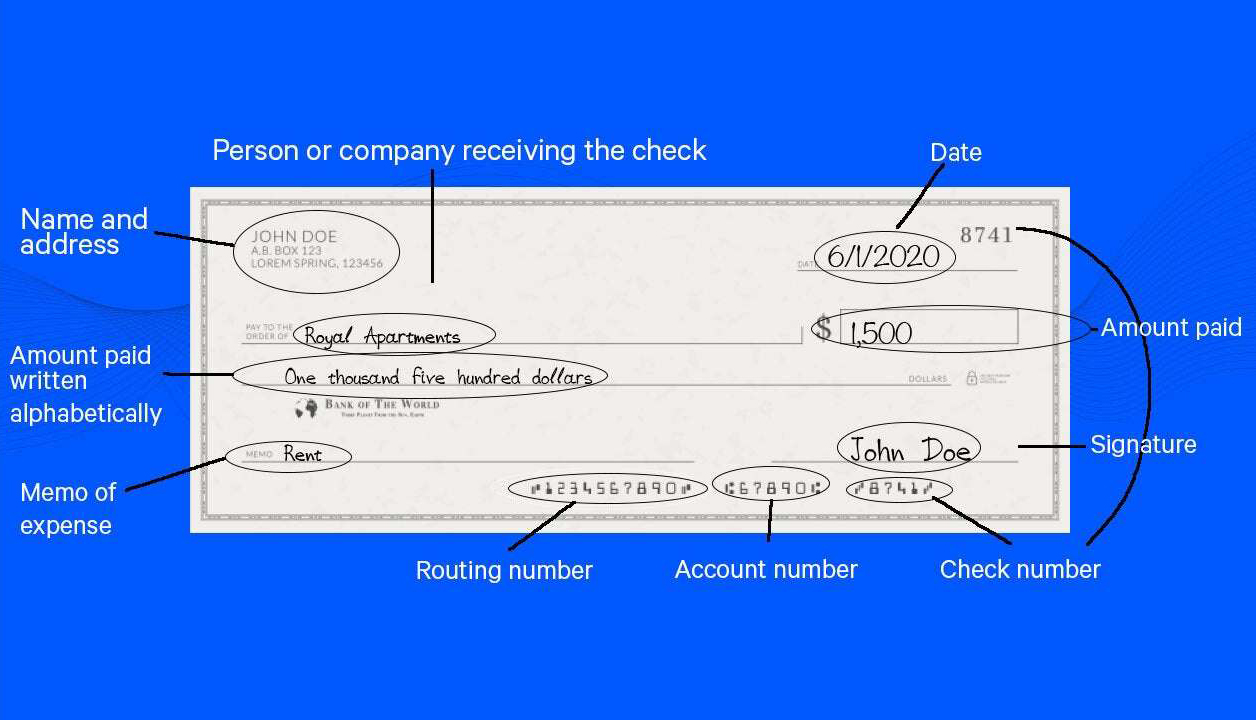

Your checking account number is a unique sequence of digits assigned by your bank to identify your specific account. It’s crucial to differentiate this from your routing number, which identifies your bank itself. The checking account number is essential for transactions involving your specific funds within that bank.

One of the easiest ways to locate your checking account number is by looking at the bottom of a check. You’ll see three sets of numbers: the routing number, your account number, and the check number. Your account number is typically located in the middle.

You can also find your checking account number on your monthly bank statements. Whether you receive paper statements or access them online, your account number will be clearly displayed alongside your transactions and balance information.

Most banks allow you to access your account information online. After logging in, you should be able to easily find your account number within the account details or information section.

Benefits of knowing how to locate your checking account number include seamless transactions, efficient financial management, and quick access to funds. For instance, knowing where to find this number allows you to quickly set up direct deposit, ensuring timely payment.

Advantages and Disadvantages of Different Methods for Finding Your Checking Account Number

| Method | Advantages | Disadvantages |

|---|---|---|

| Checking a Check | Easy and readily available if you have a checkbook. | May not have a checkbook readily available. |

| Online Banking | Quick and convenient. | Requires internet access and login credentials. |

| Bank Statement | Provides a record of your account number. | May not have recent statements easily accessible. |

Best Practice: Always keep your checkbook and bank statements in a safe and organized place.

Real Example: Imagine needing to pay rent online urgently. Knowing how to quickly locate your checking account number allows you to make the payment on time.

Challenge: You've lost your checkbook and can't access online banking. Solution: Contact your bank directly. They will verify your identity and provide your account number.

FAQ: What if I can’t find my account number using any of these methods? Answer: Contact your bank directly.

Tip: Consider storing your account number securely in a password manager or encrypted document for easy access.

In conclusion, knowing how to find your checking account number is an essential skill for managing your finances effectively. From setting up direct deposit to making online payments, this crucial piece of information empowers you to control your funds efficiently. Utilizing the various methods outlined in this guide – checking your checkbook, reviewing bank statements, or accessing online banking – you can quickly locate your checking account number when needed. By implementing the recommended best practices and staying organized, you can avoid the frustration of searching for this vital number and navigate your financial transactions smoothly. Remember to prioritize the security of your banking information and keep your account number confidential. Taking proactive steps to manage your financial information will contribute to a more organized and stress-free financial life.

Unsettling utterances creepy things to say that will make your friends squirm

Decoding the chevy 3500 dually weight a comprehensive guide

The first month decoding the early signs sintomas del primer mes de embarazo

:max_bytes(150000):strip_icc()/where-is-the-account-number-on-a-check-315278_final-30e94da21d1644329716939bef5107ac.png)