Unlocking Your Paycheck: A Guide to Understanding Tax Deductions

Ever wonder where a chunk of your hard-earned money disappears to every month? No, it's not magically vanishing – it's going towards taxes. While the concept of contributing to public services like roads and schools is great, wouldn't it feel more empowering to understand exactly how much is deducted from your paycheck and why?

Demystifying your monthly income tax deductions might seem like a daunting task, but it doesn't have to be. It's about taking control of your finances, understanding your tax obligations, and potentially finding ways to optimize your earnings.

Before we dive in, remember, this guide provides general information and should not substitute professional financial advice. Every individual's financial situation is unique, and tax laws can be complex and subject to change. Always consult with a qualified tax advisor for personalized guidance.

Now, let's unravel the mystery behind those deductions. Knowing how to calculate your income tax is the first step towards financial clarity. It allows you to plan your budget effectively, make informed financial decisions, and potentially explore legal avenues to minimize your tax liabilities.

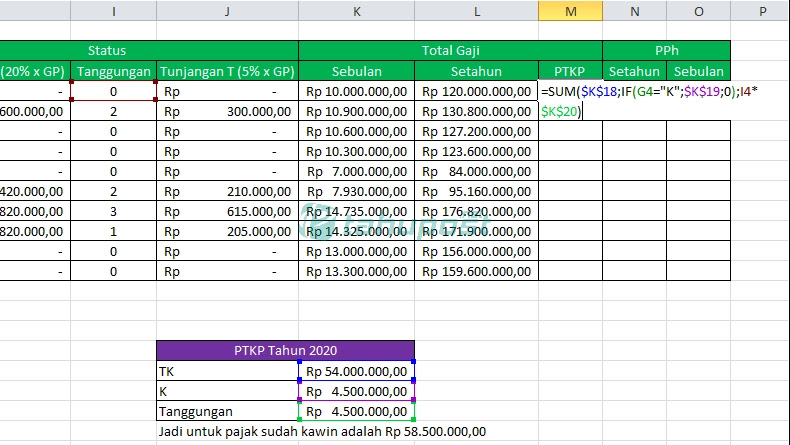

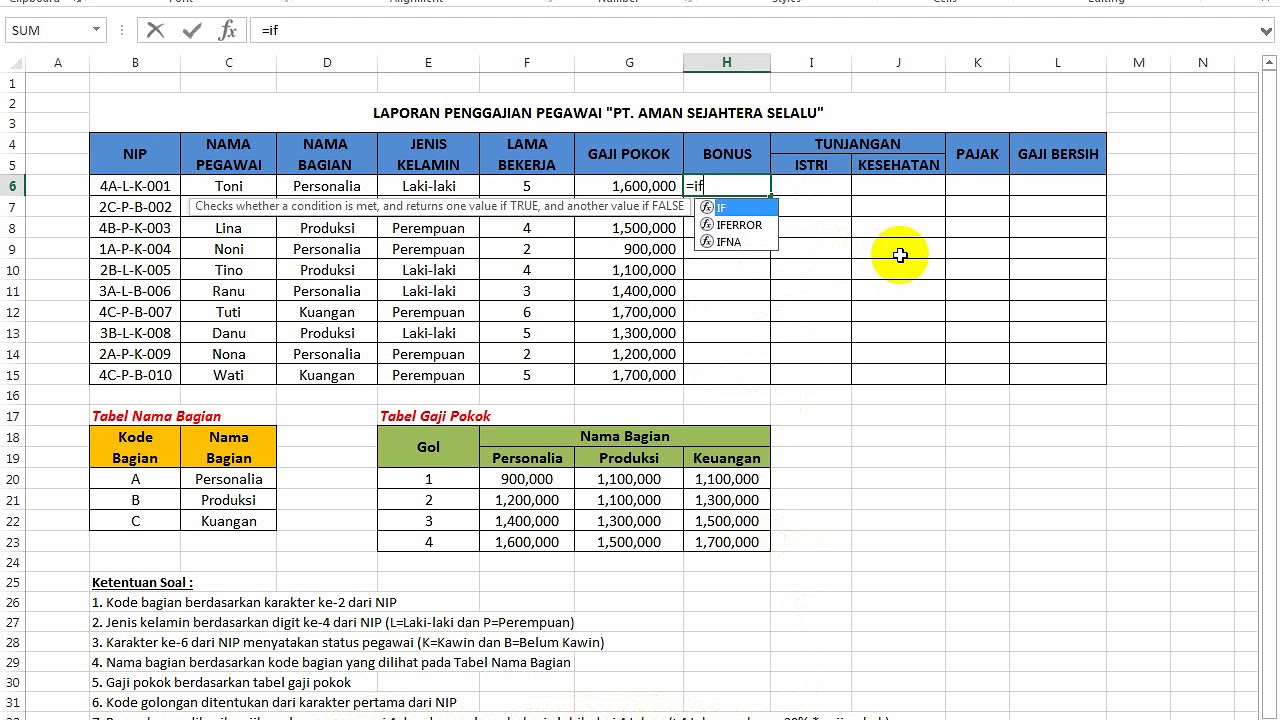

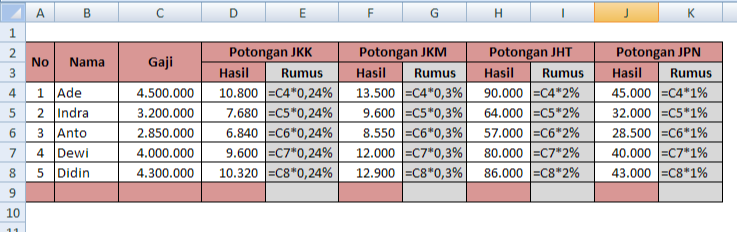

Once you understand the basics, you can delve deeper into the specific deductions applied to your income. These can include contributions to social security, health insurance, unemployment insurance, and more. By familiarizing yourself with these deductions, you can ensure accuracy in your paychecks and potentially identify any discrepancies.

Advantages and Disadvantages of Calculating Your Taxes

While the advantages of understanding your tax deductions are numerous, it's also crucial to be aware of potential downsides:

| Advantages | Disadvantages |

|---|---|

| Empowers you to manage finances better. | Can be time-consuming to learn and calculate. |

| Helps identify potential errors in your paycheck. | Tax laws can be complex and subject to change. |

| Allows for better financial planning and decision making. | May require professional help for complex situations. |

Best Practices for Managing Your Taxes

Here are a few tips to help you stay on top of your income tax deductions:

- Keep yourself updated: Tax laws are constantly evolving. Stay informed about any changes that may affect your deductions.

- Organize your financial records: Maintain a systematic record of your income, expenses, and tax-related documents for easy reference.

- Utilize technology: Numerous apps and websites can assist with tax calculations and provide helpful resources.

- Don't hesitate to seek professional help: If you encounter complexities, consult a qualified tax advisor for personalized guidance.

- Review your deductions regularly: Life changes like marriage, childbirth, or buying a house can affect your tax liability. Review and adjust your deductions accordingly.

By understanding your income tax deductions, you are not just fulfilling a financial obligation but taking a proactive step towards financial literacy. It's about knowing where your money goes and making informed decisions to build a more secure and prosperous future.

Albany ga road trip enterprise on westover has your wheels

Supercharge your laundry with borax a complete guide

Navigating mental health finding the right psychiatrist for you