Unpacking Company Financial Statements: A Clear Guide

Navigating the world of business can feel like deciphering a whole new language. One of the most important "phrases" you'll encounter is the concept of "financial statements," known in Malay as "contoh penyata kewangan syarikat." Think of these statements as a company's financial report card. They offer a snapshot of a company's financial health and performance over a specific period, providing crucial insights for anyone interested in the business, from potential investors to current stakeholders.

Now, you might be wondering, "Why should I care about these statements?" Well, imagine trying to bake a cake without knowing the ingredients or how much of each to use. It wouldn't be pretty, right? Similarly, attempting to understand a business without examining its financial statements can lead to messy and misinformed decisions. These statements are the key ingredients that reveal a company's profitability, financial stability, and overall well-being.

The practice of meticulously documenting financial transactions isn't new. It has its roots in ancient civilizations like Mesopotamia, where clay tablets served as early accounting records. Over centuries, the methods evolved, and the Industrial Revolution marked a significant turning point. The rise of large-scale businesses emphasized the need for standardized financial reporting, leading to the development of the double-entry bookkeeping system we recognize today.

Today, consistent and transparent financial reporting is not just good practice; it's the law in many parts of the world. Regulatory bodies like the Securities and Exchange Commission (SEC) in the United States and similar organizations globally mandate companies to prepare and publish their financial statements. These rules ensure fairness, accountability, and help prevent financial misconduct.

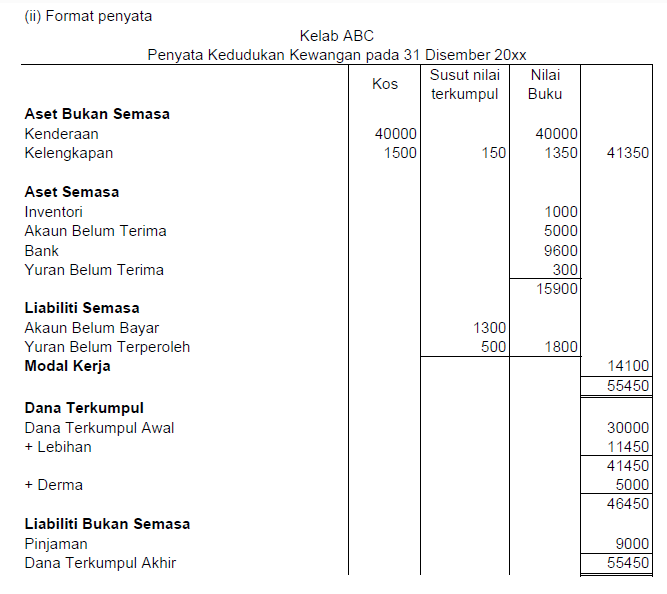

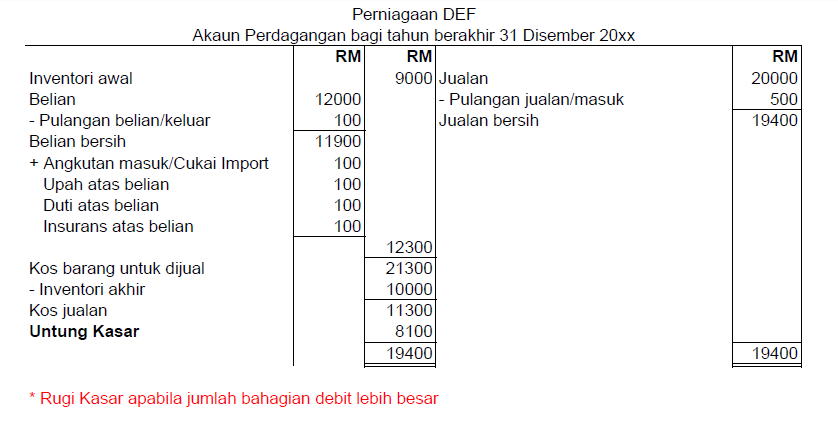

However, even with these regulations in place, understanding complex financial statements can feel like solving a puzzle. The terminology can be daunting, and the sheer volume of information overwhelming. This is where breaking down the components becomes essential. Typically, a complete set of financial statements includes the balance sheet, income statement, and cash flow statement. The balance sheet offers a snapshot of the company's assets, liabilities, and equity at a specific point in time. The income statement, on the other hand, showcases the company's revenues, expenses, and resulting profit or loss over a period. Finally, the cash flow statement tracks the movement of cash both into and out of the company during a specific period. Each statement offers a different angle of the company's financial story.

Advantages and Disadvantages of Detailed Financial Statements

| Advantages | Disadvantages |

|---|---|

| Provides a clear picture of a company's financial health. | Can be complex and difficult to understand for those without financial expertise. |

| Helps in making informed investment decisions. | May not capture the full picture, such as qualitative aspects like brand reputation or employee morale. |

| Enables tracking of progress and identification of areas for improvement. | Subject to potential manipulation or errors, highlighting the need for independent audits. |

In conclusion, while the world of "contoh penyata kewangan syarikat" or company financial statements might seem intimidating at first glance, understanding their importance and basic components is crucial for anyone involved in business. These statements offer a treasure trove of information that can guide strategic decision-making, mitigate financial risks, and ultimately contribute to a company's success.

Navigating motorcycle ownership transfer in indonesia persyaratan balik nama sepeda motor

Mastering german email etiquette a deep dive into mit freundlichen grussen ihr

The power of lied guten morgen sonnenschein text more than just a song