Unraveling Your Paycheck: A Guide to Understanding Income Tax Deductions

Have you ever glanced at your paycheck and wondered about the deductions that shrunk your hard-earned income? One significant chunk often comes from income tax. Understanding how these deductions are calculated can seem complex, but it's crucial for financial awareness and planning. This comprehensive guide will unravel the mysteries behind income tax deductions, providing you with the knowledge to confidently navigate your paycheck.

Imagine receiving a pay increase, but instead of feeling excitement, you're puzzled because the extra money seems to disappear from your account each month. This is a common scenario when you haven't factored in the impact of taxes. By grasping the mechanics of income tax calculations, you can accurately predict your take-home pay and plan your finances more effectively.

Income tax is the lifeblood of many governments, funding essential public services like healthcare, education, and infrastructure. This system of taxation is designed to be progressive, meaning individuals with higher incomes contribute a larger proportion of their earnings. Calculating income tax deductions accurately is vital for maintaining a fair and functional tax system.

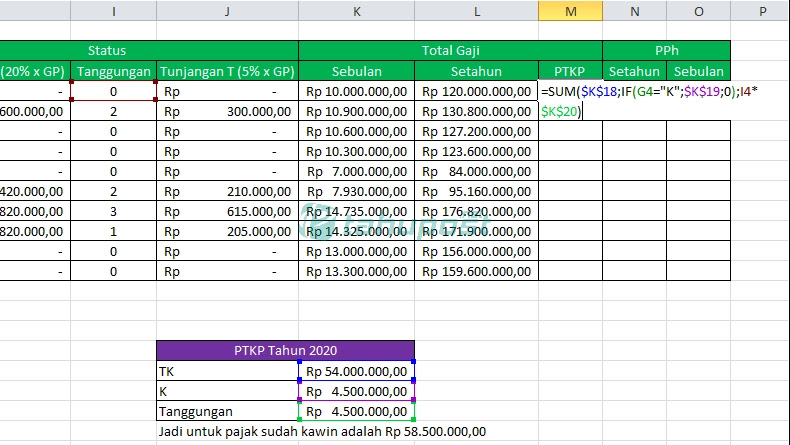

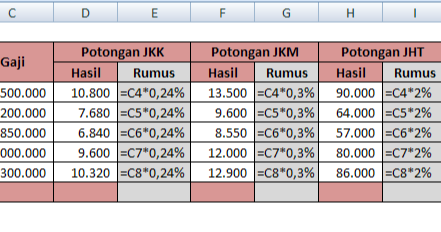

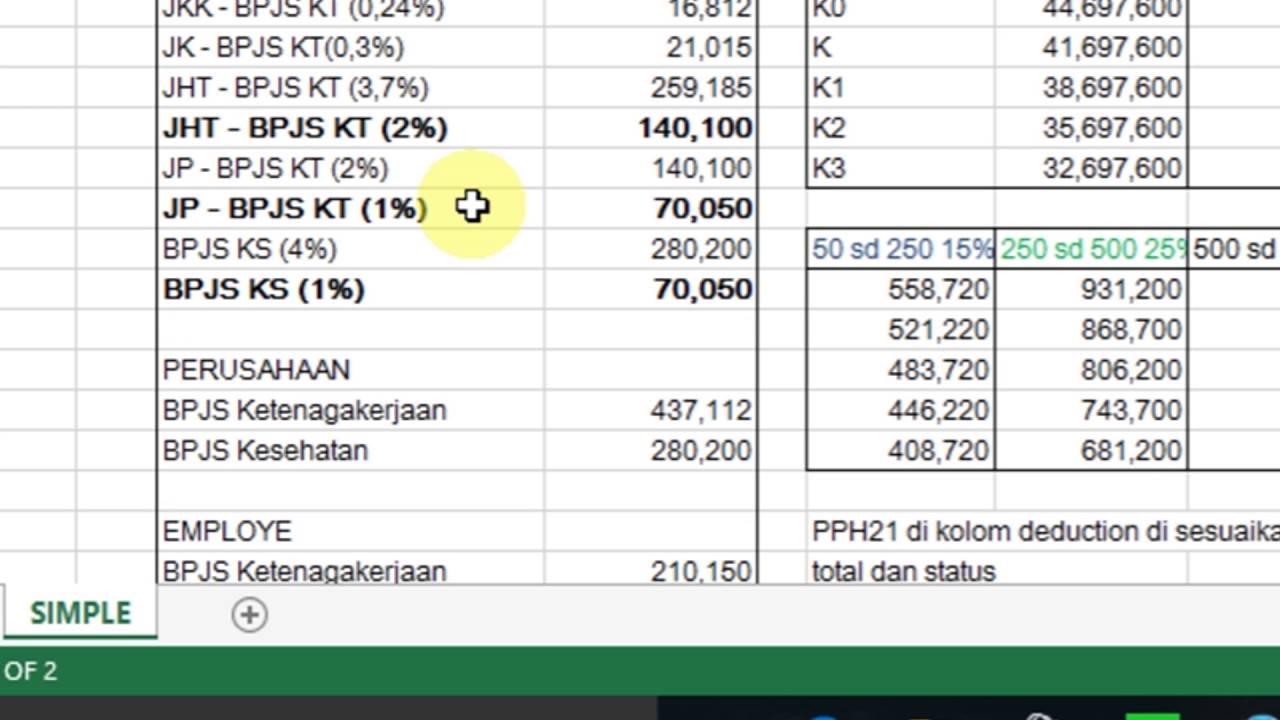

One of the main issues surrounding income tax deductions is the complexity of tax codes. Tax laws can be intricate and subject to change, making it challenging for individuals to stay updated and ensure accurate calculations. Moreover, varying tax brackets, deductions, and allowances can further complicate the process. This complexity highlights the need for clear, accessible information and resources to guide individuals through the process.

Another challenge arises from the lack of financial literacy surrounding income tax deductions. Many individuals might not fully understand how their income is taxed, leading to confusion and potential financial missteps. Empowering individuals with the knowledge and tools to understand their tax obligations can promote financial responsibility and informed decision-making.

Advantages and Disadvantages of Understanding Income Tax Deductions

Let's delve into the pros and cons of comprehending this crucial aspect of personal finance:

| Advantages | Disadvantages |

|---|---|

| Accurate financial planning and budgeting | Complexity of tax codes and regulations |

| Potential for maximizing deductions and minimizing tax liability | Keeping up-to-date with changing tax laws |

| Increased awareness of government revenue streams and public service funding | Potential for errors in calculation if not done carefully |

While navigating the complexities of income tax deductions can seem daunting, the benefits far outweigh the challenges. By arming yourself with the knowledge and resources available, you can confidently take control of your finances and make informed decisions about your income.

Unleash creativity with dibujos de la princesa peach para colorear

Grain vacuum rentals near you streamlining your harvest

Unlocking worlds reading comprehension for 5th graders