Unveiling the "Gaji per Jam di Indonesia": Your Guide to Hourly Wages

Ever wondered how hourly wages work in Indonesia? In a country where monthly salaries are the norm, the concept of "gaji per jam," meaning hourly wages, might seem unusual. But as the Indonesian workforce becomes more diverse and flexible work arrangements gain popularity, understanding hourly pay is becoming increasingly relevant.

Traditionally, Indonesian employment has revolved around fixed monthly salaries. However, the rise of the gig economy, part-time work, and remote job opportunities is introducing a shift. This shift brings with it a need to understand the nuances of "gaji per jam" and how it functions within the Indonesian context.

Navigating the world of hourly wages in Indonesia can seem complex. What are the legal regulations? How are hourly rates determined? This guide delves into these questions, providing you with the information you need to understand "gaji per jam di Indonesia."

Whether you're an employee considering an hourly-paid position or an employer exploring different compensation models, understanding the implications of hourly wages is crucial. This includes knowing your rights, ensuring fair compensation, and navigating the potential benefits and drawbacks of this payment structure.

Let's dive in and explore the intricacies of "gaji per jam di Indonesia" together. From its origins and legal framework to practical examples and tips, this guide aims to equip you with the knowledge to make informed decisions about hourly employment in Indonesia.

Advantages and Disadvantages of "Gaji per Jam di Indonesia"

| Advantages | Disadvantages |

|---|---|

| Potential for higher earnings based on hours worked | Income fluctuation depending on hours available |

| Flexibility for individuals seeking part-time or flexible work | Potential lack of benefits often associated with full-time employment |

| Transparency in payment for specific work hours | Increased need for accurate time tracking and management |

Best Practices for Implementing "Gaji per Jam di Indonesia"

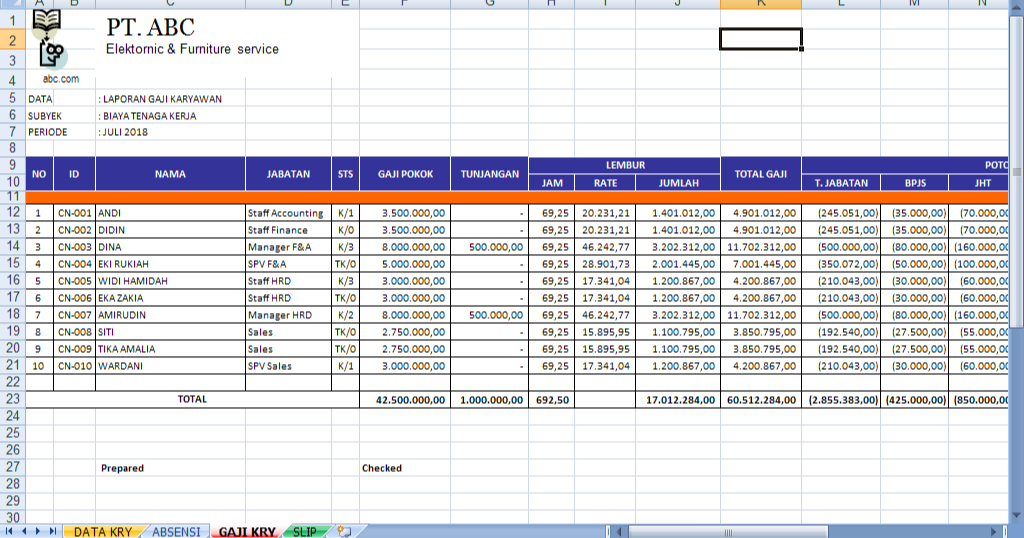

1. Clear Communication and Agreements: Establish transparent communication channels with employees to discuss hourly rates, payment schedules, and any overtime policies. Clearly outline expectations in a written agreement.

2. Legal Compliance: Familiarize yourself with Indonesian labor laws concerning minimum wage, overtime pay, and working hour limits to ensure compliance when implementing hourly wages.

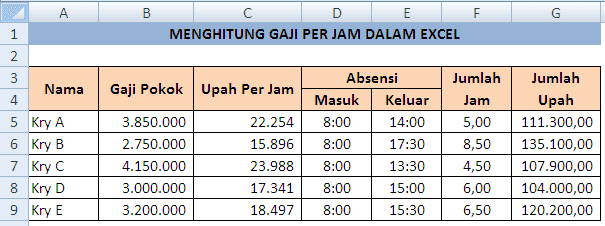

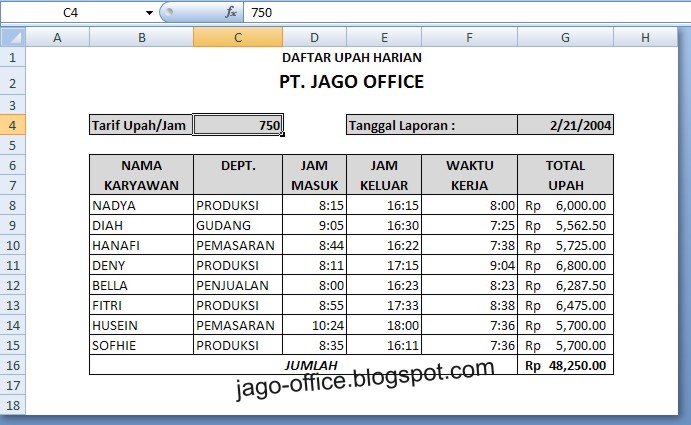

3. Accurate Time Tracking: Utilize reliable time tracking systems to accurately record employee hours worked, minimizing disputes and ensuring fair compensation.

4. Transparent Payslips: Provide detailed payslips that clearly outline the number of hours worked, hourly rate, any overtime or bonuses, and deductions, promoting transparency and trust.

5. Regular Review and Adjustment: Regularly review hourly rates to ensure they remain competitive within the industry and reflect changes in the cost of living or employee experience.

Common Questions and Answers about "Gaji per Jam di Indonesia"

Q: Is "gaji per jam" legal in Indonesia?

A: Yes, hourly wages are legal in Indonesia. However, employers must adhere to minimum wage laws and other labor regulations.

Q: How is the minimum hourly wage determined?

A: The minimum hourly wage is calculated based on the provincial minimum wage divided by the standard working hours per month.

Q: Are employees entitled to overtime pay with "gaji per jam?"

A: Yes, overtime pay is regulated by law, and employers must compensate employees accordingly for work exceeding the standard working hours.

Q: What are the common industries or jobs that offer "gaji per jam?"

A: Hourly wages are often found in sectors like retail, food service, freelance work, and part-time positions.

Q: Are there any downsides to "gaji per jam" for employees?

A: Potential downsides include income fluctuation if hours are inconsistent and a possible lack of certain benefits often associated with full-time employment.

Q: How can I find "gaji per jam" jobs in Indonesia?

A: Online job boards, company websites, and recruitment agencies often list positions offering hourly wages.

Q: Can I negotiate my hourly rate?

A: Yes, like with salaries, negotiating your hourly rate is possible, especially if you possess in-demand skills or experience.

Q: What are some important factors to consider when evaluating a "gaji per jam" job offer?

A: Consider the hourly rate, estimated number of hours per week, potential for overtime, job responsibilities, and any additional benefits offered.

Tips and Tricks Related to "Gaji per Jam di Indonesia"

* Keep Detailed Records: Maintain accurate records of your work hours, including starting and ending times, breaks, and overtime. This documentation can be crucial for resolving any payment disputes.

* Understand Overtime Regulations: Familiarize yourself with Indonesian overtime laws to ensure you receive fair compensation for any hours worked beyond the standard workweek.

* Communicate Clearly: Maintain open communication with your employer regarding your working hours, availability, and any concerns related to payment or time tracking.

* Negotiate Wisely: If you are offered an hourly rate, don't hesitate to negotiate based on your skills, experience, and the industry standards.

As the Indonesian job market evolves, "gaji per jam," or hourly wages, are becoming increasingly prevalent. Understanding the intricacies of this payment structure, from legal regulations to best practices, is vital for both employers and employees. Transparency, clear communication, and a thorough understanding of your rights are key to navigating the world of "gaji per jam di Indonesia" successfully. Whether you're seeking flexible work arrangements or looking to implement hourly wages in your business, staying informed empowers you to make decisions that align with your needs and promote a fair and equitable work environment in Indonesia.

Unveiling the mystery all secret skins in bear alpha

The world on a shoestring just how important is tourism really

The amazing defenses of octopuses como se defienden los pulpos