Wells Fargo Mobile Check Deposit Not Working? Here's What to Do

In today's fast-paced world, mobile banking has become an indispensable part of our lives. The convenience of depositing checks from anywhere, anytime, is a game-changer. However, what happens when this convenient feature stops working? Frustration can quickly set in if your Wells Fargo mobile check deposit isn't working as expected.

This article aims to be your comprehensive guide to navigating the occasional hiccups with Wells Fargo mobile check deposit. We'll explore common reasons why the service might be experiencing issues, provide troubleshooting tips, and offer solutions to get your funds deposited quickly and efficiently.

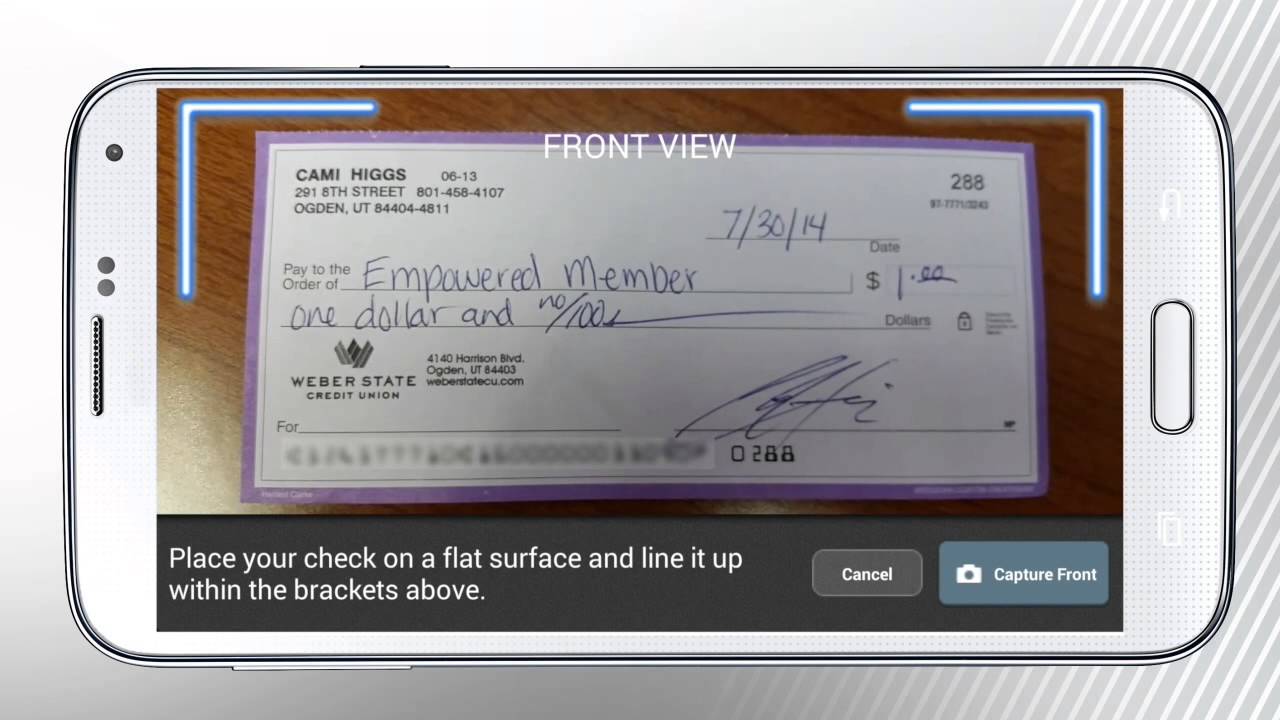

From internet connectivity woes to problems with check image quality, there are various factors that could lead to mobile deposit failures. Understanding these potential roadblocks is the first step toward a smooth and hassle-free mobile banking experience.

While the vast majority of mobile check deposits go through without a hitch, encountering a problem can be frustrating. This guide will empower you with the knowledge and tools to troubleshoot issues effectively and understand when it's necessary to contact Wells Fargo customer support for further assistance.

Remember, while mobile check deposit is designed for convenience, technical glitches can occur from time to time. By familiarizing yourself with potential issues and their solutions, you can approach mobile deposit problems with confidence and minimize any disruption to your banking routine.

Advantages and Disadvantages of Mobile Check Deposit

| Advantages | Disadvantages |

|---|---|

| Convenience of depositing checks anytime, anywhere | Potential for technical issues or errors |

| Saves time compared to visiting a branch or ATM | Limits on deposit amounts and frequency |

| Faster access to funds compared to mailing checks | Requires a smartphone and internet connection |

Common Questions and Answers

1. What should I do if my check image isn't clear enough for deposit?

Ensure you have adequate lighting and a steady hand when taking pictures of your check. If the app repeatedly rejects the image, try cleaning your phone's camera lens or consider visiting a branch or ATM for deposit.

2. Why am I getting an error message about exceeding my deposit limit?

Wells Fargo, like other banks, has limits on mobile check deposit amounts and frequency to prevent fraud. Check your account terms or contact customer support for details on your specific limits.

3. How long does it take for a mobile check deposit to clear?

While most mobile deposits are processed within 1-2 business days, some may take longer depending on the check amount and other factors. You can track your deposit status in the mobile app or online banking.

4. Can I deposit any type of check using mobile deposit?

While most personal and business checks are accepted, certain checks like starter checks, traveler's checks, or those with special endorsements may not be eligible for mobile deposit.

5. What if I made an error while entering check details during mobile deposit?

If you notice an error after submitting a deposit, contact Wells Fargo customer support immediately. They can assist in correcting the error or reversing the deposit if necessary.

6. Is mobile check deposit secure?

Wells Fargo uses encryption and other security measures to protect your information during mobile deposit. However, it's essential to follow best practices like using strong passwords and avoiding public Wi-Fi for banking transactions.

7. What should I do with the physical check after a successful mobile deposit?

It's recommended to keep the physical check for a few days after the deposit clears your account. Once confirmed, mark the check as "deposited" and store it securely or shred it to prevent fraudulent use.

8. Who can I contact for further assistance with Wells Fargo mobile check deposit?

You can reach Wells Fargo customer support directly through the mobile app, online banking, or by calling the number on the back of your debit card.

Mobile check deposit has revolutionized banking, offering unparalleled convenience and flexibility. While occasional glitches can occur, understanding common issues, troubleshooting tips, and available resources can empower you to address them effectively. By following the information and advice presented in this guide, you can navigate any bumps in the road and continue enjoying the benefits of seamless mobile banking with Wells Fargo. Remember, a little knowledge can go a long way in ensuring a smooth and stress-free experience.

The pulse of progress why i aspire to be mayor

Revitalize your suzuki outboard mastering the water pump exchange

Finding solace and history a journey to st johns church santa fe nm