What is a Qualifying Life Event? Your Insurance Crossroads

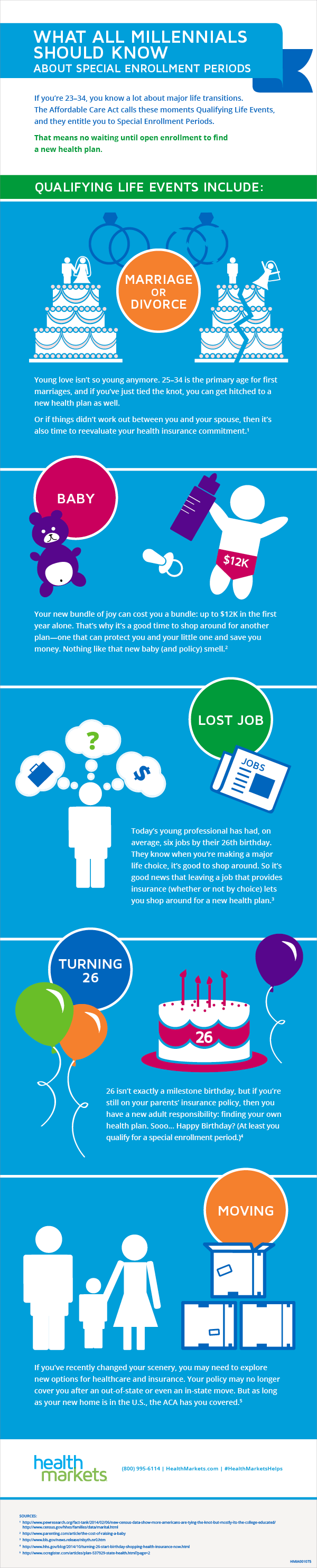

Life throws curveballs. You land a new job, tie the knot, welcome a new family member, or relocate to a different state. These seismic shifts in your personal life often ripple outwards, impacting everything from your daily routine to, yes, your insurance coverage. That's where "qualifying life events" come into play. They're the VIP pass to adjusting your health, dental, and even life insurance plans outside the usual open enrollment period.

Imagine this: you've just started a new job, brimming with excitement but suddenly realizing your current health plan isn't offered by your new employer. Panic sets in. Do you really have to stick with your existing insurance until the next open enrollment period, which could be months away? Thankfully, the answer is no. This scenario, along with a host of others, falls under the umbrella of "qualifying life events," offering you a lifeline to reassess and switch up your coverage.

The concept of qualifying life events is designed to provide a safety net, ensuring that you're not left high and dry when life takes an unexpected turn. These events are like checkpoints in your journey, allowing you to pause and make sure your insurance aligns with your evolving needs. Whether it's a move that throws a wrench in your existing health plan's network coverage or the birth of a child requiring additional medical benefits, understanding these events empowers you to make informed decisions about your insurance.

Navigating the world of insurance can feel like traversing a labyrinth, but understanding what constitutes a qualifying life event can be a beacon of light. These events trigger what's known as a "special enrollment period," a limited window of time that allows you to enroll in or modify your coverage outside the typical yearly enrollment timeframe. This means you have the flexibility to adapt to life's changes without the fear of being stuck with an unsuitable insurance plan.

The consequences of not grasping the significance of qualifying life events can be substantial. From potentially facing higher out-of-pocket costs due to an incompatible health plan to missing out on crucial coverage during a major life transition, neglecting these events can have a tangible impact on your financial well-being and peace of mind. Think of it as adjusting your sails when the wind changes direction – by recognizing and acting upon these events, you ensure a smoother and more secure journey.

Advantages and Disadvantages of Qualifying Life Events

| Advantages | Disadvantages |

|---|---|

| Flexibility to adjust insurance outside open enrollment | Limited time frame (usually 30-60 days) to enroll |

| Opportunity to secure coverage after a major life change | Requires documentation to prove eligibility |

| Potential for cost savings by switching to a more suitable plan | May not cover pre-existing conditions immediately |

Common Questions About Qualifying Life Events

1. What are some examples of qualifying life events?

Common examples include marriage, divorce, birth or adoption of a child, job loss, relocation, and changes in your dependent's status.

2. How do I know if an event qualifies?

Refer to your insurance plan documents or contact your insurance provider directly to confirm eligibility.

3. What's the time frame for enrolling after a qualifying life event?

You typically have 60 days from the date of the event, but this can vary depending on the event and your insurer.

4. What documents do I need to provide?

Be prepared to submit supporting documentation like marriage certificates, birth certificates, or termination letters.

5. Can I change any aspect of my coverage during a special enrollment period?

You can typically enroll in a new plan, add dependents, or drop coverage altogether.

6. What if I miss the special enrollment period?

You may have to wait until the next open enrollment period to make changes unless you qualify for a special exception.

7. Do qualifying life events apply to all types of insurance?

While common for health insurance, check with your providers for applicability to other insurance types like dental or life.

8. Where can I find more information about qualifying life events?

Healthcare.gov and your insurance provider's website are excellent resources for detailed information.

Life is a dynamic journey, and your insurance coverage should be adaptable enough to keep pace. Understanding what constitutes a qualifying life event empowers you to proactively navigate the often-complex world of insurance. By staying informed and recognizing these critical junctures, you can ensure that you and your loved ones have access to the right coverage, precisely when you need it most. Don't let life's curveballs catch you off guard; equip yourself with the knowledge to make informed decisions and maintain peace of mind throughout life's adventures.

Unveiling stories your guide to columbus ledger enquirer obituaries

Unlocking your potential exploring the mestrado em turismo ufpr

Personalised edible cupcake toppers uk the sweet touch for unforgettable celebrations