What Kind of Bank is SoFi? Unraveling the Fintech Phenomenon

In a world moving towards digital solutions at an unprecedented pace, the financial technology sector – better known as FinTech – is experiencing a revolution. This revolution is reshaping the way we bank, invest, and manage our finances. Leading this charge are companies like SoFi, a name synonymous with innovation and customer-centricity. But what kind of bank is SoFi, and how is it changing the financial landscape?

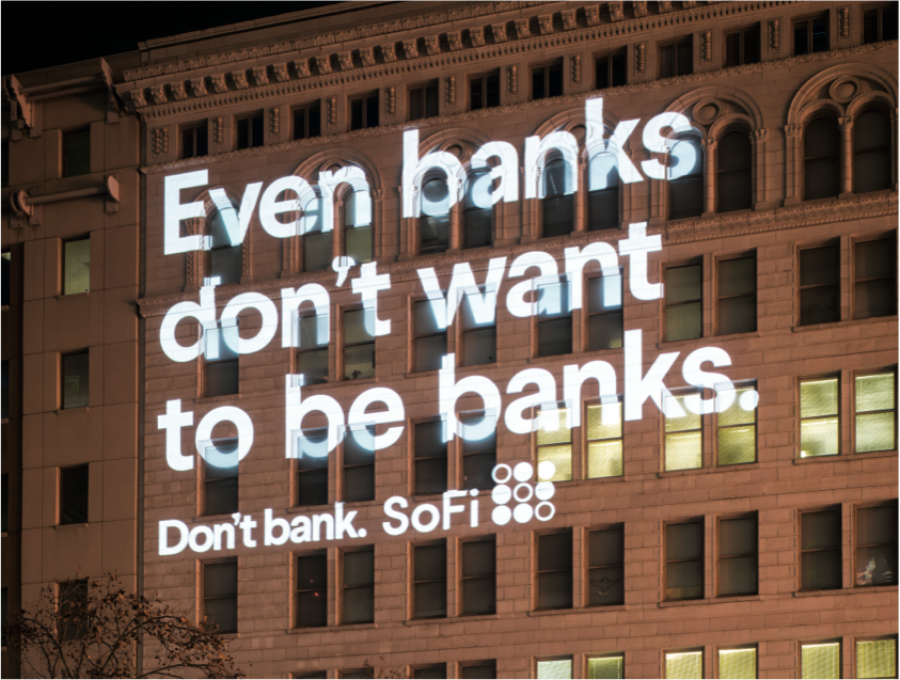

SoFi, short for Social Finance, isn't a traditional bank in the conventional sense. It operates as an online personal finance company, offering a diverse range of financial products and services directly to consumers. Unlike traditional banks with physical branches, SoFi operates entirely online, providing a seamless and convenient banking experience accessible through its website and mobile app. This digital-first approach allows SoFi to bypass the overhead costs associated with brick-and-mortar branches, enabling them to offer competitive interest rates, lower fees, and a wider array of services to its customers.

Founded in 2011 by Stanford business school students, SoFi emerged with a mission to revolutionize the student loan market. Initially, it focused on refinancing student loans, offering more favorable terms and lower interest rates than traditional lenders. SoFi's innovative approach, leveraging technology and a community-based lending model, resonated with borrowers, propelling the company's rapid growth and expansion.

Over the years, SoFi has transcended its initial focus on student loans, evolving into a comprehensive financial platform. Today, it offers a wide range of products and services, including personal loans, mortgages, investment accounts, credit cards, and even cash management accounts. This expansion reflects SoFi's commitment to becoming a one-stop shop for all its customers' financial needs, simplifying their financial lives under one digital roof.

SoFi's rise signifies a broader shift in the financial industry, driven by changing consumer preferences and technological advancements. Customers, particularly millennials and Gen Z, are increasingly seeking digital-first solutions that offer convenience, transparency, and personalized experiences. SoFi, with its user-friendly platform, competitive rates, and commitment to customer satisfaction, is well-positioned to capitalize on this evolving financial landscape.

While SoFi offers numerous benefits, one of its most significant advantages is its focus on technology. The company leverages advanced algorithms and data analytics to streamline its operations, reduce costs, and personalize its offerings. This tech-driven approach allows SoFi to offer competitive interest rates, lower fees, and faster loan approvals compared to traditional banks.

Another key advantage of SoFi is its commitment to customer experience. The company has a dedicated customer support team available 24/7 to assist with any questions or concerns. Furthermore, SoFi offers various resources and tools, such as financial planning and educational materials, empowering customers to make informed financial decisions.

Advantages and Disadvantages of SoFi

| Advantages | Disadvantages |

|---|---|

| Competitive interest rates and lower fees | Limited physical branch presence |

| Wide range of financial products and services | Focus on digital channels may not suit all customers |

| User-friendly online and mobile platforms | Eligibility criteria for some products can be stringent |

| Excellent customer support and resources |

SoFi, as a leading innovator in the FinTech space, represents the ongoing transformation of the financial industry. Its digital-first approach, customer-centricity, and commitment to innovation position it as a significant player in the future of finance. As technology continues to evolve and consumer preferences shift towards digital solutions, SoFi is well-equipped to adapt and thrive in this dynamic landscape.

Transforming minecraft with image to pixel art mods

Decoding the enigma exploring the shadows of dreams

Unveiling the savage family name history meaning and legacy